How to put business transactions into business categories?

lacadwell

Quicken Windows Other Member ✭✭

How do I put transactions into business categories? I am making new categories for my business. Everything keeps going into the personal categories. I make sure I have clicked business expenses/income but it automatically goes into personal. Help!

0

Answers

-

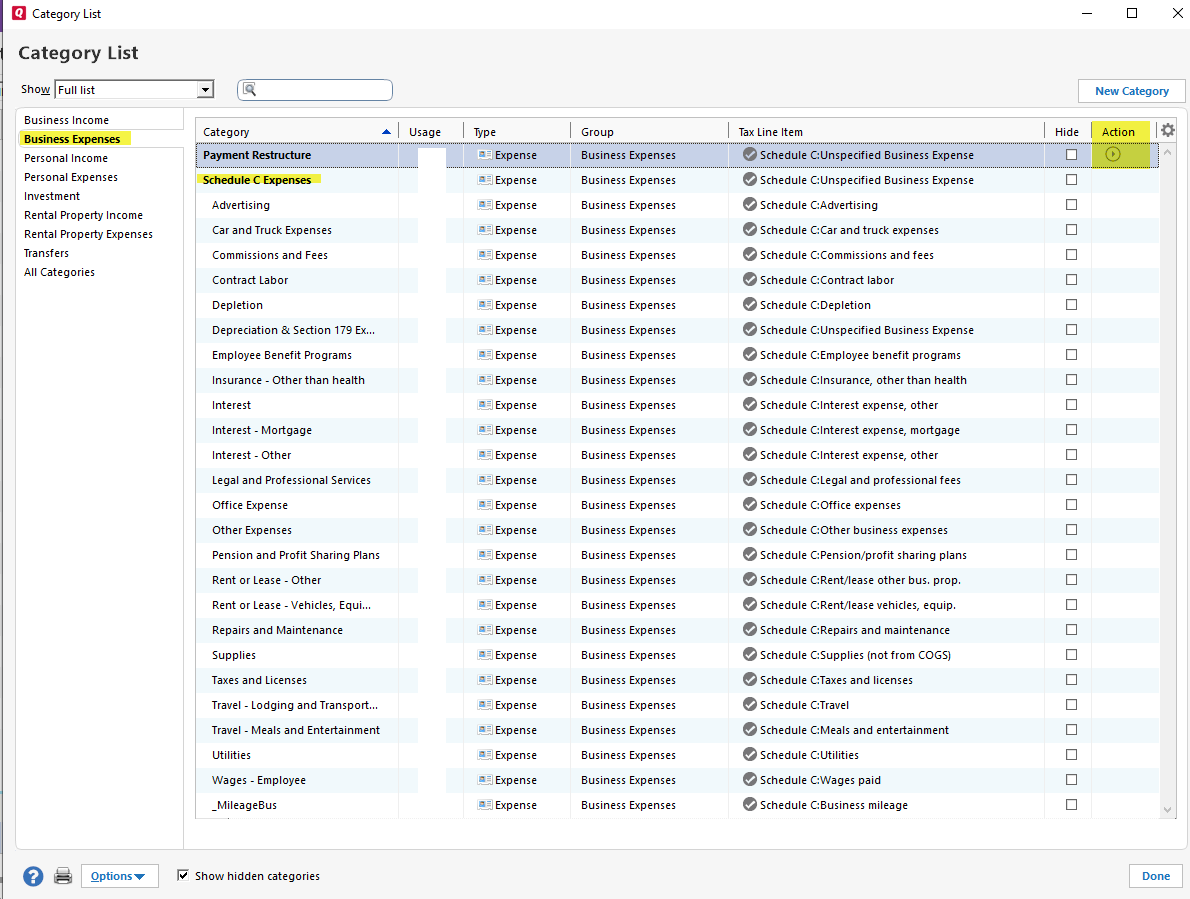

Do you have Quicken Home& Business? Business categories should be linked to a Schedule C tax item or have a business tag.Quicken Subscription HBRP - Windows 100

-

I have Quicken Deluxe 2019 which the business categories are listed. I make sure I am in the business/income category when I make a new category for business. When I go to the category list, what I put in for business has been put into personal expenses/income.0

-

I don't think Quicken Deluxe 2019 supports business categories. From the Quicken web-site under Quicken Plans Home & Business, "Separate and categorize business and personal expenses".Quicken Subscription HBRP - Windows 100

-

It says on the Quicken Deluxe 2019 description that this version easily categories personal and business which it does list business expenses/income and personal expenses/income. All of my stuff automatically goes into personal. I wanted to know 1. how to keep it from doing that. Is there a default setting and if there is how do I get to it. 2. how to switch the transactions over to business from the personal. Thanks

0 -

In Q, a category (no matter what it's name, or intended use) is ONLY a "business" category when it's tied to a business tax line.So, you can set up your own tax lines in Deluxe, but Q won't recognize them a "business categories", and there's no business specific reports in Deluxe.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

FWIW, Here is how I structured schedule c expenses when I added a business. In the category list, as mentioned, you can tie a category to a tax line under the action column by clicking the arrow icon and selecting edit. Then, click the "Tax Reporting" tab, check the "tax related category" box and in the pull-down, select the appropriate tax line item you want associated with that category. I am using QW, Home and Business Version. Not sure about Deluxe.FYI. There is no tax line for depreciation so I tied "unspecified business expense" tax line to my depreciation category.Seems to work well for me to keep me organized.Scott

3

This discussion has been closed.

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub