What Report shows the ordinary income earned from a Stock Option Exercise?

I've tried the investing activity and investing by security reports and neither show the taxable ordinary income generated by the same-day sale. The capital gains report accurately reflects the gain incurred from the qualified sale of an exercised stock option.

Win 10 Q R63.4 Build 27.1.63.21

Thanks,

Janet

Answers

-

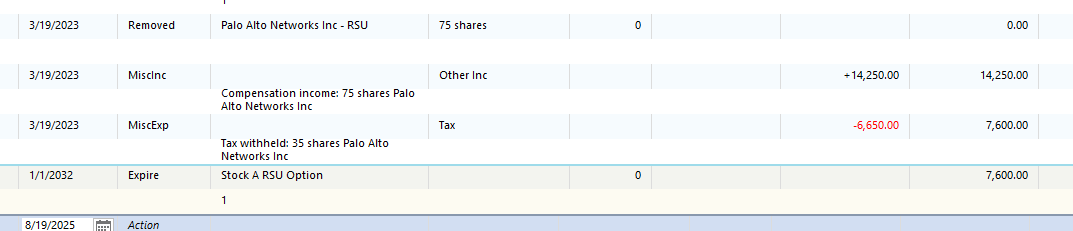

Dug out an old test file where I played around with the RSU "wizard" to find this:

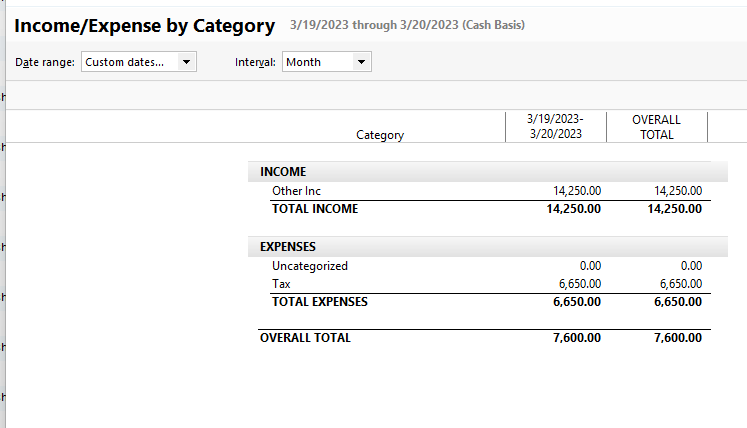

It's a MiscInc item and it does show up on an Income and Expense report:

0 -

Thanks for digging that up. Given it is something you did awhile ago, do you recall if all the line items were created by the wizard? When using the wizard to exercise a stock option, the only line items generated in the register are exercise and buy (if doing a exercise and hold) or exercise, buy and sell (if doing a same-day-sale.)

In the late 90s I manually created entries to mimic and ISO. In early 2000s I used the wizard, and looking back at those entries, I only had the entries mentioned above created by the wizard. I then created transactions to transfer out the federal and state withholding (I use yearly accounts for my taxes, not categories).

I recall reading years ago that Q tracks the tax implication behind the scenes. The wizard gives a "warning" that the type of option you choose affects how the gain is taxed, so I would think it the income and/or gain should be seen someplace.

If you have other ideas, I'm all ears.

Otherwise, I will track in Excel as I have done previously to ensure that I have accurate numbers.

0 -

"do you recall if all the line items were created by the wizard?"

Yes it was. In my memory the line item was given a name that included the term "compensation" - which makes sense - so I was a bit surprised at that "Other Income" name. At various times in the past I experimented with the various "stock options" that the wizard supported so maybe it was some other flavor of stock option that used that "compensation" term.

I used to be very knowledgeable about the taxation implications of all the various stock options but haven't thought about them for several years so I might be off-base here, but if this was a same day sale of stock acquired via an ISO, doesn't that create "compensation" income? I'd think the "wizard" would understand that and create income using a Category reflecting that, not STCG. Even over in the Tax Reports?

0 -

Ok. User error, to some degree. I had the option account coded as a separate account, Q provides a market value for the options and I don't want them included in net worth until exercised. (Earlier versions of Q did not provide a market value for the option.) So, I've been digging further today and had that realization that I needed to include separate accounts or the reports wouldn't pull the information.

This let me see data — still different from your the RSU line items. But, now that can see the data, I see a further issue related to my post on same-day-sales not reflecting data properly and am tracking to reconcile it.

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub