Automatic Payroll Deposit - 401(k) tax year preselection is the exception, not the standard

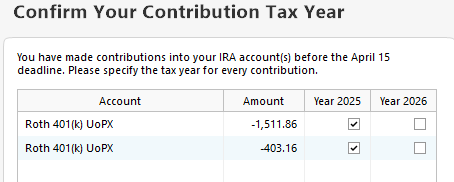

For the first three months of each year, Quicken asks me if my 401(k) contribution is for the current of the prior tax year. OK, we should be able to select that.

However: I would imagine that the vast majority of January-March 401(k) contributions are for the current tax year, not the prior one. So, why in the world does Quicken preselect the prior tax year, making me not only confirm, but also re-check several boxes each time an otherwise automatic deposit occurs?

In the interest of usability, wouldn't it be better if

1) This dialog wasn't even there (or could be turned off, at least) and the nine people who make this a prior-year tax contribution do it manually in their paycheck.

2) Pre-select the option that will be used by most people, not the one that's the exception?

[Edited - Readability]

Categories

- All Categories

- 52 Product Ideas

- 34 Announcements

- 243 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 514 Welcome to the Community!

- 680 Before you Buy

- 1.5K Product Ideas

- 55.5K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 125 Quicken LifeHub