401(k) transactions no longer BoughtX

One only thing that I can think of was I paid off a 401(k) Primary Residence loan early. Was there a setting that this switched that I need to reverse?

My account is with Vanguard if that helps narrow down the issue.

Answers

-

Hello @AZMike2021

Thank you for reaching out on the community and telling us about your issue. I do apologize for the issue you're having. That is odd that it would change after so long. A way to test if your theory is correct is we could try adding the accounts to a test file to see if they have similar issue. I'll leave steps down below.

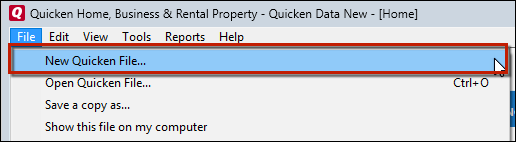

- Choose File menu > New Quicken File.

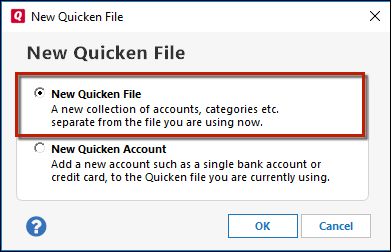

- Select New Quicken File.

- Click OK.

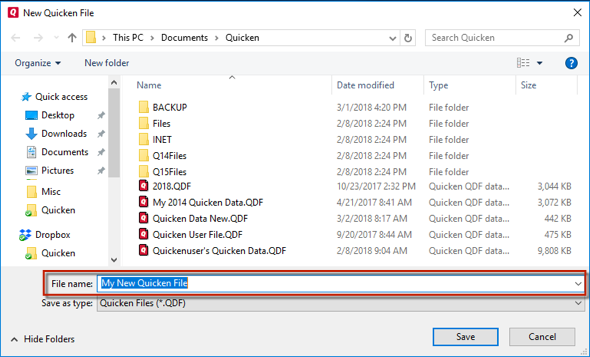

- In the File name field, enter the name of the new file, then click Save. Use a name like "Test File" to tell it apart from your main file.

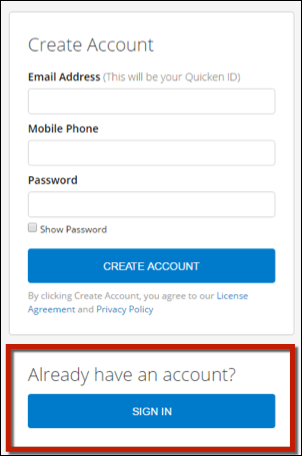

Don't use any of these characters: * ? < > | " : \ / (asterisk, question mark, left and right-angle bracket, pipe, straight quotation marks, colon, BACKSLASH, FORWARD SLASH). Also, don't add the .qdf extension; Quicken does that for you.- Sign in with your Quicken ID. If you are prompted to create a Quicken ID but already have one, click Sign In under the Create Account prompt.

- Select to not use Mobile.

- Click Add Account to start adding accounts to the new file.

After adding accounts, see if you are experiencing the same problems in this test file. Once you're able to let us know more we'll see what we can do.

Thanks,

Quicken Francisco

0 -

In the real world where does the money come from? Your paycheck no doubt. How do you handle that in Quicken? I (many) would suggest your paycheck deposit in Quicken should include the transfer of both your contribution and the company contribution to the 401k account. In that setup there would not be BoughtX transactions; they would all be Bought transactions.The previously entered BoughtX transactions had to use a transfer account. What was it? You can edit the new Bought transactions to reference the same account.Why the change? I could only speculate and that would not be helpful.0

-

I agree with q_lurker. Just set up your paycheck to transfer money into the 401k account. Or in my case I have my 401k contributions as a specific category on my paycheck and then have a scheduled income bill which I manually click enter which deposits the cash into the account. Then when the "bought" transaction occurs it will clear the cash

In my experience the way quicken reports categories is based on the financial institutions integration with quicken. Each do it their own way so have to adapt for each financial institution

Also on a side note I too have vanguard. It's always been a "Bought" transaction for me and I've always had to manually deposit the cash into the account0

Categories

- All Categories

- 47 Product Ideas

- 34 Announcements

- 244 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.5K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 124 Quicken LifeHub