FAQ: Rental Property Tags, Categorization & Reports

How does Quicken know what transactions are Rental Property

related or personal spending/income transactions?

When entering transactions Quicken tracks the type (i.e, Rental, Business or Personal) of each transaction entered by the category selected and associated tax line item on the category, if one is assigned.

Tax line information is also used when customizing reports and exporting tax data so it’s important to ensure your categories are set up correctly to avoid missing or incomplete data in your reporting.

Tax Line Items are used for a variety of transaction types in Quicken, from business to personal transactions, and each transaction type uses a specific tax line item.

Rental

Property categories use a “Schedule E” tax line item to report income or losses

from rental real estate.

More information on tax line items and a breakdown of each type available in Quicken can be found here.

Comments

-

Assigning Tax Line Items

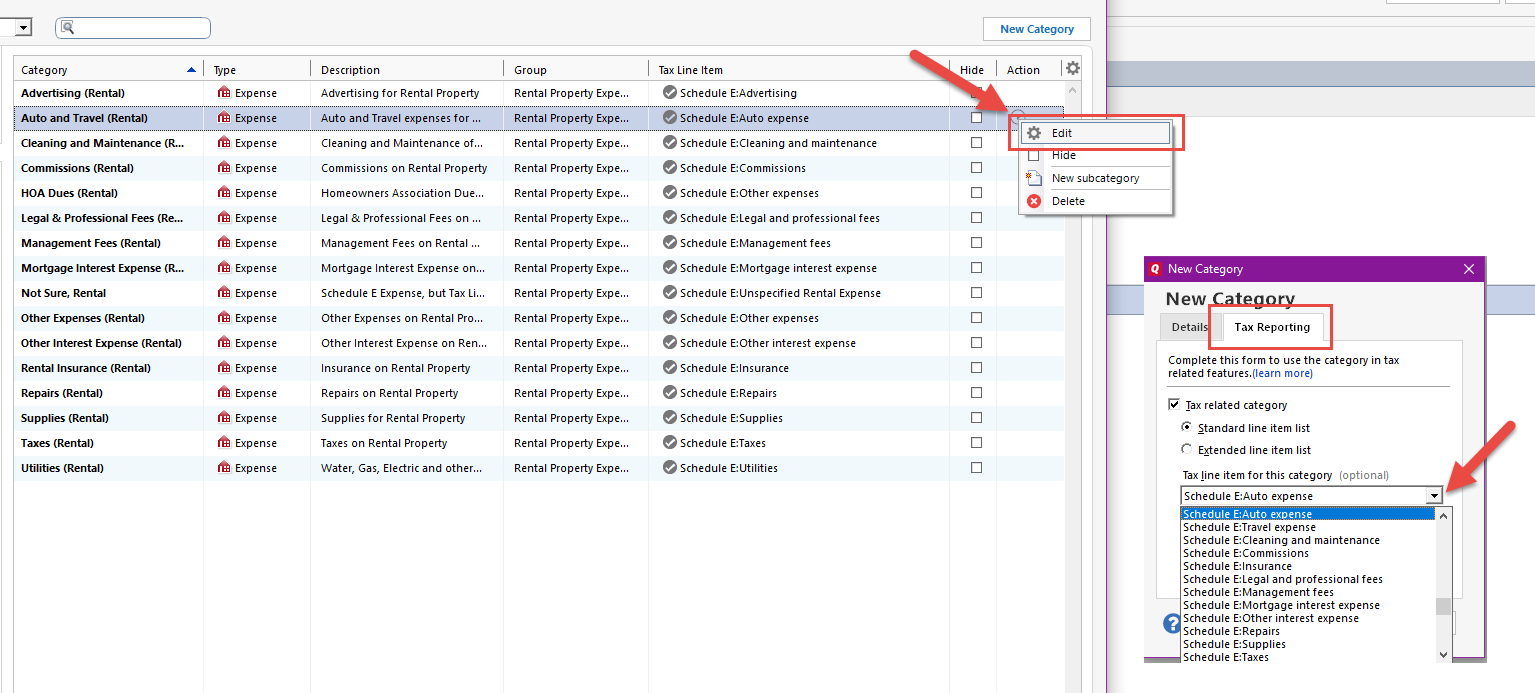

Tax line items can easily be added to new or existing categories by going to the Tools menu and selecting “Category List”

The Category List dialogue window displays all existing categories in Quicken, but can also be filtered by category type, i.e. Personal Expenses, Business Income, Rental Expenses, etc.

For our purposes select either Rental Property Income or Rental Property Expenses as appropriate.

If a tax line item is already assigned to a category, it will be visible in the Tax Line Item column of the Category List. (If this column is not visible, go to the gear wheel icon and mark the Tax Line Item box)

Already assigned Tax Line Items can be changed if needed by editing the category, selecting the “Tax Reporting” tab and selecting a different item from the drop-down list.

If creating a new category, be sure to select the “Tax Reporting” tab and assign the appropriate tax line item, if applicable.

**Please Note: New tax line items cannot be created. If none of the listed line items meet your needs, we recommend confirming with an accounting professional regarding which item from the pre-populated list is appropriate**

0 -

Rental Property Tags

Quicken includes “Tags” in addition to categories to further classify transactions. Tags can be used to track group transactions associated by a specific event such as vacation costs.

When tracking Rental Properties in Quicken, a “Rental Property Tag” is created for each Property and/or Unit added so transactions may be grouped by property in the Rent Center snapshots, Tax Planner tools and reports.

Tags may be created, renamed/edited, hidden or deleted from Quicken at any time.

If a tag is renamed, Quicken will automatically update the new tag name on any associated transactions.

Copy Number

Copy Numbers are used exclusively with Rental Properties and are used when importing Quicken Data to TurboTax, if several rental properties are owned and an individual Schedule E form is filed for each property.

Assigning a “copy number” to each rental property tag, allows each Property to be tracked individually in Turbotax by the tag and copy number to easily determine what information matches which property.

0 -

Rental Property Specific Reports

Cash Flow: Provides an overview of all spending accounts that manage deposit/expense transactions to track and manage short-term spending for Rental Properties.

- Use this report to determine if there is enough money to cover monthly bills and expenses

Cash Flow Comparison: Compares inflow and outflow (by category, tag, payee or account) for two time periods. This report is customizable to display the difference between the two periods in dollars, a percentage or both.

- INF in the Difference columns indicates that the first amount is zeroSchedule E Supplemental Income and Loss: Shows income, expenses and net profit/loss for each property tracked in Quicken. Includes every rental property transaction no matter which or type of account the transaction is in.

To be a rental property transaction, it must meet one or more of the following criteria:

1. Includes a category associated with a Schedule E tax line item

2. Includes the Not Sure rental property expense category

3. Includes a rental property tag

The report includes transactions that have already been recorded and upcoming scheduled, not entered income/expense transactions.

Profit/Loss reconciles the inflows and outflows to immediately determine if you have spent more than you made.

Tax Schedule: Lists all transactions assigned to tax forms in the category list or assigned transfers in/out of accounts. Report shows all tax-related transactions, subtotaled by category to enter in the 1040 tax form.

- Use this report if exporting to tax software0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub