_Accrued Int on bonds sold does not appear on Tax Summary

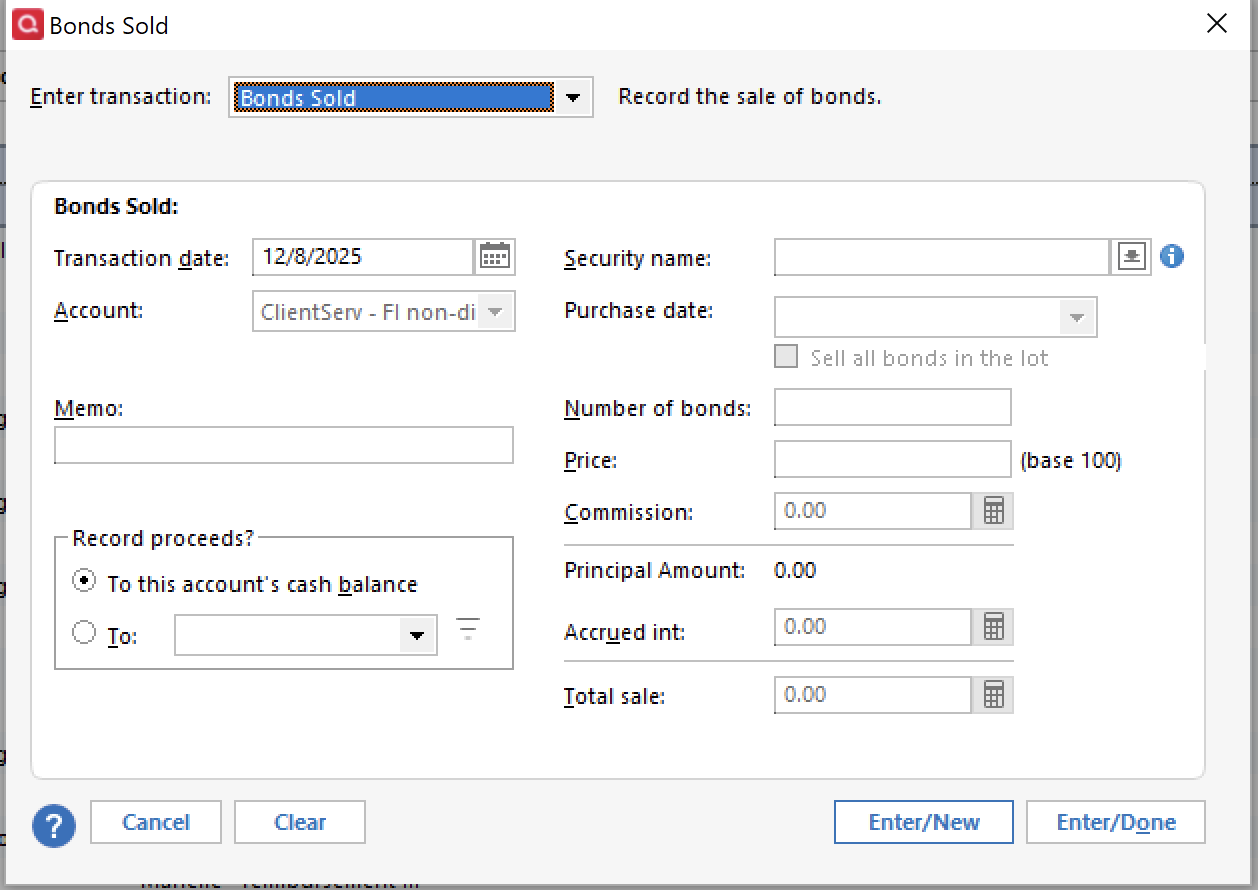

It seems that if you record a bond sale using transaction "Bonds Sold" and include the accrued interest received on the sale that the interest will NOT appear on the Tax Summary report. Instead it seems that you have to record a second transaction using "Inc - Income (Div, Int, etc.)" for the interest amount for it to show on the Tax Summary report

[Edit - Moved to Windows section of the Community]

Comments

-

This looks like Quicken Windows, not Mac. Is it?

0 -

Yes, Windows.

0 -

”you have to record”?

When you enter the accrued interest amount on the form you showed, you are collecting that amount as you sell the bond between payments. Quicken then creates two transactions, the Sold transaction and the MiscInc transaction. That second transaction will have the Category “_Accrued Int”. Are you saying Quicken did not create that MiscInc transaction? You had to do that separately?

0 -

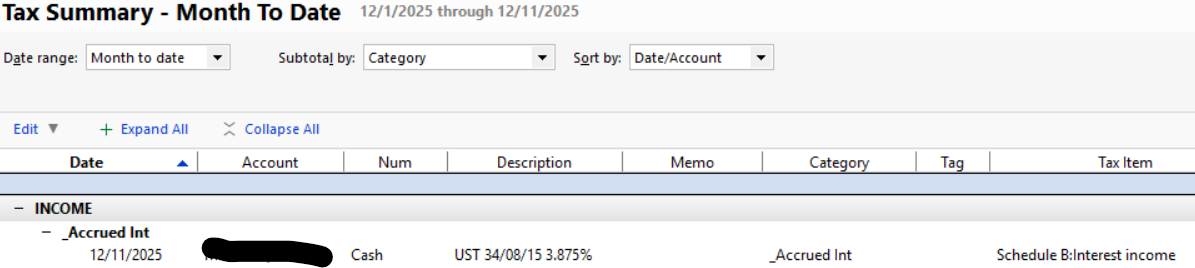

No, Quicken did create the two transactions that you noted above. The problem is that the interest does not show on the Tax Summary report. The way I got around this is to edit the MiscInc transaction by putting the amount in the Interest field and zeroing out the Miscellaneous field.

0 -

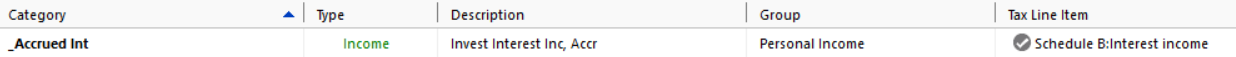

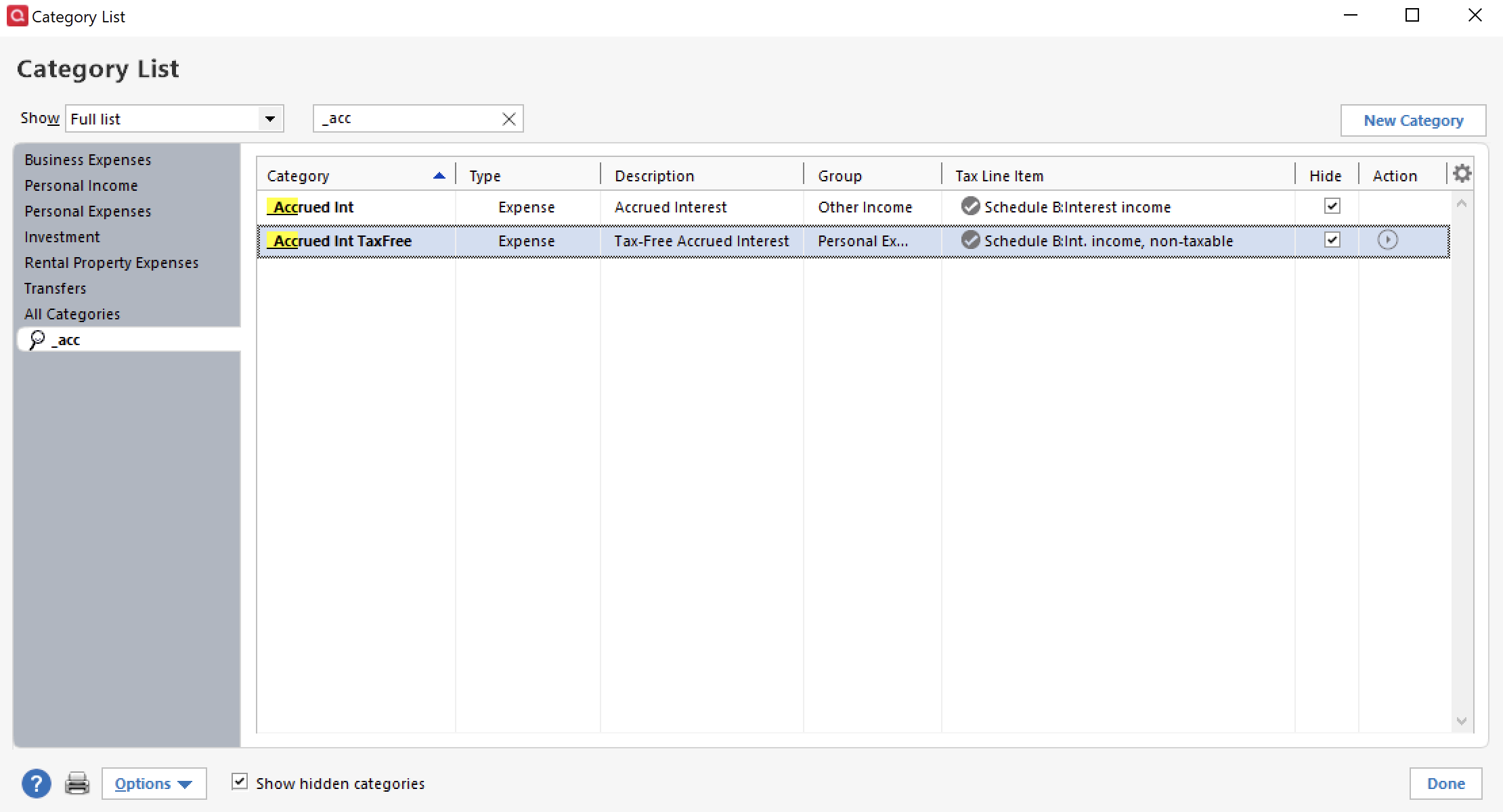

It is showing up ok for me in that report. Does your _AccruedInt category include the right Tax Line assignment?

0 -

_Accrued Int is showing up on the Tax Summary report as an Expense.

I can't seem to edit the category

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub