Problem with Fidelity Investment Accounts After Latest Update

After the latest update, my Fidelity accounts in Quicken have gotten messed up with incorrect holdings. This is bad. I'm not sure what to do? I don't think the solution is changing positions and share amounts manually creating an "out of sync" mess.

Comments

-

Hello @richie5665,

Thank you for expressing your concerns, and I am happy to help.

To clarify, when you say incorrect holdings, are you referring to duplicate transactions, duplicate securities, or holdings that you don't own at all?

If duplicates are the case here, you can resolve those manually. For transactions, you can delete or manually match the duplicates. For duplicate securities, Quicken should prompt you with a Security Mismatch and allow you to match up the securities.

Let me know if these options address the issue you are having.

Thank you.

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I also had many duplicate Fidelity investment transactions, too many to many identify and delete, after downloading them 2 days ago after Quicken did the update. I called support and they said it is a known issue and they are working on it with Fidelity. I had to restore the backup Quicken did before its update. They also said they would email me a link to the Quicken Community post about this issue so I could monitor its resolution status. I never received the email. Is this supposed to be the post they were referring to or is it another post. I could not find one that seemed to cover it.

1 -

Hello @ebrooks999,

Thank you for adding to this discussion.

I reviewed the ticket from your interaction and the alert referenced therein is for this Known Issue.

I do want to let you know that some duplicates can be expected when initially migrating. Going forward, new duplicates should not continue happening.

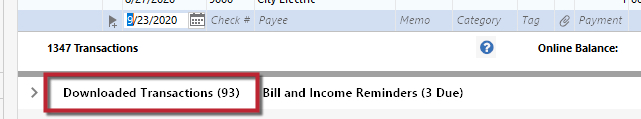

Being that you are on Quicken for Windows, you do have the option of turning off automatic entry in your registers. This puts all of your newly downloaded transactions in the bottom, in a Compare to Register window. From there you can accept new transactions, and match or delete duplicates.

Hope this helps!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

My Fidelity retirement accounts have become severely messed up. I now have securities renamed, securities that were named incorrectly, and transactions being loaded with "unidentified security". I have had transactions for a Vanguard international fund shown as being for a Vanguard bond fund, even though the memo shows the correct security.

This is becoming so bad, that I may need to find some alternative to using Quicken.[Edited-Readability]

0 -

[Removed-Rant]

0 -

Hello @jgharris7,

Thank you for adding to this discussion, though I am sorry for your frustrations.

Are you seeing the "unidentified security" issue with Fidelity? If so, that is a Known Issue.

As for the issues with renamed/misnamed securities, you can try correcting these manually, but restoring a backup may be easier, depending on how long you have been having this issue.

Hope this helps!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Today I decided to start over and add my Fidelity IRA rollover account as a new account in Quicken, since nothing was updating and my balances were wrong. To do this I deactivated and moved the old Quicken linked account to keep separate (required or Q would overwrite it apparently).

The newly added account required that I enter the cash balance manually, which I did. I was quizzed about older possible transfer transaction (with a popup that kept me from referring back to verify it) and then I had a brand new crazy incorrect balance for securities!

This is when I realized the securities balance in my original was double the actual value. However the NEW account has a huge securities balance that does not match anything I can understand. I appear to be wealthy beyond my wildest dreams, with a total value of some 9 million $s in just this account…

I have spent/wasted so many hours on Quicken issues over the years, but this takes the cake!

This is just insane.

PTArtist.com1 -

Hello @SandraStowell,

Thank you for adding to this discussion, though I am sorry for the frustrations you have been experiencing.

To clarify, you are saying you added your IRA as a new account and did not link it to an existing account. It asked you about past transfers, and then added an account that has incorrect information. Is that correct?

If so, I think it would be best for you to go to Help>Report a problem>Send to Quicken. Then call Quicken Support directly so they can take a look at the log files and see how the information for this account is being sent over. They will be able to determin the root cause and escalate the issue if needed.

Thank you!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub