Comcast Spinoff of Versant

I'm looking for help in recording the spinoff from Comcast of the company Versant. What prices and approach should I take in Quicken for Windows Classic Premier to properly capture this?

Best Answer

-

@WSC In a Corporate Spinoff, each lot of the parent company (Comcast) is independently processed. If you held multiple lots of Comcast such as might have been acquired through a dividend reinvestment plan (DRIP), each lot creates a new lot of the spinoff company. In this case, if you had 1 share of Comcast acquired 3 years ago, you now have 0.04 shares of Versant with that same acquisition date. But that is not Quicken saying you acquired the 0.04 shares then; it is Quicken saying capital gain tax computations will treat those 0.04 shares as acquired three years ago. The Acquisition date is 3 years ago, but the transaction date is (should be) 1/5/26. The transaction date is when the shares appear in your holdings.

Your brokerage download (in all likelihood) does not accurately reflect cost basis or acquisition dates of the Versant shares. How important is that to you? For their Add Shares (?), you can certainly edit the transaction and fill in an actual basis and representative date and be sufficiently accurate today. But if you sell off shares at different times later on, records will get out of whack. For many users who rely solely on the brokerage to report gains correctly, that out of whack is not a problem.

If you choose to keep the spinoff created Versant (delete the brokerage downloaded version), you need to be sure that kept security has the correct ticker VSNT. After deleting the brokerage version and keeping the spinoff version, your next download from the broker should match up their info with your kept VSNT and add the CUSIP to that kept security. Future prices and dividends will associate to the Versant you kept.

Your Investing Listing? Not sure what that means. You may need to update the customization of that listing to include the newly added security.

1

Answers

-

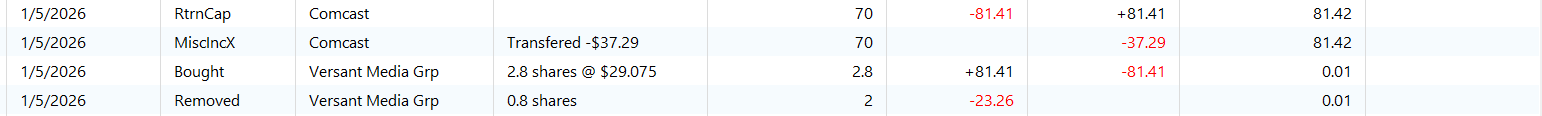

Here's what I used. I own 70 shares of Comcast. Before these txn there was a $0.01 Cash Balance.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

How many lots of Comcast do you own? One lot is easier than mulitple lot.

For one lot I would:

- Look at your Comcast basis before and after the spin-off and compute the difference.

- Take note of how many Versant shares you were due to= 0.04 times your Comcast share quantity.

- Enter a RtrnCapX transaction for 1/5/26 with: the amount equal to that basis change, and the Market Value field = Versant shares times 40.57, closing VSNT price 1/5/26.

- Enter an ADD Shares transaction for the full number Versant shares you were due and the acquisition date same as your Comcast shares.

- Enter a Sold shares transaction selling any fractional Versant share for the Cash-in-lieu amount you received.

This avoids the screwy MiscIncX transaction that shows up from the Corp Spin-off wizard.

@NotACPA How does your investment performance report look? Does the Investments column balance the returns as related to this spin-off?

0 -

@q_lurker That negative MiscInc is "Cumulative _UnrlzdGain" on the spinoff. It was downloaded from Fidelity, as was all of the activity that I posted for the spin-off. Both before and after these txn, there was a $0.01 cash balance in the account.

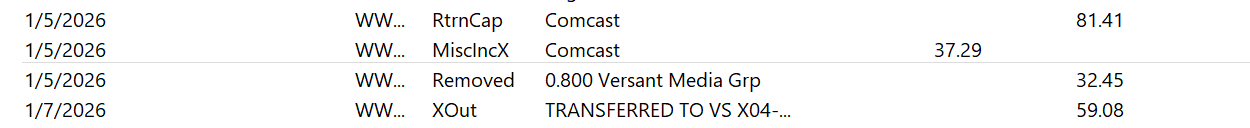

And, here's the snip from my Investment Performance report:

And another stock also paid a $29.97 div on 1/6, which is why the cash xferred out is greater than generated by Versant.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

@NotACPA Your data baffles me. So no chance you did a Corp Spinoff in your file?

I can't imagine 'Intuit' in acting as aggregator between Fidelity and Quicken would create the same MiscIncX transaction that Quicken would generate. Further, the Remove of the 0.8 shares is flat out wrong. It is a sale subject to generating a capital gain/loss. Fidelity might have sent that, I suppose, but I rarely see an FI present it as a sale until 1099's come out in the following January. The Buy in your prior snip is also off-base and is going to show as a 1/5/26 lot rather than the date you acquired the Comcast shares. The Corp Spinoff uses (correctly) an Add Shares, not a Buy.

Could you run the Inv Perf report customized to only Comcast and Versant? I think because cash and the transfer out were included is why the Buy (which should have been an Add) does not show up. Limited to the two securities is when the Investments and Returns column should balance such that the spinoff itself has no effect on performance.

0 -

There's so much going on in my life right now, that I don't truly remember all the details of what happened a month ago.

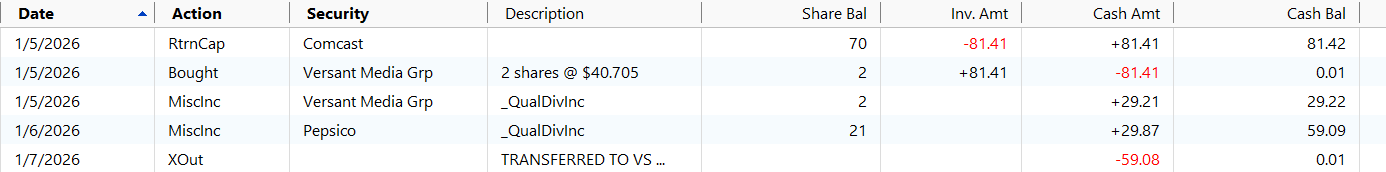

SO, I went online to Fidelity to see what they were showing. As a result, I've changed what I previously recorded.

This is what I've now got. NOTE, in particular, that Fidelity shows that "In Lieu" payment as a dividend, for which I use MiscInc so that I can record it as a QualDivInc.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

My Corporate Security Spinoff action in Quicken added dozens and dozens of entries on going back to 2011 when I first bought Comcast, including Versant at that point in time when, of course, it didn’t exist. They appear as “Added”. Why did it do that? It doesn’t look anything like your screen shot.

My brokerage house had already uploaded a Versant stock to my account. My spinoff created a duplicate stock name. Do I delete the one from my broker? If I do, every time I get a stock price or dividend, they’ll be looking for their name and create it, not use the one I created. How do I fix this? And, there is no CUSIP ID for the stock name I generated. I see no place to enter that value.

Finally, I can’t get either version of Versant to appear in my Investment listing. I’ve made sure it’s in the Securities list.

0 -

I only hold a single lot of Comcast. So, I'm only showing (only have) actions for that single lot.

Also note that, when appropriate, I use MiscInc & _QualDivInc, which is a manually input action that I use instead of the downloaded DivInc

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

I only have one lot as well. It appears to have created new entries with each dividend payout, which is 4x/year over 12 or 13 years. Why is Quicken treating those dividends (_DivInc) as lots?

And, how do I get Versant to show up in my investment listing. This is most frustrating.

0 -

@WSC In a Corporate Spinoff, each lot of the parent company (Comcast) is independently processed. If you held multiple lots of Comcast such as might have been acquired through a dividend reinvestment plan (DRIP), each lot creates a new lot of the spinoff company. In this case, if you had 1 share of Comcast acquired 3 years ago, you now have 0.04 shares of Versant with that same acquisition date. But that is not Quicken saying you acquired the 0.04 shares then; it is Quicken saying capital gain tax computations will treat those 0.04 shares as acquired three years ago. The Acquisition date is 3 years ago, but the transaction date is (should be) 1/5/26. The transaction date is when the shares appear in your holdings.

Your brokerage download (in all likelihood) does not accurately reflect cost basis or acquisition dates of the Versant shares. How important is that to you? For their Add Shares (?), you can certainly edit the transaction and fill in an actual basis and representative date and be sufficiently accurate today. But if you sell off shares at different times later on, records will get out of whack. For many users who rely solely on the brokerage to report gains correctly, that out of whack is not a problem.

If you choose to keep the spinoff created Versant (delete the brokerage downloaded version), you need to be sure that kept security has the correct ticker VSNT. After deleting the brokerage version and keeping the spinoff version, your next download from the broker should match up their info with your kept VSNT and add the CUSIP to that kept security. Future prices and dividends will associate to the Versant you kept.

Your Investing Listing? Not sure what that means. You may need to update the customization of that listing to include the newly added security.

1 -

q_lurker: Yeah, you're right. I think at the end of the days, it's just an "Add stock" and note the details in the memo field. Thanks for the great help.

0

Categories

- All Categories

- 54 Product Ideas

- 34 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.1K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub