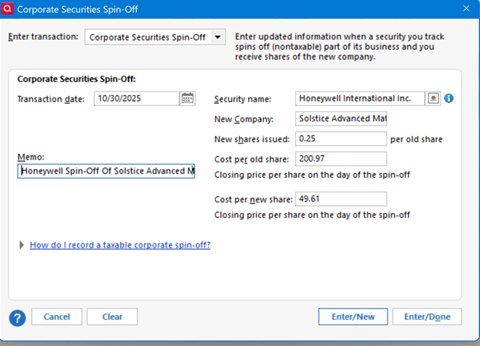

Honeywell International Spin-Off Of Solstice Advanced Materials - Cost Basis

Hello Fellow Investors,

Below are the numbers from the Honeywell Form 8937.

You can use them for the 10/30/2025 Spin-Off of Solstice Advanced Materials.

For a Schwab Account these will give you the exact cost basis reported by Charles Schwab in your portfolio!

Honeywell - Solstice Spinoff |

|

| |

|---|---|---|---|

FORM 8937 | HON | SOL | TOT |

Cost Basis % | 94.1874% | 5.8126% | 100.0000% |

Closing Prices | 200.97 | 49.61 | 250.58 |

Comments

-

Hello @Rick8,

Thank you for sharing this information. I'm sure others will find this information useful.

Your contribution is appreciated!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Rick8 I also appreciate you posting this information. For those interested, the Form 8937 is currently posted here.

To be a touch nitpicky, you posted that the two prices were closing prices; actually they were volume-weighted average prices (VWAP). The closing prices on 10/30 were (per my data) $200.11 and $48.74 for HON and SOLS, respectively.

To maintain a neutral Average Annual Return value across this type of spinoff, I prefer to use the closing price of the spinoff and a computed price for the parent in that Corporate spinoff form you included. Thus I would use the prices of SOLS = 48.74 and HON = 197.4456 (= 200.97 / 49.61 * 48.74) to get the 94.1874% and 5.8126% basis allocation ratios you cited and that Schwab used for your account.

More generally, I would compute the price for the parent as:

- PP = BR * PC * SR / (1 - BR) where

- PP = Price for the Parent company

- BR = portion of the basis retained by the Parent

- PC = Closing price of the spunoff Child

- SR = Share ratio = child shares received per parent share owned

Thus, in this case:

- PP = 0.941874 * 48.74 * 0.25 / (1 - 0.941874) = 197.4458

Hope this helps and does not further confuse.

0 - PP = BR * PC * SR / (1 - BR) where

-

q_lurker, I know all that. I just tried to make it simple so the labels matched the Quicken fields for those that did not want to get into the weeds. It is always an issue with a spin-off as each financial institution uses its own method. This is what Schwab used and the numbers work out to the penny (now extinct!). The SEC should require everyone to use the same method with the 8937 due out the day after the split. However, like the rest of the Gov't, common sense does not seem to ever prevail!😔

0 -

That cost basis info was very helpful.

0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub