I'm having trouble properly recording transactions from my Fidelity 401K account.

My companies end of year true up, resulted in some of the Safe Harbor and Employer Matches being taken out. Fidelity shows those two different ways; as Negative Contributions and as Adjustments which don't seem to work when they auto downloaded to quicken. How should I enter those transactions and where do I show the cash going since it went back to the company not to me. I'm using Quicken Classic Premier on Windows.

Answers

-

You say that they don't work when downloaded … but be more specific. What exactly happens? What do those Fidelity actions download as?

And the cash going back to the company would be a "Cash Transactions - Withdraw", with the same category used as when you 1st received the cash … thus netting out.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

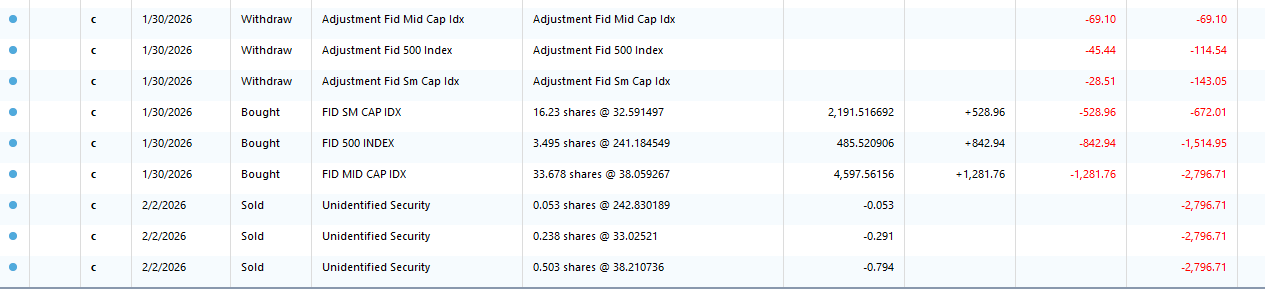

This first snip is how they came into Quicken:

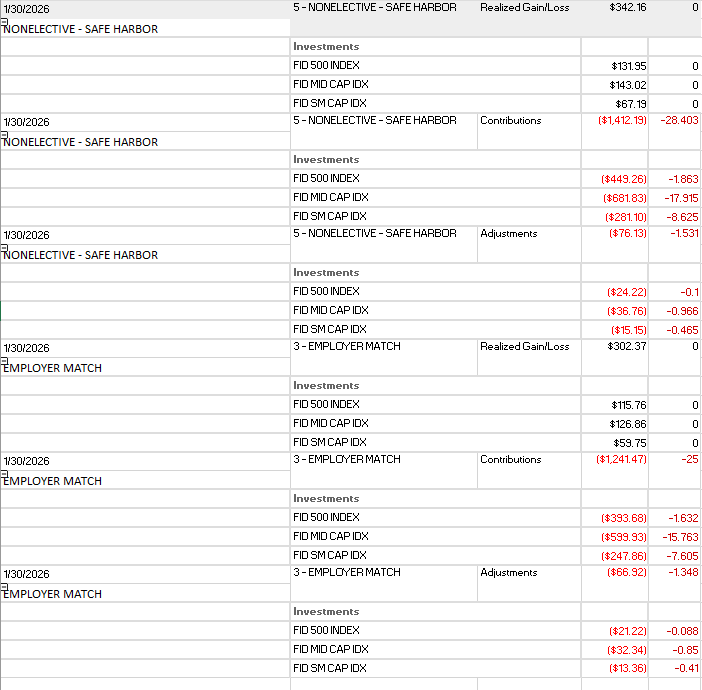

This next snip is how they appear in Fidelity (copied into Excel first):

There are no tax implications because Safe Harbor and Employer Matches so the excess funds go back to the company and not to me.

Thank you

0

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 238 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub