Fidelity NetBenefits rollover transactions--Withdraw should be Sold, ContribX should be Xin

I rolled a 401(k) to an IRA, and the liquidation transactions for the 401(k) downloaded as Withdraw instead of Sold, leaving the shares of the funds in the 401(k). I manually corrected this by adding my new IRA account and then changing each Withdraw to a SoldX to the IRA, entering the fund and shares sold. I also had to re-enter the amount of each transaction even though I was editing them. Problem report filed.

Comments

-

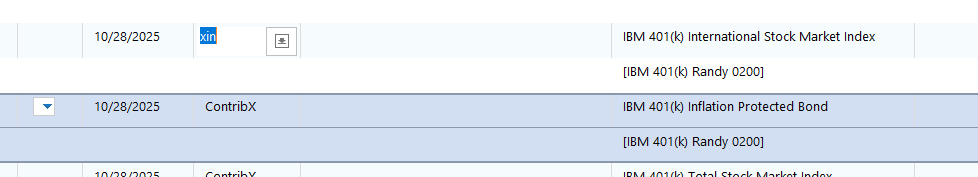

Oh, and the resulting transactions in the IRA were ContribX. These are not contributions, so they should be Xin instead, but when I try to edit one it gets stuck as such after hitting enter:

Then if I move to another transaction, the ContribX reappears as if I'd done nothing. Hitting the Edit button doesn't work either since there doesn't seem to be an option in the menu which corresponds to Xin.

Basically it seems there is no support for rollover transactions to an IRA—moving cash in is always a contribution.

0 -

I had the same experience with a rollover from 401k on 10/23/25. 401k shows no shares sold; just a withdrawal.

1 -

I have the same problem doing an after tax 401k to Roth IRA conversion (known colloquially as a "mega backdoor Roth" conversion). It shows up as a withdrawal with no associated shares or sale, resulting in a negative balance in my 401k and incorrect share counts.

The transactions in the Roth worked as expected. And for the first time in a week my 401k holdings (non publicly traded securities) didn't update in price so I had to do it manually.

1 -

Any update on this from anyone at Quicken?

0 -

Anyone?

0

Categories

- All Categories

- 51 Product Ideas

- 34 Announcements

- 239 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.1K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub