529 set up correctly but quicken lists it as taxable

I have 4 529 accounts set up in quicken. 3 are listed in the non-taxable account list while 1 is listed in the taxable account list. They were all set up similarly and I can't seem to find a way to move the 1 in taxable to non taxable. I tried deleting it and reestablishing to no avail. Please advise.

Answers

-

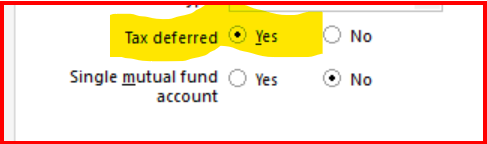

@RWWW for that one account, go to the General tab in Account Details and check that this setting is set to "Yes" -

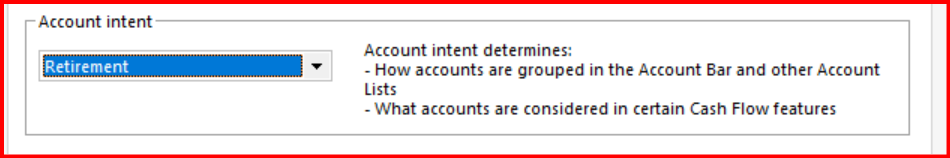

The other thing to check is the Account Intent in the Display tab. It should be set to "Retirement" -

The Account Intent section may not be there depending on the type of account and/or the Tax deferred setting.

0 -

thank you. The account intent doesn't come up on my account, however, I changed the account from tax deferred to taxable and then back to tax deferred and it solved the problem.

0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub