IRA Tax Withholding Categorization

Why would an IRA's distribution tax withholding show under taxes under the appropriate categories (fed & state) but also show as uncategorized? Multiple distributions and total tax withholding and uncategorized are the same amount. Even if my process is flawed I would assume it would be one or the other. Any insight is most welcome.

Answers

-

What type of account are you showing the example from?

How are the Withdrawals from your 401k set re: "Tax Schedule"?Because the usual method of recording these is to transfer the entire amount from the 401k (with the Tax Schedule set to "1099-R: Total Pension Gross Distribution") and the the taxes withheld (in the non-taxable account) shown as negative amounts … resulting in the Net deposit being shown in the register of the banking account.

But, since you haven't shown what you're describing, it's a bit tough to diagnose. You haven't shown anything as being "Uncategorized".

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Sorry for long winded response.

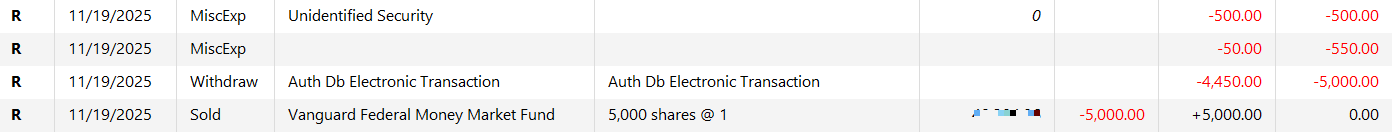

Funds are coming from a MM within a Rollover 401K.

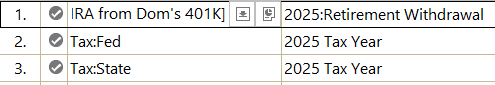

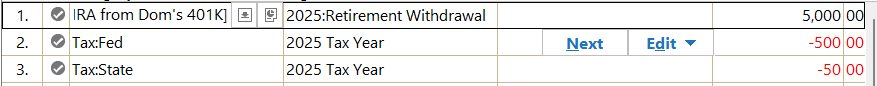

I download the transaction from the IRA and accept in total (first image). I then copy a deposit transaction from our checking and adjust the amounts as necessary.

Quicken then asks if this corresponds to a transaction on the IRA or something to the effect and I respond in the affirmative.

I figure I'm not doing this correctly. However I can report total distributions and taxes withheld. It just that it also shows the taxes as uncategorized.

From Rollover:

Our Checking

0

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 512 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub