Error with Merrill Lynch downloads

Quicken Classic - Version R65.29, Build 27.1.65.29. I have three Merrill Lynch accounts. The first time I used the EWC+ update all three accounts downloaded and reconciled great. The second time I updated the accounts one account (A) was perfect but the other two (B&C) had the transactions switched. The transactions for B were assigned to C and the transactions for C were assigned to B. I disabled automatic updates for all three accounts and used the statements to reconcile (frustrated).

I went into the account list and account B has the correct nickname but has account C's account number and C has the correct nickname but B's account number. I have no idea how this happened. Is the remedy as simple as switching the nicknames to match the account numbers?

Best Answer

-

Hello @gslaby,

Thank you for sharing your experience!

I think the best course of action here would normally be restoring a backup from before the issue started, and then disconnecting and reconnecting the accounts to ensure they are linked properly. Unless you have already cleaned up all of the transactions going to the wrong accounts, which it sounds like you may have done.

If transactions are all sorted out, then all you would need to do at this point is disconnect and reconnect the accounts to get the downloads straightened out going forward. Please follow the steps below for the disconnect/reconnect process.

- Create a backup of your Quicken file first.

- Deactivate all Merrill Lynch accounts in Quicken.

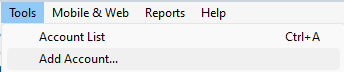

- Select the Tools menu and select Account List....

- In the Account List, select the account you want to deactivate, and then click Edit.

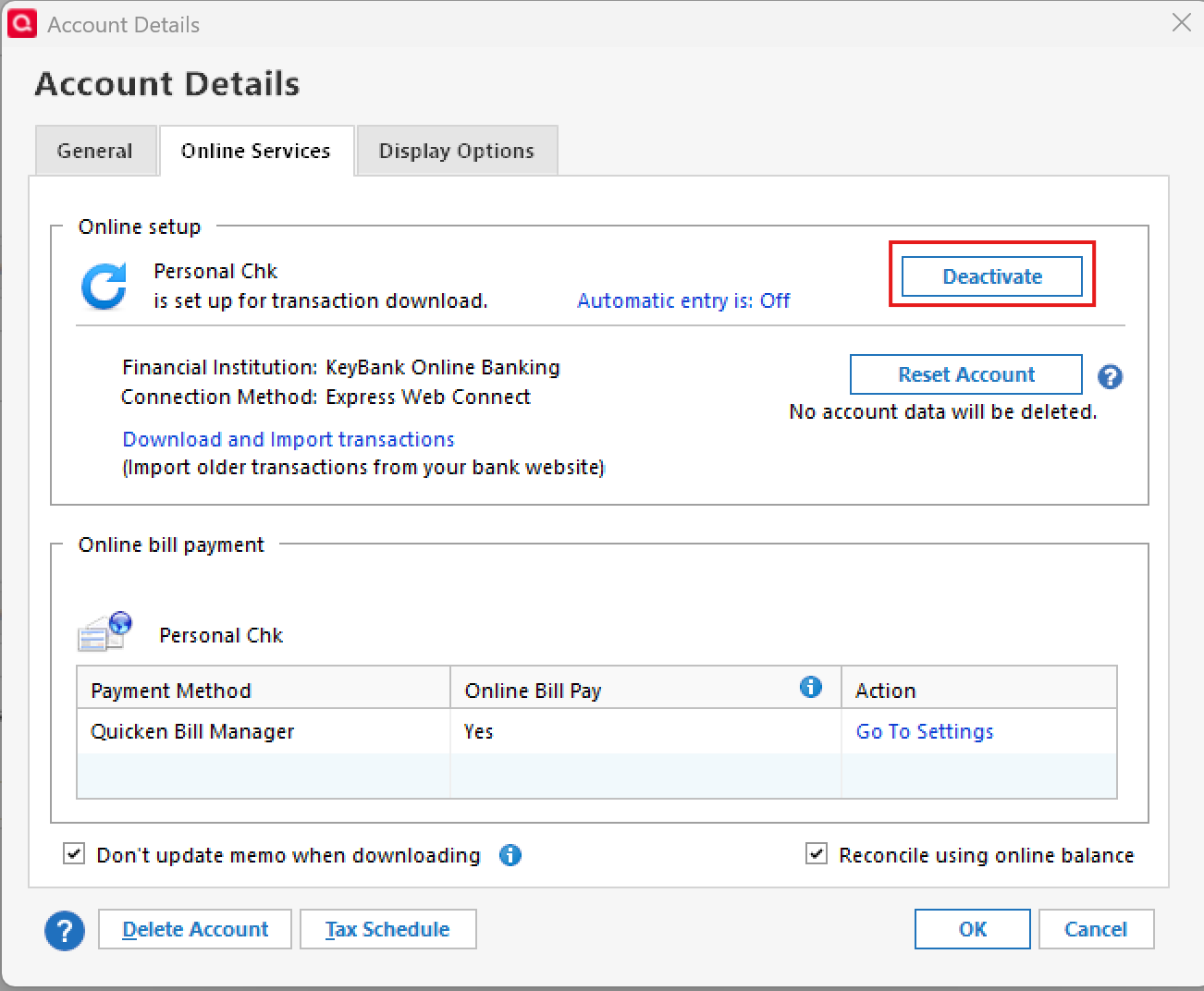

- In the Account Details window, click the Online Services tab.

- Click Deactivate next to the service you want to disable.

- Click Yes to the message confirming if you want to disable this service. Note: If you do not receive this message, additional information is available below.

- Click OK to the confirmation message.

- If you have an investment account that is linked to a cash account, you need to deactivate the online services from the investment account, which will automatically deactivate the linked cash account.

- Important: If you are deactivating/reactivating an account to fix an issue, you'll need to deactivate all the accounts with the affected financial institution that you have activated in Quicken (including hidden ones). Once they're all deactivated, then you can follow the steps to reactivate.

- Revoke Quicken’s third-party access from your Merrill Lynch account on their website.

- Reactivate the accounts in Quicken.

- Go to Tools > Add Account.

- Select the bank for the deactivated account(s). If prompted, select the connection method.

- Enter your credentials and click Connect.

- When the list of located accounts appears, choose LINK next to each account you want to reactivate.

- Click Next, then Done on the last prompt.

Let us know how it goes!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0

Answers

-

Hello @gslaby,

Thank you for sharing your experience!

I think the best course of action here would normally be restoring a backup from before the issue started, and then disconnecting and reconnecting the accounts to ensure they are linked properly. Unless you have already cleaned up all of the transactions going to the wrong accounts, which it sounds like you may have done.

If transactions are all sorted out, then all you would need to do at this point is disconnect and reconnect the accounts to get the downloads straightened out going forward. Please follow the steps below for the disconnect/reconnect process.

- Create a backup of your Quicken file first.

- Deactivate all Merrill Lynch accounts in Quicken.

- Select the Tools menu and select Account List....

- In the Account List, select the account you want to deactivate, and then click Edit.

- In the Account Details window, click the Online Services tab.

- Click Deactivate next to the service you want to disable.

- Click Yes to the message confirming if you want to disable this service. Note: If you do not receive this message, additional information is available below.

- Click OK to the confirmation message.

- If you have an investment account that is linked to a cash account, you need to deactivate the online services from the investment account, which will automatically deactivate the linked cash account.

- Important: If you are deactivating/reactivating an account to fix an issue, you'll need to deactivate all the accounts with the affected financial institution that you have activated in Quicken (including hidden ones). Once they're all deactivated, then you can follow the steps to reactivate.

- Revoke Quicken’s third-party access from your Merrill Lynch account on their website.

- Reactivate the accounts in Quicken.

- Go to Tools > Add Account.

- Select the bank for the deactivated account(s). If prompted, select the connection method.

- Enter your credentials and click Connect.

- When the list of located accounts appears, choose LINK next to each account you want to reactivate.

- Click Next, then Done on the last prompt.

Let us know how it goes!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Thank you for the reply.

This did not work, the B&C account downloads were still assigned to the wrong account.

On direction #3, I could not find a place to revoke third-party access. But after I deactivated the accounts in Quicken ML showed I had no linked sharing.

1 -

So I went back and looked at a backup I did in May of 2025. All accounts had the correct account numbers in the account list for that account. So, some time since the early November download and reconciliation (for October 2025) when everything worked correctly the account numbers were swapped.

In the May file the accounts are in all number format XXXXXXXX. In the Current file they are CMA-XXXX and IRA-XXXX using the last four numbers from the original account number prior to the change. But B&C are assigned to the wrong accounts. The A account has the new format but continues to download to the A account.

Is there a way to view backups without actually restoring them? I ask because when you click on file it says VIEW/RESTORE backups. I just want to open them to view the account numbers.

Is there any benefit to me to go back to backups to try to figure out the time frame where the account number swap actually to place. I am guessing somewhere after early November. Don't know if that would be of any value.

Or do you think it might work to go in and edit the account numbers to the old format? I don't want to have to that change point and backup and then have to update all my other accounts.

I hope my description makes sense to you and thank you so much for any help or suggestions you can offer

0 -

Thank you for following up with additional information.

You asked if there is a way to view backups without restoring them. No, this is not possible; you must restore the backup to view it.

Yes, it is worth restoring the backups to see where the issue began. If you find a backup is less than 90days old and does not have the issues, you should be able to update the accounts in that file, and hopefully all would be fixed.

Let us know if this method works for you.

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Just checking in, we haven't heard back from you in a while.

Do you still need assistance?

Thank you!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

It is resolved. Thanks so much. It was a matter of deactivating and reactivating the one step updates for the accounts. I’m not sure why but I had to do it multiple times before it finally worked but it did.

1 -

Thanks for following up to let us know what resolved this issue.

If you need more help, don't hesitate to reach back out!

Thanks again!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 237 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub