Lifetime Planner: Resources for Setting Medicare Expenses Using the Special Expense Assumption

Lifetime Planner: Resources for Setting Medicare Expenses Using the Special Expense Assumption

Last year, I put together a few resources when researching my post-65 Medicare expense assumptions in Lifetime Planner (LTP). Perhaps others will find these resources and approach useful when considering the likely post-65 change in healthcare expenses in their own LTP plan.

The point of this post is to highlight the resources available to you in order to make a better informed estimate around post-65 healthcare costs, given your unique situation, and how to model them in Quicken's Lifetime Planner.

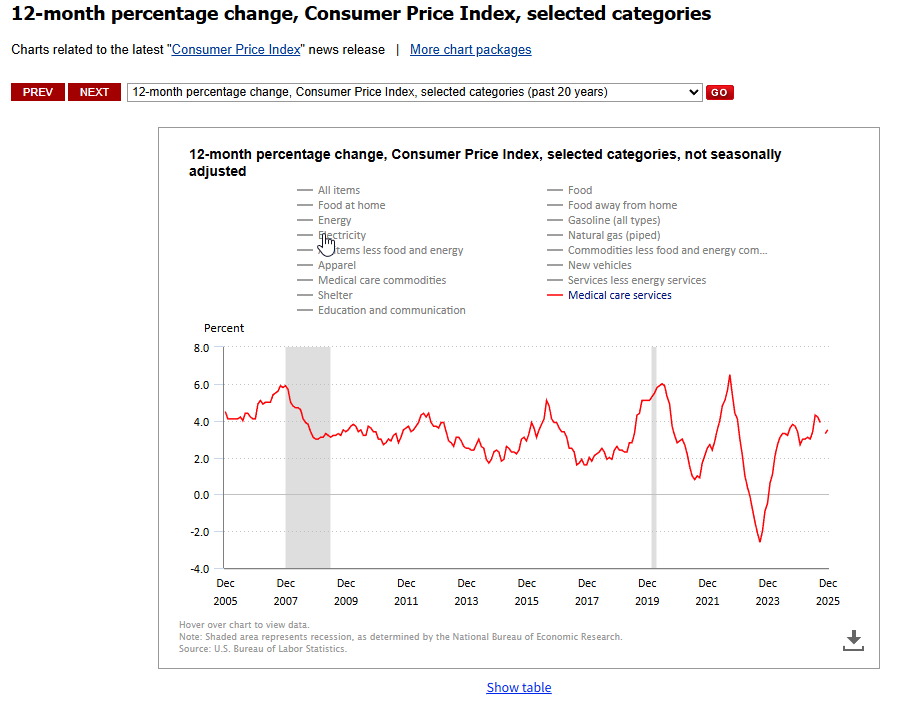

As with any of the planner's inputs, you should review them periodically for relevance and accuracy, especially those expense assumptions historically affected by high inflation rates and government regulations, et al.

Since I am 5 years away from Medicare age, this is a planning/forecasting exercise for me. Please feel free to comment with your forecasting approach or actual experiences.

A FEW COMMENTS ABOUT MEDICARE….

- Medicare provides for post-65 healthcare coverage.

- It is optional but most sign-up. Expat retirees, such as myself, have a particularly difficult decision to make since Medicare only covers USA based care.

- It is not free. If you haven't planned for it, you will likely have a significant impact to your retirement budget post-65.

- Its complicated, making forecasting challenging. But, it's a forecast - your best estimate based on what you know now in terms of your future goals.

- Because of the size of the Medicare expense and the time frame involved (25+ years?), it's prudent IMO to do some thoughtful review of this special expense.

- Read more here: Medicare Basics

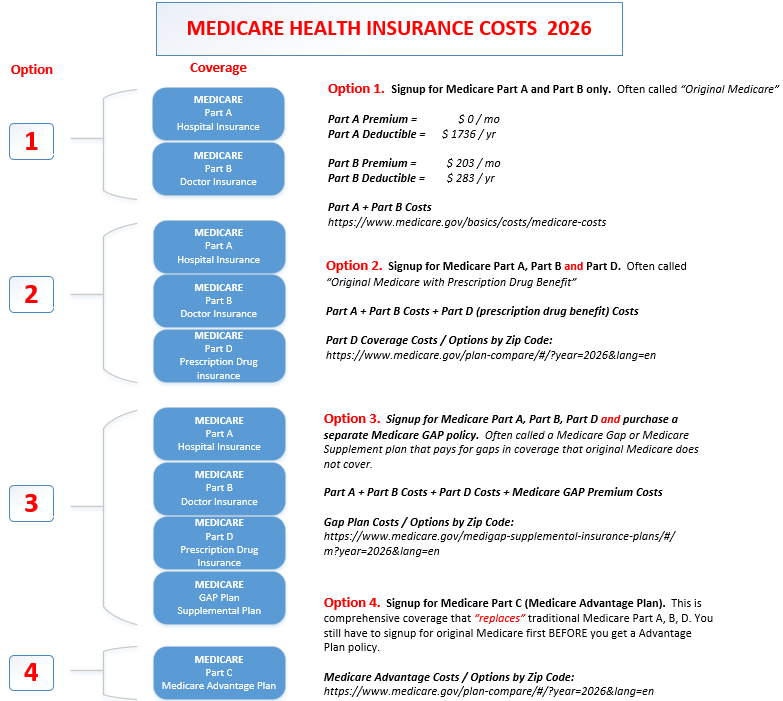

WHAT ARE THE COST AND COVERAGE OPTIONS FOR MEDICARE?

There are a number of Medicare options to consider, all with varying costs, coverage rules and financial risk exposures:

- Original Medicare, Part A and B

- Original Medicare plus Part D, prescription drug plan

- Original Medicare plus Medicare Gap or Medicare Supplement plan

- Part C, Medicare Advantage Plan

To help determine expenses for the 4 options, I've included links to cost and coverage information for the 2026 year. Costs for Part A and B are fairly straightforward. Part D, Supplement Plans and Advantage Plans are quoted by zip code and provide actual plan detail and costs for your local area.

- Medicare Part A, Part B, Part D, Part C and MediGap Overview

- Medicare Part D, Prescription Drug Plan Costs and Coverages (zip code based search)

- Medicare Gap (Medigap) or Supplemental Plan Cost and Coverages (zip code based search)

- Medicare Part C, Advantage Plan Costs and Coverages (zip code based search)

- Don't forget IRMAA…You may incur higher costs for Part B and D based upon a high MAGI.

HOW TO PUT THIS ALL TOGETHER?

For each option, I built an Excel table to collect costs (from Medicare and from personal historical medical expenditures). Based on costs and my unique situation, I assigned a subjective financial exposure (risk for outspending budget). From there, I made a reasoned choice as to a future expense / risk for post-65 Medicare. For sure, not an easy task.

Option 3 example is shown below:

MODELLING YOUR MEDICARE EXPENSES IN LIFETIME PLANNNER

My personal recommendation is to enter your Medicare expense assumption using the Special Expenses Assumption, as it allows you to: use "today's dollars", set the inflation rate differently than the overall general inflation rate and easily see your "special expense" under the Event List under Plan Results graph.

In this approach, you would add 2 Special Expense assumptions, one for self and one for spouse, starting at age 65, as show in the image below. In my spreadsheet, I calculated Medicare expenses for one spouse and simply doubled it. Of course, if a spouse has special health needs this would not work.

Don't forget to review your current Pre-65 medical expense assumption so as to not "double dip" when you turn 65 and your Medicare expense assumption kicks in! My approach, is to model my pre-65 medical expenses as a Special Expense Assumption spanning from today to age 65 at which point my post-65 Speical Expense Assumption starts. IOW, I completely separated my medical expenses pre and post-65. Of course there are other approaches, but I found this simplest (and rememberable) for me.

FINALLY, CHECK TO MAKE SURE YOUR EXPENSES ARE MODELLED CORRECTLY!

Ensure your assumption is correctly built into your plan by clicking on the plan year you turn 65 in the plan results graph. Then, in the Summary Table, shown in the image below, scroll to Expenses Summary. Special Expenses section and look for your Medicare Special Expense line. Remember, the first year's expense will likely have a prorated amount based upon your birth month. You can scroll to the next year(s) to see the entire expense allocation. I like to show my graph (and this table) in today's dollars to avoid any confusion.

That's it! Useful? Did you find the post-65 medical expense higher or lower? Did it cause you to reconsider other parts of you plan? Better approach than a GUESS? Add your practise and experience!

HELPFUL REFERENCES on YouTube

- The Retirement Nerds (Excellent Overview of Medicare Programs)

- Boomer Benefits (Broker)

- Medicare School (broker)

Other Lifetime Planner Resources:

Categories

- All Categories

- 52 Product Ideas

- 34 Announcements

- 247 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 514 Welcome to the Community!

- 680 Before you Buy

- 1.5K Product Ideas

- 55.5K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 832 Quicken on the Web

- 126 Quicken LifeHub