Best Practice for Recording Car Purchase/Loan

Austin@

Quicken Mac Subscription Mac Beta Beta

I just purchased a new car, and am hoping to learn how best to set up the purchase and associated loan in Quicken Mac.

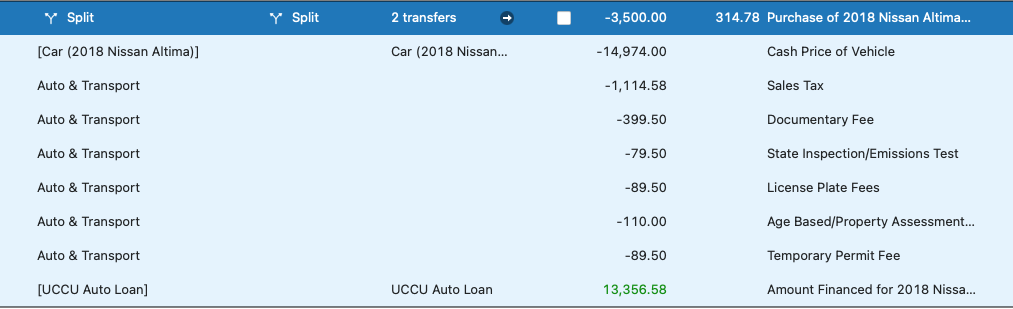

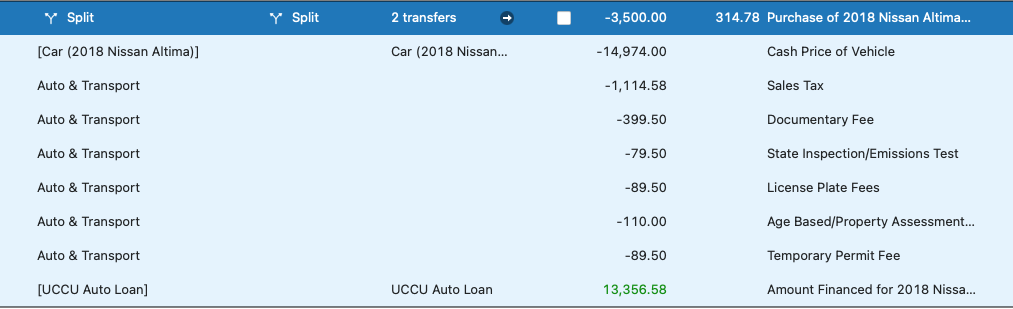

I purchased the car for $14,974 and put a down payment of $3,500, and financed the remainder. So far, I've set up an asset account for the car and a loan account for the loan, and for the purchase transaction, I have set up the following splits:

I'm new to this, so I'm not sure if this is the best way to handle something like this. Is it typical/best practice to set up both an asset account and a loan account when purchasing a vehicle so Quicken can more accurately calculate Net Worth? Or would it be better to simply forget the split lines and transfers and just record the $3,500 down payment as an Auto & Transport expense, have the loan account set up separate, and forget about the asset account representing the car's value at the time of purchase?

Any ideas/thoughts/recommendations are appreciated. Thanks!

I purchased the car for $14,974 and put a down payment of $3,500, and financed the remainder. So far, I've set up an asset account for the car and a loan account for the loan, and for the purchase transaction, I have set up the following splits:

- Purchase price set up as a transfer to the asset account

- Split lines for dealer fees, registration fees, etc. categorized as expenses

- Positive loan amount set up as a transfer to the loan account

I'm new to this, so I'm not sure if this is the best way to handle something like this. Is it typical/best practice to set up both an asset account and a loan account when purchasing a vehicle so Quicken can more accurately calculate Net Worth? Or would it be better to simply forget the split lines and transfers and just record the $3,500 down payment as an Auto & Transport expense, have the loan account set up separate, and forget about the asset account representing the car's value at the time of purchase?

Any ideas/thoughts/recommendations are appreciated. Thanks!

0

Comments

-

I don't think there's a single right answer about how to do this. Personally, I wouldn't bother with the asset account. Here's why: Over time, the loan balance will get paid off until it's eventually zero. But the asset value is unchanged. But your $15,000 car is no longer worth $15,000. Some people like tracking the asset value, so you could go to Kelly Blue Book or some other source once a year to get a blue for your car, and then make and adjustment to the asset value. But how accurate is that estimate? Is it worth trying to track in Quicken. Eventually the value drops to close to zero, or you sell the car to get a newer car, starting the cycle all over again.

To me, what you're really interested in tracking in Quicken is how much you are spending for your car, interest, maintenance, fuel, etc. This helps you see where your money is going, budget for the future, etc. The current value of the car is not terribly relevant. You know you'll eventually need to replace the car, but if you take out a new loan at that time, all that will change is your monthly loan amount; the old and new car's values don't matter too much. Again, others might track the value; I'm just giving you my thoughts.

Quicken Mac Subscription • Quicken user since 19931

This discussion has been closed.

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub