Reports - Tax Summary - Dates not correct for State

Wayne Andre

Quicken Windows Subscription Member ✭✭

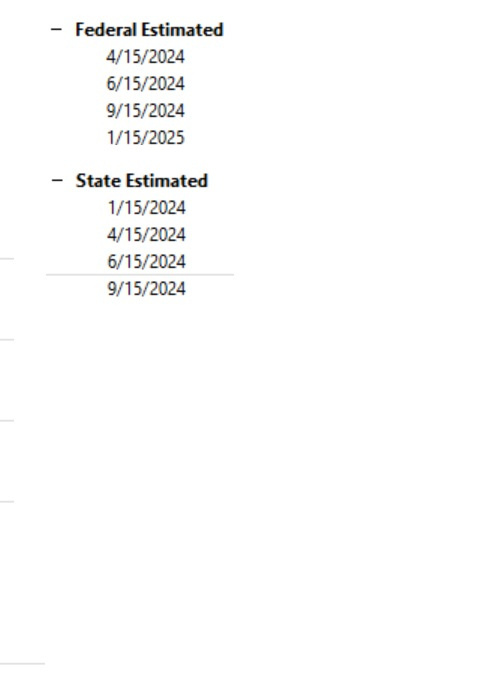

Notice the Federal Estimated dates are correct, but the ones for State are wrong. State should be same as Federal

0

Comments

-

State should be same as Federal

Actually that is not quite correct, and it is confusing.

Federal estimated taxes are due in April, June, September, and January of the following year. The due dates for state estimated taxes vary by state. Most states match the Federal schedule, but some are different.

The federal deduction for state taxes paid is based on the calendar year they were paid, not the year they were credited for state tax purposes. That is why the Tax Planner and Tax reports use the dates that the state taxes were paid.

QWin Premier subscription1

This discussion has been closed.

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 512 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub