Regarding IRA accounts and QCD's

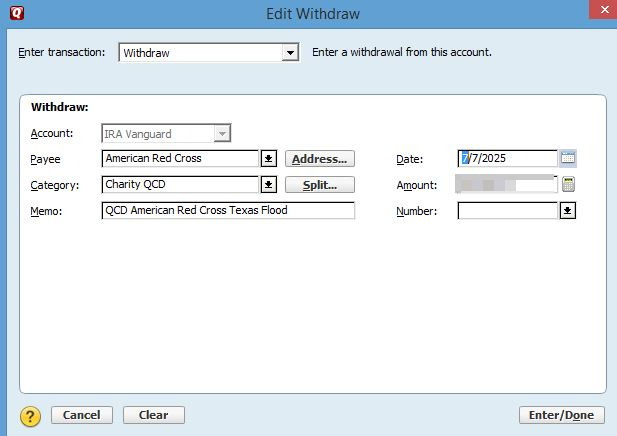

If this has already been asked and answered, I apologize. I didn't see any recent posts. The issue of taking an RMD and showing the taxable transfer has been fixed. These show as "WithdrwX" in the register and works great. This year, I made a couple of QCD's. I'm not sure how to show them. I tried doing just a withdraw. It shows as "Withdrw" in the register. This did not show on the tax planner as taxable income. I tried writing a check in the IRA account. It shows as "Writechk" in the register. Again, this did not show on the tax planner as taxable income. The IRA account does show Transfer Out as "1099-R Total IRA Taxable Distribution". Do I need to go back and 1st withdraw and transfer the money to a dummy account?

Thank You

Mike

Answers

-

When I turned 70 1/2 I started making QCDs. A QCD is not taxable income even if they cover a RMD. That's the main reason to do a QCD. I just entered the sales in my IRA which gave me a cash balance. Then I made a Withdraw and categorized it to "QCD Charity". I made a separate Category called QCD Charity from my regular Charity donations since the QCD is not taxable.

I'm staying on Quicken 2013 Premier for Windows.

2 -

@volvogirl Do you have the Tax Schedule function turned on in that IRA? If so, wouldn't even that w/d to your "QCD Charity" get called taxable?

While I like your idea in general, I'm not sure how it would work for me since my primary source of income is my RMDs, which are taxable.

Currently I record the entire monthly amount as a transfer from an IRA to my checking account and then split that transfer in checking to reflect the Fed Tax withheld.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

I'm not sure. Where is that? I have old 2013 version. My IRA account is checked for Tax Deferred and on the Tax Schedule tab it says Transfers Out to 1099R: Total IRA gross distrib. But I'm not using a Transfer to another account. The QCD is just a withdraw from the IRA account. I don't need to take my RMD until next year when I turn 73. But even then the QCD won't be taxable even if it's for the RMD.

I'm staying on Quicken 2013 Premier for Windows.

1 -

In my current experience, WithdrwX transfer from an IRA are treated as income per the tax schedule setting.

WriteChk transactions are not thus that is my chosen process for QCD transactions.

I do think some tweak in the last few years clarified and aided that distinction.

If I create a Withdraw transaction (no category), tax planner does not treat it as income. If I edit that transaction by making category = [Checking], it remains a Withdraw transaction, but is now included as taxable income in the tax planner.

All with R61.21.

1

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 248 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub