Testing Roth Conversion result in Tax Planner

I would like to perform a quick test of a future Roth Conversion. The objective is to see the approximate projected impact on my tax liability.

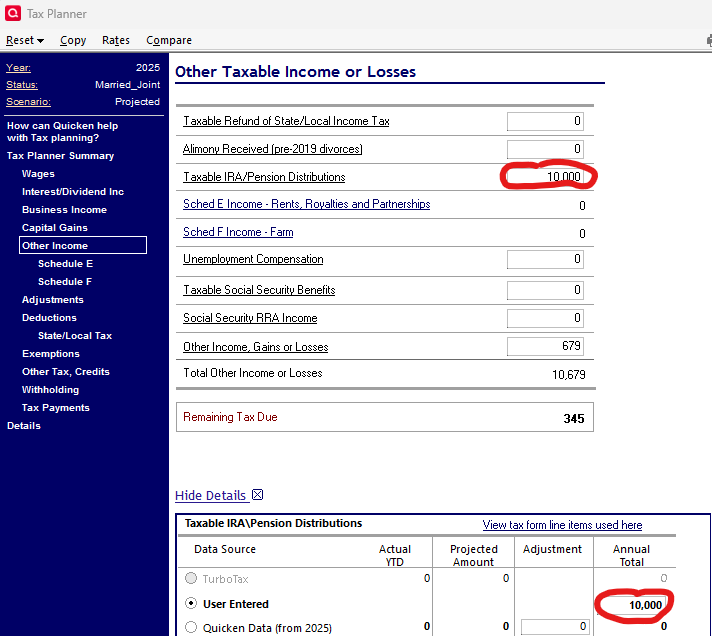

I have read and aware of the less-than-ideal Roth Conversion steps in Quicken. So instead of going thru those many hoops in my registers, would the end result be the same if I manually enter the amount in the Tax Planner > Other Income > Taxable IRA/Pension Distributions?

My testing of both methods show the same result but I'd like to know from the experts if I am missing something. TIA (R62.16)

- Q Win Deluxe user since 2010, US Subscription

- I don't use Cloud Sync, Mobile & Web, Bill Pay

Best Answer

-

I think your test should work, assuming you don't have any other IRA or pension income and no taxes are withheld from the conversion. If taxes are withheld from the conversion, you would enter the gross amount where you have indicated and the withholding on the Withholding page.

QWin Premier subscription1

Answers

-

I think your test should work, assuming you don't have any other IRA or pension income and no taxes are withheld from the conversion. If taxes are withheld from the conversion, you would enter the gross amount where you have indicated and the withholding on the Withholding page.

QWin Premier subscription1

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub