A Corporate Spin-Off Transaction has, I think, corrupted my data file

Honeywell (HON) spun-off 1 share of Solantis (SOLS) for every 4 shares of Honeywell held. I entered this using the Corporate Securities Spin-Off transaction in the enter transactions tool:

Sec Name: HON

New Company: SOLS

New shares issued: .25 (1:4)

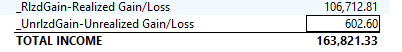

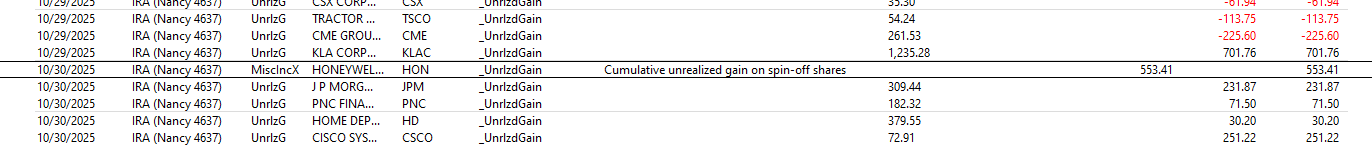

After completing this entry I created an Investment Income report. The report had a line for _UnrlsdGain-Unrealized Gail/Loss row under income that was not there before the spin-off transaction. I don't recoginze the amount. When I double click on the _UnrlsdGainj amount a report opens with hundreds of transactions with Action "UnrlaG"; I don't reconginze the amounts and when I look for them in the named account I can't find them. Clicking on any of the row amounts jumps to a row without an amount and with a Memo "Cumulative unrealized gain on spin-off of shares".

When Quicken does stuff like this I ask myself if it can be trusted.

WTF? over.

PS. I've restored a back-up from before entering the spin-off, and "added" the spun-off shares individually from the data on my Fidelity account "Positions".

Answers

-

The canned spin-off transaction for a single lot holding includes a MiscIncX transaction assigned to the _UnrlzdGain category. The magnitude of the transaction (if I recall correctly) is the difference between the basis of the spin-off shares and the fair market value of those shares. I think that is a screwy and confusing transaction. There is a better way using the fair market value field of the associated RtrnCapX transaction.

The hundreds or other reported transactions using that category likely relate to day to day changes in the security prices. They too are ‘normal’, though confusing.

Nothing you have described appears to me to reflect a corrupted file.

Depending on your real needs, as long as you get the right share count and basis transfer from HON to SOLS, you should be fine. If you’d like my opinion on the best transactions, post back and I’ll share them.

1 -

Thank you q_lurker.

There were seven purchase lots of HON in two accounts.

I think what you are saying is that

the Quicken corporate spin-off algorithm has, in addition to calculating and assigning a cost basis and lot purchase date for the resulting SOLS shares, it calculated the unrealized gain allocated to HON from the shares spun off, and now displays that in the Investment Income report.

When I drill down into the _UnrlzdGain amount in the Investment Income report there are many, many rows, including one that appears to be from the spin-off; the memo field says "Cumulative unrealized gain on spin-off shares" The amount appears to be assigned to the HON stock and displays in the "cash" and "cash+invest" columns.

and

the transaction for some reason caused the Investment Income report to display the current unrealized gain on all the other stock holdings. i.e. the data's not corrupted, it's just a quirk of the program to start showing all the unrealized gains in the Investment Income report.

The "_UnrlzdGain-Unrealized Gain/Loss" row did not display in the investment income report before the corporate spin-off transaction was entered.

So…I probably would have been fine to just carry on after using the Corporate Spin-Off transaction. However, I restored a 10/29 back up, used "add shares" to add the SOLS shares to each account by lot, cost and purchase date using the data from Fidelity. There were only 7 lots so it wasn't too hard. The more tedious part was re-enabling on-line access download for all my accounts.

0 -

You seem to have a good understanding of what I was trying to say.

I may have mis-stated about the appearance of daily unrealized gains. I seem to only get those if I customize an Investment Income report, Advanced tab, to “Include unrealized gains”. I am not totally clear on your screen snips.

As you Added SOLS shares per the Fidelity data, did you also reduce the basis of the HON lots? If that too is important to you, I think it requires Remove Shares of those HON shares then new Add shares for the 7 lots with the reduced basis.

1 -

It would help me to know what steps the Corporate Spin-Off transaction takes. Is there anyway to find that out?

0 -

I guess I have to trust Q. There is still an oddity to me in that the Investment Income report includes the category "_unrealizedgains", but only after the spin-off transaction does the report show an amount, and when that amount is double clicked the drill down contains unrealized gains from many securities unrelated to the spin-off.

Answering my own question "What actions does quicken perform, what calculations when I enter a Corporate Spin-Off transaction", I think the following is from Google AI:

***

In a corporate spin-off, Quicken's "Corporate Securities Spin-off" wizard performs a cost basis allocation based on the relative fair market values of the parent and new spun-off company on the effective date of the spin-off. The wizard automatically generates the necessary transactions to split the original cost basis across the original shares and the new shares received.

Quicken's actions and calculations for a spin-off:

- Cost Basis Calculation: The wizard calculates the new cost basis for each company using the following formula:

- (Parent Co. Shares × Parent FMV/Parent Co. Shares × Parent FMV + Child Co. Shares × Child FMV) × Original Parent Co. Basis

- New Spun-off Company Basis:

- (Child Co. Shares × Child FMV / Parent Co. Shares × Parent FMV + Child Co. Shares × Child FMV) × Original Parent Co. Basis

- Transaction Generation: For each lot of the original security, Quicken automatically generates the following transactions to implement the calculated cost basis allocation:

- Handling Fractional Shares: If the spin-off results in fractional shares, the wizard will initially create the fractional share. A subsequent "Sell" transaction must be manually entered to record the cash-in-lieu payment you received from your broker for the fractional share.

- Multi-Lot Holdings: For users with multiple lots of the original security, the wizard will generate a separate set of

Remove SharesandAdd Sharestransactions for each lot to ensure the cost basis for each lot is correctly adjusted.

1

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub