Additional 401K contribution in paycheck tracking

I am looking at how to properly set up this in my payment reminder. My employer does and additional contribution to my 401K. This appear on my paycheck but it not a pretax deduction. I already have my employee contribution set up and linked to my 401k investing account in quicken. Aside from going in manually in quicken and adding that, is there a way to add it as part of the paycheck reminder so I do not have to. No matter what I do, it alters my net pay. Any suggestion will be helpful.

Comments

-

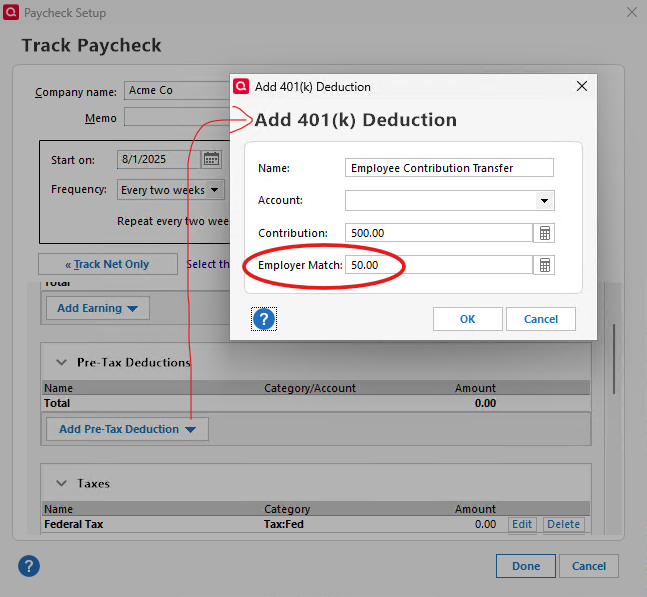

Hello @LesleyP, Is the additional contribution you are referring to same as the employer match or something else? Are you saying that if you enter that additional contribution amount in the "Employer Match" field as shown in the image below, it results in a mismatch with your pay stub?

- Q Win Deluxe user since 2010, US Subscription

- I don't use Cloud Sync, Mobile & Web, Bill Pay1

Categories

- All Categories

- 60 Product Ideas

- 34 Announcements

- 239 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub