Cannot activate one step update for Bank of America Accounts

I had one step update working for my three acounts at Bank of America but last one step update did not download transactions for all accounts - just one of the three. We are taling about transactions at least a couple of weeks old. So I tried reset account (twice) and deactivate/reactivate (once). None worked. What happens is that during the process to look up my accounts, it finds them but the options to link to existing account do not have options to link to the correct account for some of the accounts. In each attempt there was at least one account where the only existing account(s) I could link to were not the correct account. The results were not consistent. I think that in each case there was one account where I could link to the correct one but at least one of the other two allowed only linking to the wrong account - sometimes the wrong BoA account, sometimes an account in another bank.

Any idea how to fix this?

Thanks

Jim

Comments

-

Hello @jdparker225,

Thank you for sharing a detailed account of your experience. I am happy to help!

It is definitely strange that Quicken is suggesting you link to incorrect accounts, or just not allowing you to link to the correct accounts. It could be that Quicken thinks some of the accounts are already connected; therefore, it removes them as options to link to.

I think a good place to start would be to completely sever the connections with Bank of America and then reestablish them.

To do this:

- Create a backup of your Quicken file first.

- Deactivate all Bank of America accounts in Quicken.

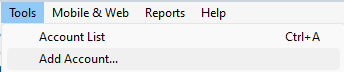

- Select the Tools menu and select Account List....

- In the Account List, select the account you want to deactivate, and then click Edit.

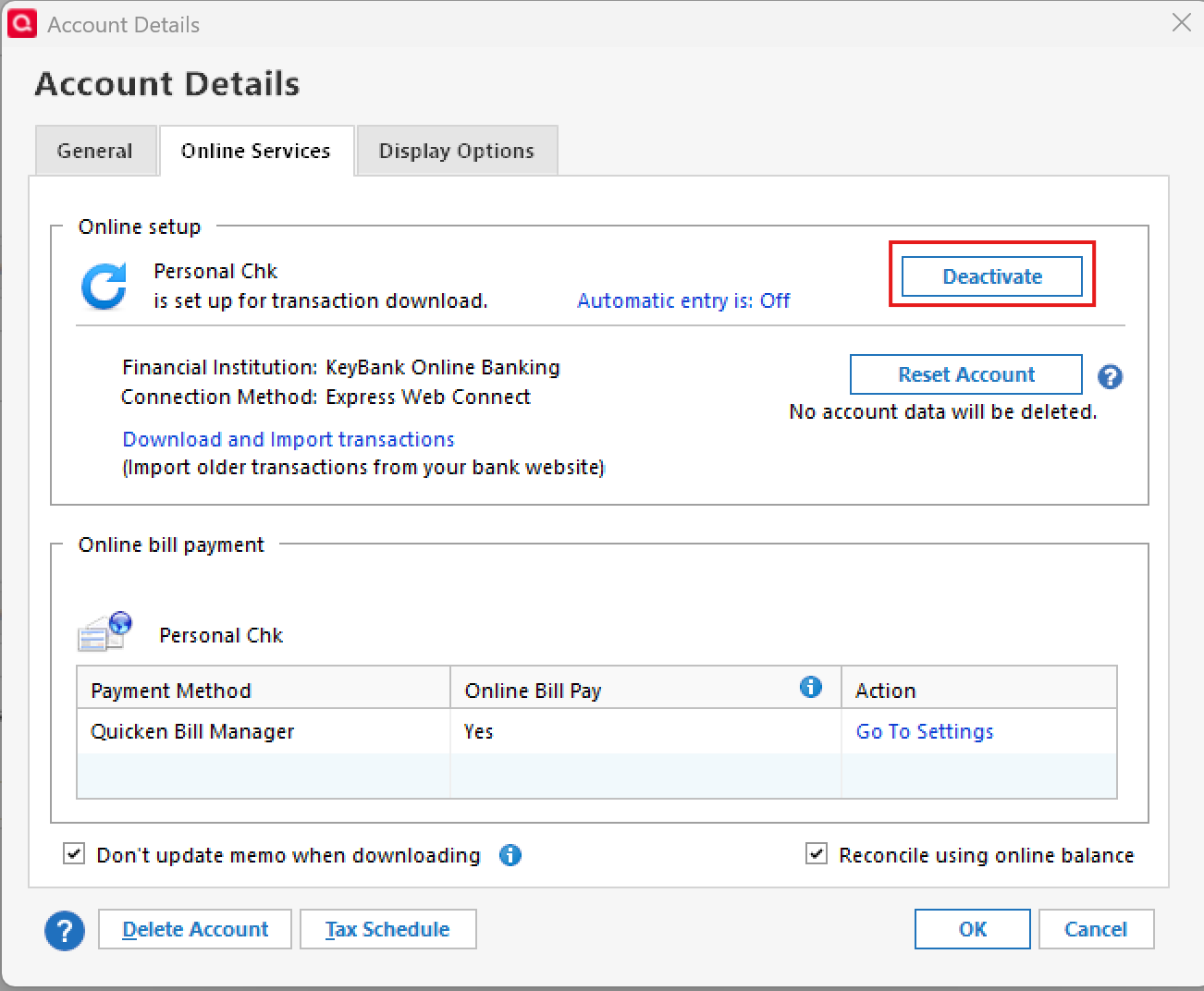

- In the Account Details window, click the Online Services tab.

- Click Deactivate next to the service you want to disable.

- Click Yes to the message confirming if you want to disable this service. Note: If you do not receive this message, additional information is available below.

- Click OK to the confirmation message.

- If you have an investment account that is linked to a cash account, you need to deactivate the online services from the investment account which will automatically deactivate the linked cash account.

- Important: If you are deactivating/reactivating an account to fix an issue, you'll need to deactivate all the accounts with the affected financial institution that you have activated in Quicken (including hidden ones). Once they're all deactivated, then you can follow the steps to reactivate.

- Revoke Quicken’s third-party access from the Bank of America website.

- Check for any old/hidden accounts and disconnect those too if you find any.

- Reactivate the accounts in Quicken.

- Go to Tools > Add Account.

- Select the bank for the deactivated account(s). If prompted, select the connection method.

- Enter your credentials and click Connect.

- When the list of located accounts appears, choose LINK next to each account you want to reactivate.

- Click Next then Done on the last prompt.

Let us know how it goes!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Quicken Alyssa Thanks, that did it. When I looked at the account list, one of the 3 accounts was, somehow, not deactivated. In the past, when I have deactivated one account of a financial institution, I was able to reactivate without any problems - it would find all 3 accounts and allow me to link to all existing accounts. First time that it has behaved this way.

Again, thanks.

Jim

1 -

Thank you for following up to let me know that those steps resolved the issue. Happy to hear everything is now in working order!

If you need more help, don't hesitate to reach back out!

Thanks again!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Quicken Alyssa Yes, it is working now but doesn’t what happened indicate a Quicken error that should be fixed? If you deactivate or reset one account at a financial institution, shouldn’t all accounts at that institution be deactivated or reset? I would classify what you gave me was a workaround not a fix. I can’t see what did happen as the intended behavior.

Thanks

Jim

0 -

Thank you for following up and asking this question.

I can see where you are coming from, but it is an "expected behavior". Our Deactivate/Reactivate Support Article actually touches on it as well.

This happens because Quicken does not/should not allow you to link to accounts that are already connected. It's to help avoid linking to incorrect accounts.

That being said, I know that what you mentioned about Quicken sometimes allowing you to connect accounts without deactivating all other accounts with that financial institution, is sometimes true as well. So while both can be true, disconnecting all accounts is the safer way to do it.

Hope that helps clear up any confusion.

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 238 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 512 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub