Fidelity NetBenefits account negative shares

This is only happening in 1 of my Fidelity accounts.

This only has one security. It was magically duplicated on 8/8/25 and now has a "2" after it. No, merging the two securities does not help.

My issue is the share balance. The account started on 10/11/24, so I have literally the first payment/deposit and the first buy. The problem is, if I look at the share balance, I start with a "-6.4" balance in shares. There is a grayed-out "remove shares" line with that same amount, and then in parentheses (to reach 0 on 08/03/25). So why is it doing this and I cannot seem to edit anything to fix this? Why am I reaching 0 on 08/03/25, and then I get a new security with a "2" after it? My portfolio is negative from the start.

I can start clean, but then it only pulls transactions from August of this year. Just don't get it.

All my other brokerage accounts work and behave just fine. Thanks in advance!

Comments

-

Hi, @NitDawg

That grayed out transaction at the beginning of the register is a Placeholder. Think of it as a balance adjustment, and it is adjusting the share balance to what is being reported by Fidelity. In this case, it sounds like it removed -6.4 shares so the 0 balance was correct for 8/3/2025.

I am not there to see your data, but I do suspect the 2 after the fund name indicates that Fidelity started reporting the same fund with a slightly different name, so Quicken dutifully removed the old shares, and added the new shares of the fund. This would make sense if you switched to the new connection method around 8/3.

You mentioned "merging the securities did not help", but usually that does, and the placeholder will disappear. Did you merge the correct securities together?

Again, I am not there, so this will require a little investigation on your part. It shouldn't be too hard to figure out what is going on. Using the Portfolio view will to see total shares of the fund/value should help.

But knowing those gray transactions are share balance adjustments should point you in the right direction.

1 -

Thanks! Super helpful. The placeholder makes a lot of sense.

The merging securities did work on one other NetBenefits account, so I'm getting there… all my other non-NetBenefits Fidelity and other brokerage accounts have been smooth sailing.

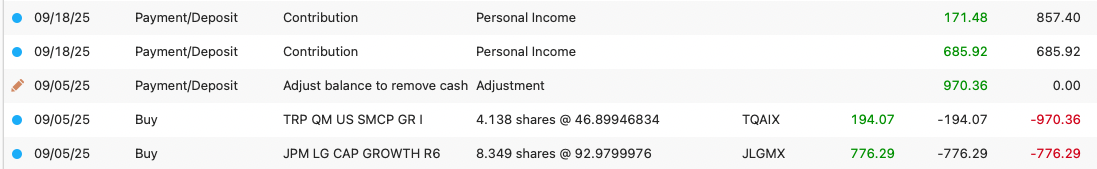

Another strange issue, again, since the connection update on one NetBenefits account, all new transactions that used to be "buys" with all the security details are now just payments/contributions/personal income with no security information. I would hate to have to start over on this one unless there is a straightforward way to import an account's history when things like this happen (hopefully it doesn't happen too often).

But now all new contributions look like the top 2 lines, whereas before, things worked as expected:

And this has persisted.

Thanks! I could have also used Jonathan_in_NC as my user name :-)

0 -

Hi again @NitDawg (Jonathan_in_NC)

Based on the transactions, this looks like a 401k with your paycheck contributions.) And, no, your Buys should continue to be buys. But when Fidelity first cutover to the new connection method, many (if not most) users were getting a few random Payments/contributions instead. (I was personally getting 3 such transactions that didn't even align with my usual 9 different funds that typically occurred. This went on for about 6-8 week, but is now resolved-at least from what most people are reporting .You might see continued Buys later when the fix occurred.

Since I knew what was going on, I simply (after I merged securities) went to the Fidelity website and downloaded the transaction date range and manually typed in the buys with the corresponding amounts/shares purchased. I then deleted all those random payment transx. I felt this was the fastest way than waiting for a fix/having an incorrect file. I don't think their fixes are retroactive, so while it may be working now, you will have to manually enter the missing transaction for that data range of weirdness.

If you go this route, you will want to make a backup of your data file before attempting anything.

1 -

Sweet, that's easy enough, and I appreciate the insight! I'm a backup obsessor, so I'll give it a shot. At least the dollar amounts are correct, and it's just a matter of changing with a few clicks. Gosh, this has been an adventure…at least with Fidelity. Hopefully, we get back to steady-state soon!

0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub