Any suggestions on how to treat Costco Rewards?

This question applies to all types of store credit refunds I would suspect. We get our yearly Costco Rewards check, which is only redeemable in store against purchases, we merrily spend it plus a bit more of course, but now comes the time to document the transaction in the register.

Say the total is $400, and consists of more than one spending category, and the Reward is $200. I want to accurately track the spending actually done and account for the Reward as well.

Any ideas would be welcome.

Best Answer

-

Take the money and run … to Costco. 😉

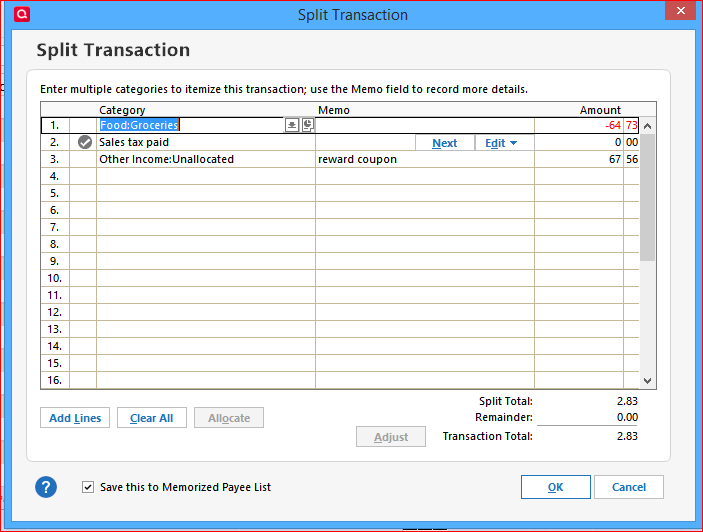

Next time you make a purchase and cash the rewards coupon, allocate the coupon amount to an "Other Income" category, e.g.,This year, because I got more cash back for the coupon than I purchased, $2.83, the above is recorded as a deposit in my $-Cash account register.

0

Answers

-

Take the money and run … to Costco. 😉

Next time you make a purchase and cash the rewards coupon, allocate the coupon amount to an "Other Income" category, e.g.,This year, because I got more cash back for the coupon than I purchased, $2.83, the above is recorded as a deposit in my $-Cash account register.

0 -

With the Costco reward, I wait until it is time for my membership dues and I use it to pay for that. So my membership fee, instead of $130, becomes $30 for example. With credit card cash rewards, I created a non-taxable income category called "Cash Back Reward" where I apply the reward to my statement and when it is downloaded I categorize it as that.

- Q Win Deluxe user since 2010, US Subscription

- I don't use Cloud Sync, Mobile & Web, Bill Pay0 -

As for me, I always put the Credit Card Rewards (or a significant portion of) into my Saving Accounts (I have several) or Add On CD accounts. I don't attempt to track C.C. Savings Rewards in a separate category as you wish to do, if I understand correctly. I guess you could create a separate savings or checking account specifically for C.C. Rewards, labeling it as such; then when the total is high enough, begin spending from those accounts. Then label the items you buy as money from C.C. Rewards as a Category or Tag; or label it as such in the memo field in ledger?

⚓️

0 -

Since the Costco Rewards can only be spent at Costco, I'd post it into my "Receivables" account and use that Receivables account as part of a split transaction with my next purchase.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Thanks for all the suggestions. I was able to use the method described by @UKR to achieve my goal of having accurate reporting the expenses as well as capturing the reward income (I just used Misc Income with a tag for Costco).

Mike - Quicken Deluxe - latest version always0 -

I think the best suggestion of the group is to use an asset account recorded to an expense category (not income - a rebate of expenses already paid).

When you receive the Costco reward (assume 30):

Account/Category

Comment/Payee

Amount

Asset Account

Payee Costco

30

Expense category of Rebates

Record Costco reward received

(30)

Then when you use the Costco reward at Costco, use a split transaction to offset the asset account. For example, spend 55 on bananas and use your 30 Costco reward and pay the remainder with your Costco credit card:

Account/Category

Comment/Payee

Amount

Costco Credit Card

Payee Costco

25

Asset account

Comment Use Costco reward

(30)

Grocery (category)

Comment Bananas

55

Quicken user since 1993

0 -

For me, I've created cash accounts for each card. I keep them separately. I don't use them in my budget, only to see how much I have in each. From time to time, I update the sales.

0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub