Traditional IRA to Traditional IRA Transfer

Hello, is anyone able to execute a regular transfer of funds between established traditional IRA accounts without it automatically showing up as a ContribX transaction in the destination IRA (which messes up tax accounting). Its just a transfer… Tried several ways, called Intuit….no luck.

appreciate if anyone has ideas and/or a workaround. thank you

Quicken for Windows subscription

Answers

-

I assume you called Quicken support, not Intuit. Quicken has been an independent company for several years now.

Does the IRA - IRA transfer (technically called a Rollover) affect Quicken's Tax reports or the Tax Planner?

For me it does not. The rollover shows as a ContribX in the receiving account but because both accounts are tax deferred they are excluded from the Tax reports and Tax Planner.

QWin Premier subscription0 -

@Blacklab610 you can get rid of the "ContribX" by doing a Withdraw in the From Account and a Deposit in the To Account.

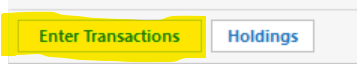

NOTE: You cannot access these transactions by entering them directly into the account register. You need to click on "Edit" in the register line, or click on "Enter Transactions" in the register header.

0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub