Tax Center - Projected Tax - Withholding/w-4

Robert Sheran

Member ✭✭✭✭

Quicken deluxe R47.7 b 27.1.47.7 running on Win10 OS.

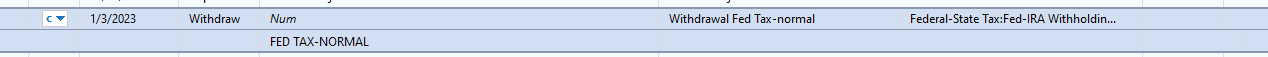

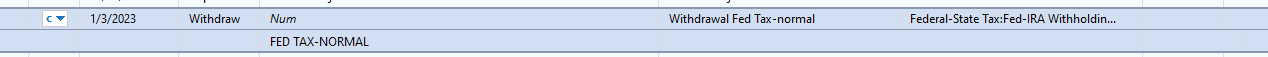

I have expense category for IRA tax withholding for myself and spouse linked to tax reporting form 1099-R:IRA federal tax withheld. The withholding section in Tax Planner fails to record 1099-R-IRA withholding. The category is linked with tax withdrawal transactions recorded in Investments Registers. I am trying unsuccessfully to find why quicken is unable to find the transactions and include in the tax planner. hope this makes sense, any suggestions what I am doing wrong? (see attached screen

prints)

prints)

prints)

prints)0

Comments

-

Forgot to show Quicken deluxe R47.7 b 27.1.47.7 running on Win10 OS

0 -

How are you recording the withdrawal transaction? It should be as a split deposit to a non Ira account with the transfer from the IRA as the first line followed by the withholding amount as an expense, thereby equaling the net deposit. Be sure to create the transaction in the receiving account, not the IRA.

Transfers out of the IRA should also be set to the taxable distributions line on the IRA tax schedule.

Quicken Business & Personal Subscription, Windows 11 Pro

0 -

Sorry I don't not quite understand. I do not manually input transactions from my investment broker. The investment transactions for IRA withdrawal is two (2) separate transactions downloaded (Direct Connect). (1) Withdrawal deposit that is the net deposit after tax withholding, (2) Withdrawal of taxable amount (expense). They are not (1) transaction with split transaction category. The distribution (deposit) is registered with the category field showing a category containing the Banking account that funds were sent to (checking), The tax withholding transaction has no category assignment so I created an expense category for Fed/State tax withholding and link it to the appropriate tax form. The IRA distribution deposit(s) do appear in Tax planner as expected, So I do not understand why the expense is not.

0 -

The screen shot doesn't show which tax lines are being used. It looks like you have subcategories so not sure which ones or all are shown as being included.

Quicken Business & Personal Subscription, Windows 11 Pro

0 -

Bob, The tax withholding transactions that are registered in my IRA investment accounts are linked to an expense category (see attachment). The category's tax reporting is set for 1099-R....as seen in prior screen print. Does this help?

0 -

i can see where you would expect that to work, but quicken is finicky when it comes to withdrawals from IRAs and you may not be able to use what is directly down-loaded.

Please try entering a deposit in your checking account as a split transaction where the first line is a transfer FROM the IRA equal to the total taxable amount. Then add a second expense line for the federal withholding amount categorized to the withholding category that you have set up. Does that now show up in tax planner correctly?Quicken Business & Personal Subscription, Windows 11 Pro

1 -

You have found a couple of bugs. First that the Tax Planner is not picking up Tax Line transactions when they are in an investment account register (a long-standing bug Quicken has shown no interest in fixing). Second you will notice that the tax line you are interested in does not have Self and Spouse options for both Other boxes. You might also notice corrupted tax lines evidenced by nonsense text in the Other Spouse box.

You should report the bug. A temporary work around would be to run the transactions through your checking account as suggested earlier. Since the Spouse box is broken for your Other tax line even in that case, you would either need to send the transaction to the Other Self box tax line for both you and your spouse or re-assign your 2 custom categories to their respective W-2 tax lines so they show up in the Self & Spouse boxes on the top line. In either case, they still need to flow thru a spending account so the Tax Planner will pick them up.

1 -

Ok both recommended work around steps do work, but, makes a workflow that should be simpler/automated. Fortunately I do not use Quicken to upload tax data to my TurboTax which I can only assume would fail to fill in tax lines correctly and possibly be cause for Fed review. Feels like something important for Quicken to spend time fixing...Thanks Bob and Markus for your support.

0

This discussion has been closed.

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub