How to record an expense associated with a net rent deposit?

Delaine

Quicken Windows Subscription Member

I am recording rent received when it hits the checking register. However, that is net rent after the management fee. How do I record gross rent and then the associated expense.

0

Answers

-

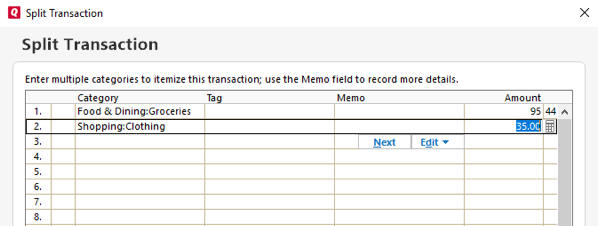

Hello @Delaine, you can use multiple categories on a transaction by recording it as a split. That way you can designate part of the transactions as rent and the other as a fee, here is how you would do this;

Instructions

- Open the account you want to use.

- In the register, click the transaction you want to categorize.

- On the transaction toolbar, click the Split icon.

- In the Split Transaction dialog, enter (or edit) the category, tag (optional), and amount for each individual item on a separate line.

What can I do here?

- As necessary, adjust the individual line amounts. (Optional)

Tell me more

- Click OK to close the Split Transaction dialog.

- On the transaction toolbar, click Save to enter the transaction into the register (unless you've enabled the register preference Automatically Enter Split Data)

- Quicken Jade0

This discussion has been closed.

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub