Return to Capital - curious how others do it?

I am wondering if at the end of the year when you get your tax forms, do others enter Return of Capital transactions? I have never done it - I am now just tracking in an excel spreadsheet.

But the problem with this Quicken transaction is that a return to capital would adjust the cost basis correctly, but it also provides a cash balance so that is not good.

So, my sense is tracking offline is the only idea but wondering what others do?

Thanks,

David

Answers

-

Since usually the tax forms are ‘correcting’ a previously reported dividend to actually be a RtrnCap, I frequently enter the RtrnCap as a normal transaction, then enter a MiscExp transaction assigned to that same security with the category of _DivInc. That reverts the cash back to $0 and makes the dividend total for the year for that security match the tax forms.

Other options include RtrnCapX transaction referencing the same account (the cash disappears into thin air), or some separate transaction out to make the cash go away.

1 -

For accuracy you do need to make adjustments for both Returns of Capital and Foreign Taxes Withheld.

I make those entries as the 1099s show up by making two adjustments "as of" 12/31/(prior yr). One entry adjusts the "dividend" up or down as necessary, and the other entry is either a Return of Capital or for the Foreign Taxes Withheld.

1 -

Are they any downsides to doing this? especially since these transactions won't show up on the monthly brokerage statements. it seems to make sense but not sure the impacts of Miscellaneous Expenses. I have about $15k of Return to Capitals on a closed end REIT.

I guess the Investments and Returns will go up by the $15k.

Thanks,

David

0 -

No downsides I am aware of.

especially since these transactions won't show up on the monthly brokerage statements.

Well the tax reports aren’t consistent with the monthly statements either.

I guess the Investments and Returns will go up by the $15k.

You’re putting in two counteracting transactions. No net change.

Your other path is to delete the existing dividend transaction replacing it with a smaller dividend and the RtrnCap. Spread it out over the monthly or quarterly distributions. Doing what I suggested is essentially the same result. That make sense?

0 -

Actual Return of Capital distributions will result in cash deposited in the account. For some fund distributions it's not always clear how much to allocate to return of capital and how much to dividends. The split is usually available on the fund website. Generally, I can't think of a case where you would use a miscellaneous transaction to offset a return of capital distribution.

ADDING- after rereading the last post from OP, it sounds like a true ROC where earlier dividends are partially being recharacterized as return of capital. As for earlier distributions they should be adjusted to reflect the actual dividend versus ROC. Otherwise, tax planner will record more taxable dividend income than actually received. @Tom Young negative dividend should work

butas should miscellaneouswill not because it does not haveif it has a tax line assigned that will deduct the amount from taxable income.On the other hand, a return of capital transaction directed into the same account can be used to record an amortized bond premium. That will not increase the cash balance of the account but will adjust the cost basis of the security. This is a convenient trick allowed by Quicken to record amortized bond premiums and not truly a return of capital transaction. There is no need to use a miscellaneous transaction to offset cash since none is added.

It sounds likeIf the OP is referring to an amortized bond premium entry to adjust the cost basis. I do this annually for some bonds purchased at a premium. For each bond, on 12/31, I enter a return of capital transaction directed to the same account the bond is held for an amount that will adjust the cost basis of the bond to match the cost basis for the bond shown on the brokerage year end statement. As mentioned by @q_lurker this method does not add to the account cash balance.In reality, brokers post the adjusted cost on a daily basis. If a bond is sold before year end, I enter a return of capital transaction dated the day before the sale in an amount that adjusts the cost basis of the bond sold to match the brokers cost basis on the date of the sale. This allows Quicken to calculate a capital gain if there is one that matches the gain recorded by the broker.

0 -

My understanding - The REIT makes regular distribution throughout the year that at time of distribution get recorded in Quicken as dividends (or perhaps, I suppose some other form). End of year tax data says some of the distributions were return of capital (non-taxable) rather than taxable dividends (or other). The MiscExp I use is not to offset a return of capital distribution; it is to decrease what had been recorded as taxable income (dividends, in my experience) based on inaccurate initial recording. I understood the OP had received tax information that said return of capital but not an actual cash distribution.

2 -

"If the OP is referring to an amortized bond premium entry to adjust the cost basis. I do this annually for some bonds purchased at a premium. For each bond, on 12/31, I enter a return of capital transaction directed to the same account the bond is held for an amount that will adjust the cost basis of the bond to match the cost basis for the bond shown on the brokerage year end statement."

If you're referring to making a self-referential entry for the amortization of the premium as a return of capital then I believe this is an instance, too, where two entries are required. As I recall, with a straight bond purchased at a premium and you elect to amortize the premium (for taxable bonds; I think you must do so for a non-taxable bond) the proper entry is a return of capital, with an offset to interest income. The amortization process should bring the bond's cost to par while reducing your taxable interest income.

Looking way back to when I did have some individual bonds the entries (I made them at the same time as the coupon interest was paid) were along the lines of:

0 -

2 entries are not required if in the transaction details you select the account the bonds are held in as the Transfer Account. The cost basis will be adjusted but no cash will be added to the account. This is a convenient trick available in Quicken.

0 -

Yes, I know about that convenient trick. But if we're both talking about the same thing, buying a par value $1,000 bond for say $1,075, then tax law allows/requires (depending on taxable nature of the bond) you to reduce the interest income you'd otherwise report. You can see that happening in the entries I posted above.

Cash is not affected but the cost basis and the interest income is.

0 -

Back to my original question which was on closed end REITs, I found this online in another discussion group. So, instead of a Miscellaneous expense, it seems a negative dividend makes sense since that is really what it is.

- The first entry is a REDUCTION of dividends in the amount of return of capital reported on the 1099-DIV. That is, you enter a dividend action but with a negative dollar amount.

- The second entry uses the return of capital action with the same dollar amount as a positive number.

The only thing is that I tried it on an old file - and while the Total cost matched between Quicken and my broker, the individual lots didn't tie. I am not sure why since the allocation should be the same.

I think this is a good solution.

David

0 -

Sorry the amortized bond premium took off on a wrong tangent.

The MiscExp transaction with a positive to the _DivInc category is fully the same as a Div transaction with a negative amount, but I agree the Div transaction is more obvious as to what is being done. If I recall correctly, the negative amount needs to be entered through the pop-up form rather than as a transaction list line entry.

I would expect Quicken to be allocating the ROC to lots on a per share basis. If a lot has 10% of the shares, 10% of the ROC amount is used to reduce the basis of that lot. Your brokerage (or the REIT) may be using a different scheme. Do you know or can you identify that different scheme?

0 -

@q_lurker I made a mistake and entered it using today's date instead of the date on the tax form. So, it worked with the proper date less a rounding error. Great!

Unfortunately, I don't have all my 1099s going way back to see the actual dates. The tax forms don't have this information. But, now I know how to do this.

Quicken customer support doesn't know what a Return to Capital is so they were useless.

David

0 -

The earlier suggestion to enter the Return of Capital (and/or LTCG if applicable) and offset it with a reduction of the Dividend, both on 12/31 of the tax year, is a good solution. However, unless something has changed since the last tax season, the Mac version of Quicken does not allow one to enter a negative Dividend. Over the years, I have sent in several suggestions to allow this, with a warning alert (“Are you sure you want to enter a negative Dividend?”). Without this capability, I have had to replace each of the monthly dividends paid over the year with the corrected monthly Dividend, Return of Capital, and Long-Term Capital Gain amounts in order to tie to the 1099. So 36 entries instead of just 3 if I were able to enter a negative Dividend on 12/31 along with the total Return of Capital and LTCG for the year.

0 -

the Mac version of Quicken does not allow one to enter a negative Dividend.

Does the MAC version have the equivalent of the MiscExp transaction that you can assign to the appropriate dividend category?

0 -

Thank you. Good thought, that partially addresses the issues. The applicable MiscExp categories are either an investment category "Div Income" or a general category "Dividends." Neither is the same as the "Dividend Income" investment category that is used for my regular investment dividends. (And the same applies if I create a new category called "Dividend Income" and also assign it to Schedule B.)

What I found w as that using one of those dividend categories with MiscExp to reclassify the dividends to RC or LTCG does work in that it keeps the grand total of dividends in synch with the 1099 grand total. But in the various Quicken Tax Reports that negative dividend (created via MiscExp) shows up separately from the regular monthly dividends for that security, at the top or bottom of the dividends section of the report depending which of those 3 categories is used). So the grand total of dividends across all my securities (Sched B dividends) is then correct. But If I'm checking the dividends for each security in Quicken against those listed in my 1099, the total of that security will be off unless I take into account the MiscExp elsewhere in that report.

So thanks again for the idea. It's helpful, but it would still be better if Quicken allowed negative amounts in the Dividend Income investment category in the same way it allows negative RC transactions.

0 -

QWin MiscExp transactions allow for a security to be specified such that the by-security listings include the MiscExp transactions.

0 -

I did enter same security name. But it still does not show up in the listing of the (in this case) monthly dividends and total for that security. The transaction shows up as a separate listing with the same security name, but at the beginning or end (depending which dividend category is used in the MiscExp. I've attached a slimmed down and redacted Quicken Tax Report showing what I mean. As you can see, the 12 monthly EatonVance dividends total $14,423.97. The hypothetical $1,000 MiscExp entry to reclassify that amount of dividends to LTCG to tie to the Form 1099 shows up separately at the bottom of the Schedule B dividend report even though it has the same security name.

0 -

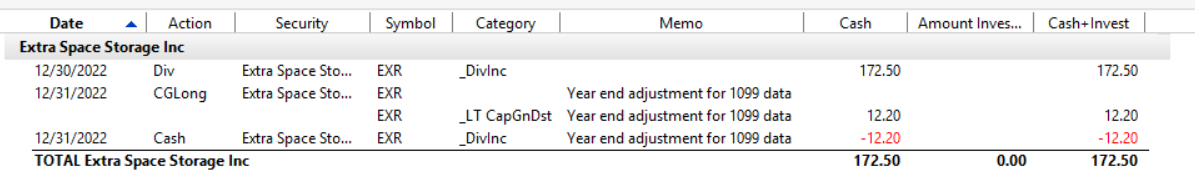

This is what I see in an investment transactions report subtotaled by Security for this type of situation.

In this case the 12/30 transaction was recorded as "DivInc" to the _DivInc category. When 1099 information indicating the distribution was partly DivInc and partly LTCapGain, I entered the LTCapGain transaction (adding $12.20) and a MiscExp for $12.20 'spending' the cash against the _DivInc category. FWIW: There are a variety of other ways I could have used as well.

These last few posts appear to be focusing on a shortcoming in the Q-MAC version. Perhaps you should discuss the topic in that area rather than this Q-Win are.

2

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 237 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub