Bond transactions from Schwab appear in Online Center not in Register

Matthew Guerreiro

Member ✭✭✭

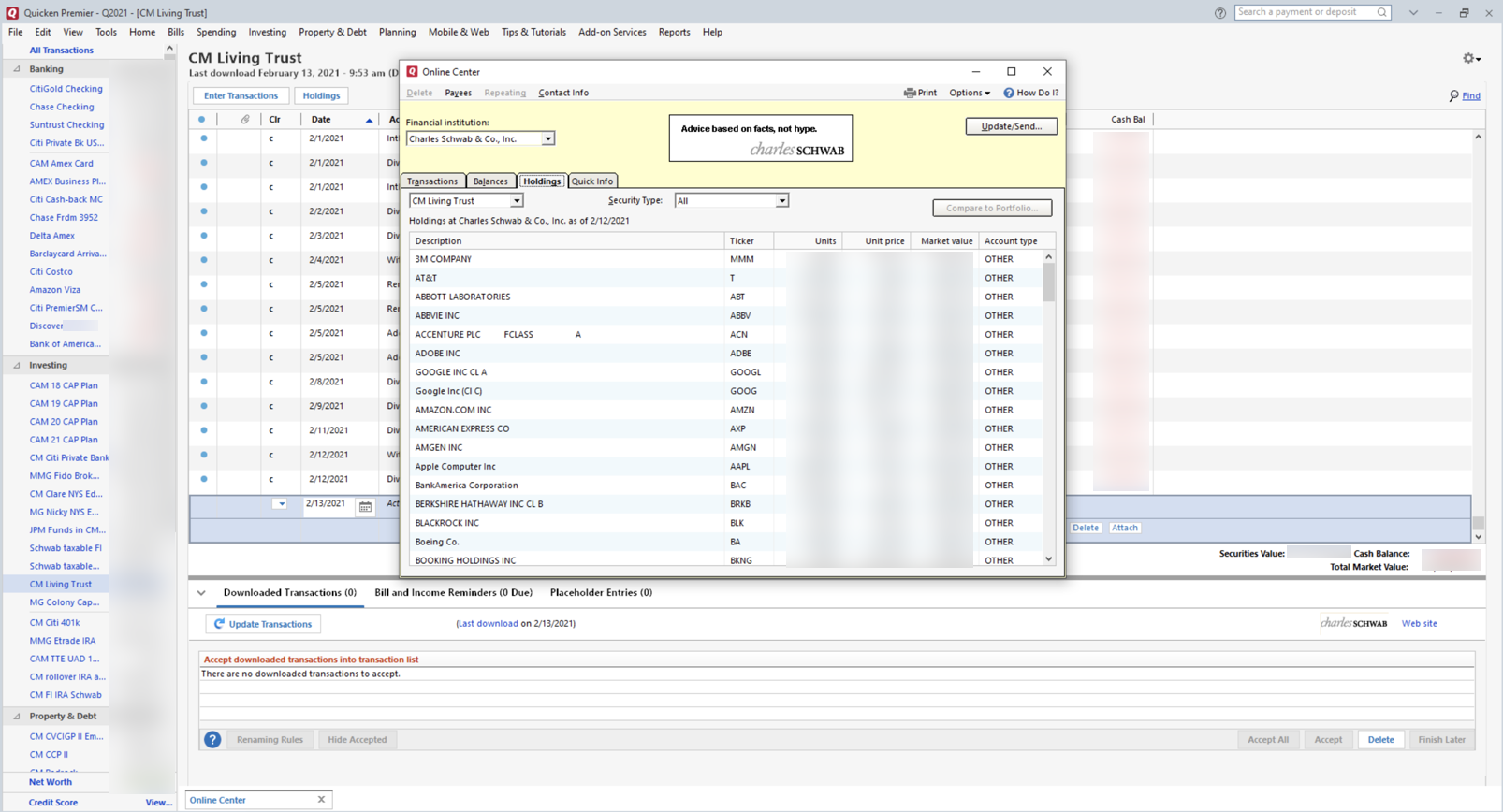

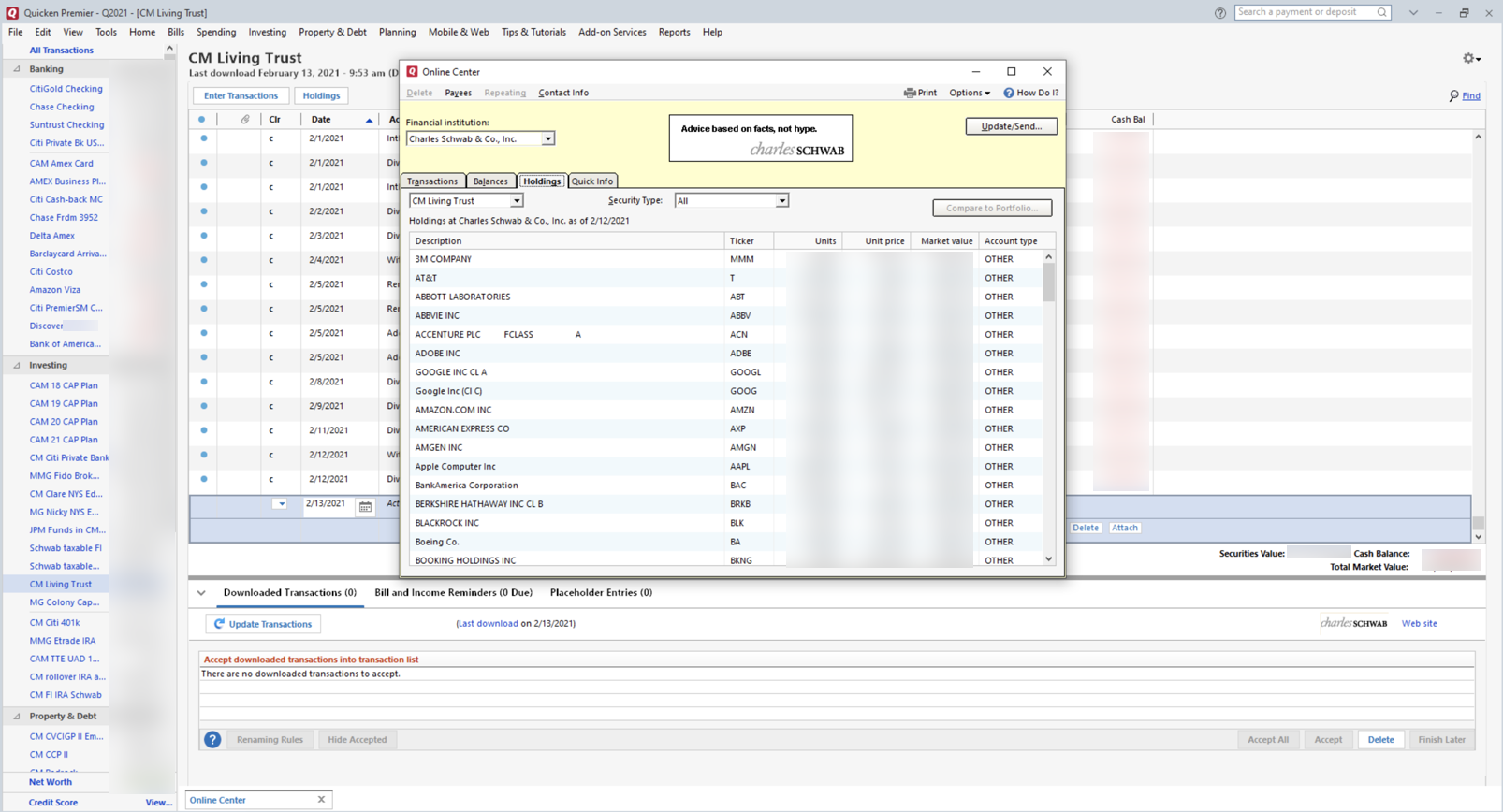

I've been having a problem with Schwab for a while. Sales of muni bonds are not appearing in the register. However, in the Online Center you can see the transactions.

In the Online Center Holdings tab, the Compare to Portfolio button is greyed out.

Is there any way to fix this other than manually adding these transactions?

Thanks!

Matt Guerreiro

[Screenshots edited for privacy]

In the Online Center Holdings tab, the Compare to Portfolio button is greyed out.

Is there any way to fix this other than manually adding these transactions?

Thanks!

Matt Guerreiro

[Screenshots edited for privacy]

0

Best Answer

-

I've had Schwab accounts in Quicken forever and have never seen the issue you're describing. The worst Schwab does for me is download a maturing bond transaction as a deposit rather than a 'sale' - and thus not clearing the holding from the Quicken portfolio. (I have to edit every such deposit and change it to a sale of the corresponding fixed income security to make things work out. This is entirely a Schwab issue as they format the data that is sent to Quicken.)

You might check your Schwab account online on the Realized Gain/Loss tab to see if these sales appear fully there yet. The thing with selling municipals is that the cost basis is amortized from purchase through the maturity date to reach a basis of 100 at that date, with zero capital gain if held to maturity. If sold prior to maturity, and their systems aren't updating amortized basis daily (my experience is that Schwab does not do so) - then it may take time for the back office to compute the gain/loss amount. Very different than selling stocks due to this amortization thing. Maybe they only clear things at the end of month for sold munis. I've only held to maturity so no personal experience with Schwab on that.

Again, check your online realized G/L for these sales. If final numbers with no footnotes appear there, then perhaps call the Fixed Income Department number to raise the issue as, again, what Quicken gets from Schwab is entirely determined by Schwab themselves.

Quicken user since 1990, MacBook Pro M2 Max on Tahoe 26.2 (and Win 11 under Parallels Desktop)

0

Answers

-

I've had Schwab accounts in Quicken forever and have never seen the issue you're describing. The worst Schwab does for me is download a maturing bond transaction as a deposit rather than a 'sale' - and thus not clearing the holding from the Quicken portfolio. (I have to edit every such deposit and change it to a sale of the corresponding fixed income security to make things work out. This is entirely a Schwab issue as they format the data that is sent to Quicken.)

You might check your Schwab account online on the Realized Gain/Loss tab to see if these sales appear fully there yet. The thing with selling municipals is that the cost basis is amortized from purchase through the maturity date to reach a basis of 100 at that date, with zero capital gain if held to maturity. If sold prior to maturity, and their systems aren't updating amortized basis daily (my experience is that Schwab does not do so) - then it may take time for the back office to compute the gain/loss amount. Very different than selling stocks due to this amortization thing. Maybe they only clear things at the end of month for sold munis. I've only held to maturity so no personal experience with Schwab on that.

Again, check your online realized G/L for these sales. If final numbers with no footnotes appear there, then perhaps call the Fixed Income Department number to raise the issue as, again, what Quicken gets from Schwab is entirely determined by Schwab themselves.

Quicken user since 1990, MacBook Pro M2 Max on Tahoe 26.2 (and Win 11 under Parallels Desktop)

0

This discussion has been closed.

Categories

- All Categories

- 42 Product Ideas

- 36 Announcements

- 225 Alerts, Online Banking & Known Product Issues

- 21 Product Alerts

- 497 Welcome to the Community!

- 677 Before you Buy

- 1.3K Product Ideas

- 54.4K Quicken Classic for Windows

- 16.5K Quicken Classic for Mac

- 1K Quicken Mobile

- 814 Quicken on the Web

- 115 Quicken LifeHub