Need help recording pre- and post-tax items related to my paycheck. (And Form 1040 Report)

Version 8.3.2 of Quicken Classic Premier for Mac on macOS 26.1.

I'm trying to get the most out of Quicken Mac's limited tax reports so I'm revisiting how I have our paychecks laid out. We each received taxable life insurance benefits and my wife pays our pre-tax health insurance premium. My question is:

How can I record the imputed income of the life insurance benefits accurately without inflating our net income? And how can I accurately account for the health insurance premium, which lowers taxable income, in the built in reports?

Bonus question: How does the Form 1040 report work? No transactions show up when I run it. All of our tax related transactions are present on the Tax Schedule report.

Answers

-

Hi, @sneff30

Let's step back a second before we go further regarding tax: Do you have your paycheck currently setup as a Split breaking out the gross pay minus all the various deductions for taxes, insurance(s), possible transfers to things like HSA/401k accounts? Doing this will allow the Net Pay to remain correct.

Please answer this, and then we can move from there.

0 -

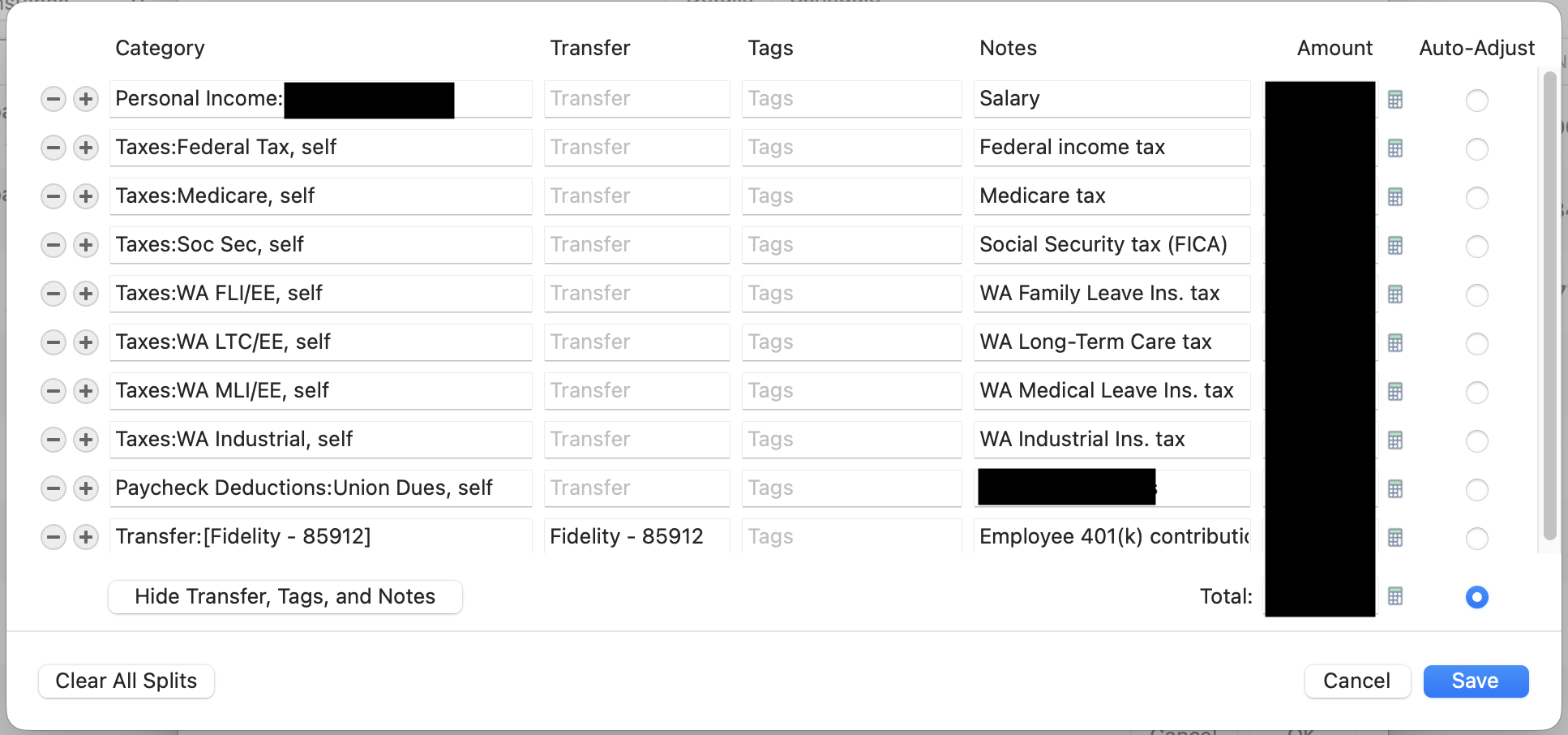

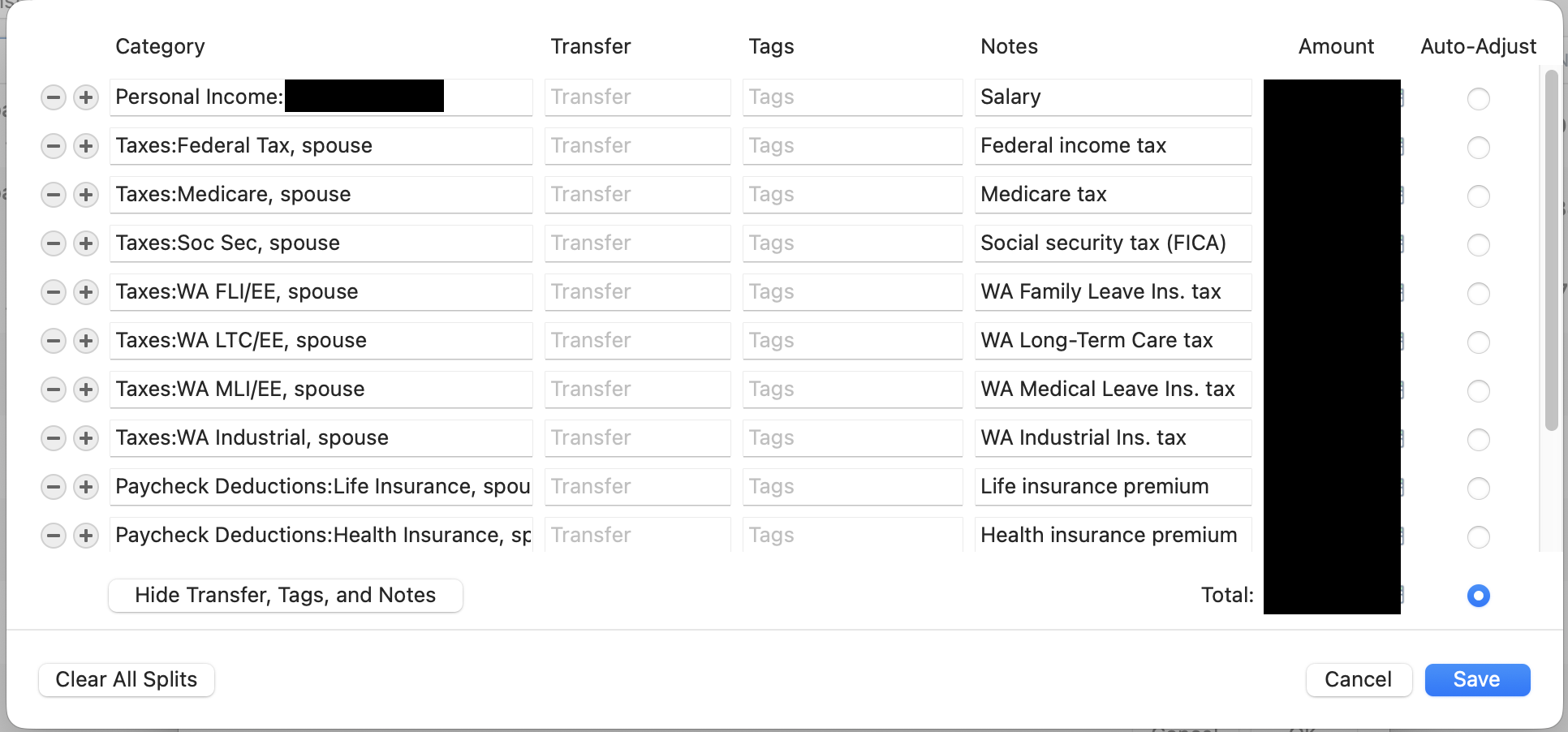

Thanks for your reply. Here is a screenshot of what I'm working with right now. The life insurance premium in the second screenshot is my wife's employee paid extra life insurance, not the employer paid benefit.

Like I stated in my OP, we each get life insurance benefits from our employers which is included in our taxable income. Her paycheck has pre-tax health insurance deducted which I do have properly recorded in her paycheck in Quicken. This reduces our taxable income.

I acknowledge this is super in the weeds in terms of tracking income, but if Quicken Mac can do it I would like to try.

0 -

Thanks-the screenshots help explain that you have split the paychecks out. Great.

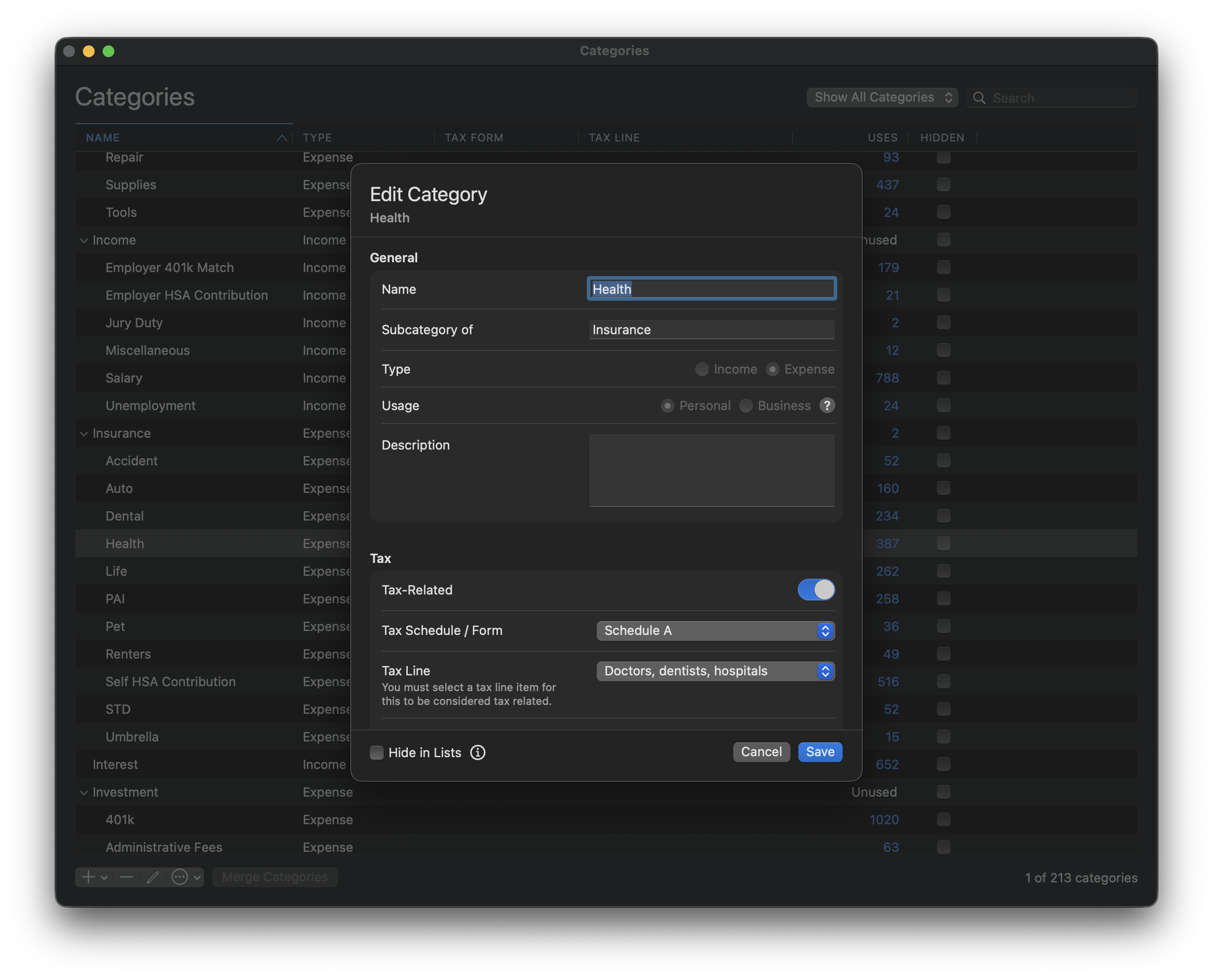

For your various tax deductions, you will want to go in to the Category list and edit that category and mark it as tax related. Then, you can add what IRS line/form it applies to. This will allow those lines to show up on Quicken's tax reports. Is that what you are asking?

The tax reports Quicken has won't display "taxable income" I believe only tax software at tax time can determine that. It will only show the total of the various schedules based on your transactions.

Also, if you haven't already setup these as tax line items, don't worry if the Form 1040 tax report is blank-that is looking for various less typical taxes that aren't shown in your paycheck.

0 -

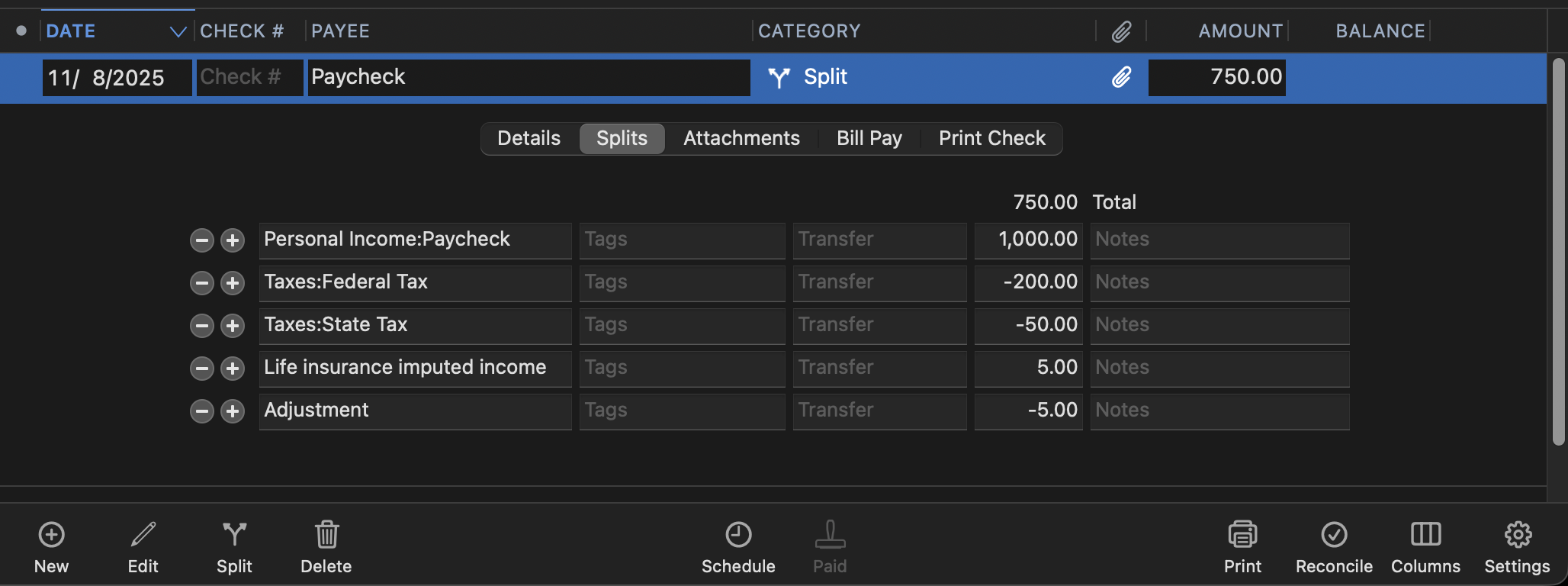

I don't think there's a great way to record imputed income like that since it doesn't actually result in a transaction in an account. The best I can come up with is to add two lines to your paycheck split - one for the imputed income and a second with an adjustment offsetting the inputed income so the total comes out right. Something like this:

If you edit the "Life insurance imputed income" category to mark it as tax-related and assign it to W-2 income, then it will be included in your W-2 income on your Tax Schedule report:

I'm not sure where imputed income is actually supposed to be reported, so that might not be the right tax line. It;s been almost a decade since I last had any.

0 -

Let me ask you…..is the imputed life insurance included in the personal income on the top line? You may need to enter another income line for it. Many many years ago when I worked I had the option to get the life insurance. And if it was over a certain amount I had to pay tax on the imputed income so I opted out. My tax notes say….

Imputed Life Insurance is code C in W2 box 12. It is the taxable cost of group-term life insurance over $50,000 (included in boxes 1, 3 (up to social security wage base), and 5).

I'm staying on Quicken 2013 Premier for Windows.

0 -

As for the Form 1040 report, it looks to me like that only includes categories that have been assigned to Form 1040. These days not very much actually gets on that form, most items have been shoved off onto one of the Schedules instead and those categories only show up on the Tax Schedule report.

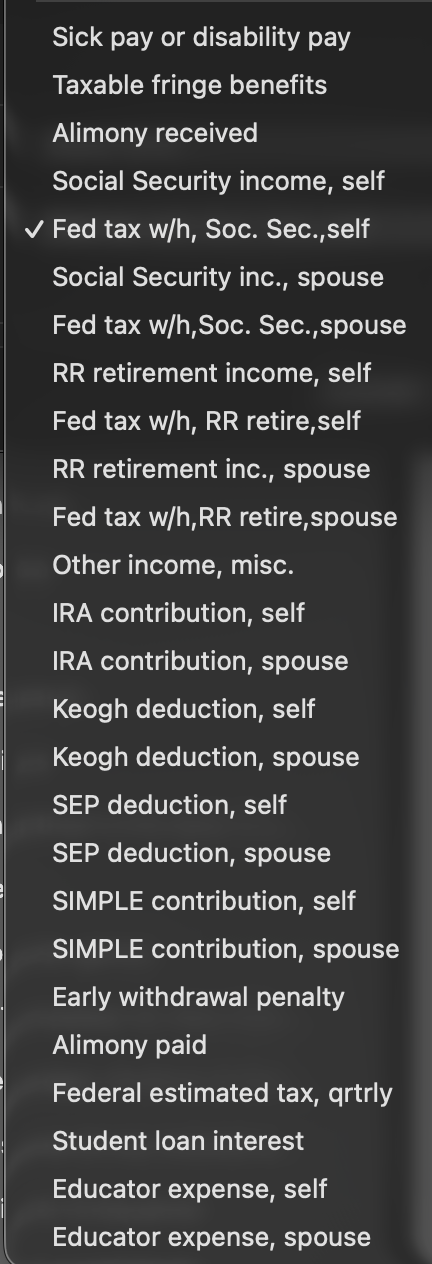

This is the list of items that Quicken has associated with Form 1040:

0 -

No, I've got a good handle on the tax line items for all our various income and taxes. It all shows up on the Tax Schedule report. I handle our tax calculations in Excel so my goal is just to get a solid automated method of tracking. I think what @Jon suggested is the most effective way to get this on to my reports without messing up the net income of our paychecks. I can create a separate line item so it's easy to see.

Nope, it's only included in total taxable at the bottom our checks and on our W-2s. This is useful for me because we file separately in a community property state, so I use our total taxable for a few calculations.

That's what I concluded after looking around some more. I have all the info I need on the Tax Schedule report. Just wondered if the Form 1040 report could be of any more use.

Thanks everyone for the comments!

0

Categories

- All Categories

- 56 Product Ideas

- 34 Announcements

- 239 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub