How to manage old accounts? What to delete and how?

Hello,

I've accumulated above140 accounts over past 15+ years.

My current active accounts under 30 accounts, with about 15 connected for online updates.

Some old accounts are:

a few 401k for former employer, sure funds were transferred to current active 401k account

old Credit Cards, closed accounts

matured CD

old Flex Spending , FSA for former employer

old closed brokerage, investment accounts. Funds were transferred to another and eventually to current active brokerage account

I truncated my data file a few times in the past that lead me to none existing account issues for many transactions. So I'm afraid to really delete old account for this reason.

How to manage those old closed accounts?

tnx

Comments

-

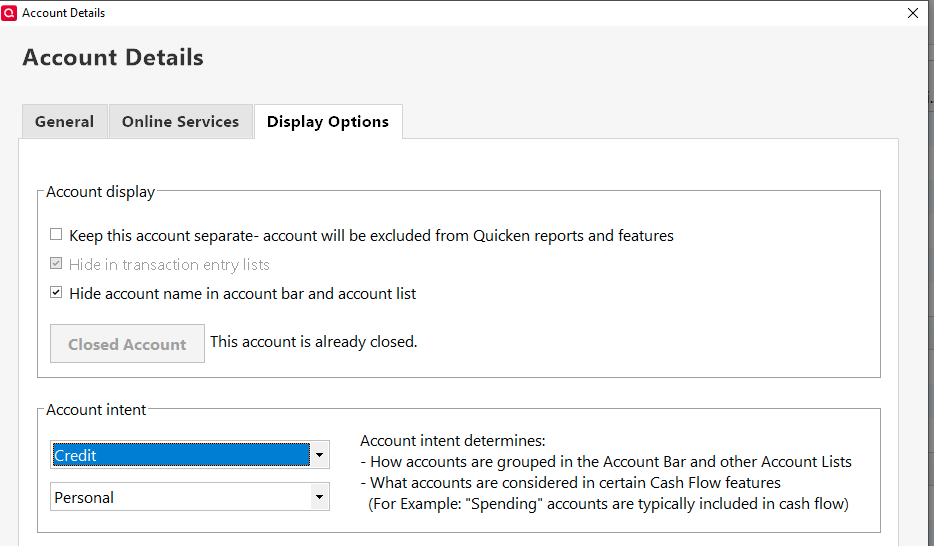

Don't delete anything. Just close the account IF it's closed in real life, and then HIDE it.

BUT, if you closed it this year, and you need info in it for your current year tax return, don't Hide it yet.

Also note that Closing an account can't be undone … so if it's not closed in real life, don't close it in Q.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Thank you for the reply.

Yes, I have all those old accounts as Closed and Hide.

Its just so many of those are accumulated over so many years.

I got such high number when I addressed Mobile Sync related issue, that showed me 124 accounts as total.No, I don't use Mobile Sync, its disabled.

Best Regards0

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 238 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 512 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub