Tax Planner 2026 Other Withholding

Windows Classic Premier, R66.12 Build 27.1.66.12

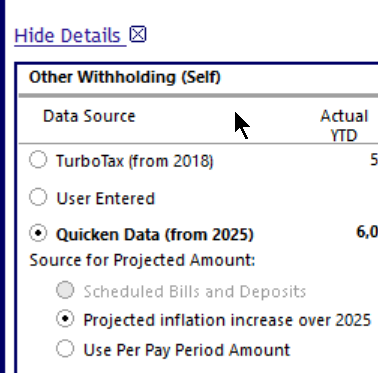

The Other Withholding category in the Tax Planner is stuck on 2025. I've tried the usual Validate and Super Validate but no help. The Tax Planner is set for 2026. Seems like every year I struggle with issues in the Tax Planner.

----Quicken User since 1998 ----

Comments

-

That is designed behavior for a tax planner section that had actual transaction data for the previous year but does not yet have actual data or a scheduled transaction associated with it for the current year. Quicken uses last year's value plus inflation to project the current year number.

If you will not have withholding in that section in 2026, change the projection to User Entered and zero. Like it or not, that's the way it has always worked.

2 -

Same was happening for me until I started entering actual 2026 paycheck and income transactions for the new year.

Seems the Tax Planner is unaware it's a new year until transactions for the new year are present.

I found this the case for other categories of Tax Planner data. Now that I have a full complement of transaction activity for 2026 Tax Planner is working very well.

Hope this helps.

You Don't Have to Have a Point, To Have A Point

0 -

I have had other withholdings this year with a tax category that is pegged to this item. How long before it switches over to 2026?

----Quicken User since 1998 ----

0 -

I found a fix.

The transaction was originating from a 401K IRA account and was split into Federal, State, and deposit amounts. That's how it was downloaded from Wells Fargo. The deposited amount was going to a taxable trading account. Anyway, the fix was to change the transaction from the 401K into just one withdrawal and then on the deposit side to the trading account it was split into the other tax categories. Quicken then realized this and changed the Other Withholding to 2026 and picked up that transaction.

----Quicken User since 1998 ----

2

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub