is it possible to track nondeductible IRA contributions

I am new to tax related features.

Is there a way to track nondeductible IRA (to use for backdoor Roth conversion)? (Form 8606)

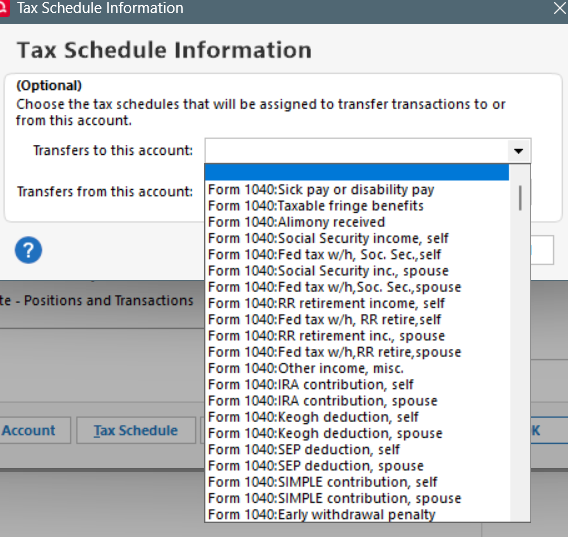

For an IRA account > Tax Schedule Information pop-up, under "Transfer to this account", I only see "IRA Contribution - Self"

Comments

-

As far as I know the answer to your question is "No," The distinction between what's deductible and what's not deductible is a calculation and Quicken doesn't make that calculation, it doesn't really have enough information to make that calculation.

Over in the Tax Planner I believe you can enter the nondeductible portion of your IRA contributions.

0 -

I think you can do it manually as long as you don't use Transfers. Enter a Withdrawal in the contributing account and a Deposit in the IRA, categorized as you please.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub