How to return to the reconciliation screen?

philwells1

Quicken Windows Other Member ✭✭

I previously started reconciling an account (Quicken 13 Deluxe), and forgot to complete the done button. Now my account shows "c's" for cleared but not R's for reconciled. Can I return to the original screen somehow to complete the process, or do I need to do something else? I need to reconcile the following month, but since the prior balance wasn't "reconciled" I have the wrong beginning balance. Your help would be appreciated.

0

Answers

-

Hello @philwells1,philwells1 said:I previously started reconciling an account (Quicken 13 Deluxe), and forgot to complete the done button. Now my account shows "c's" for cleared but not R's for reconciled. Can I return to the original screen somehow to complete the process, or do I need to do something else? I need to reconcile the following month, but since the prior balance wasn't "reconciled" I have the wrong beginning balance. Your help would be appreciated.

I apologize for any confusion you may have experienced, and thank you for bringing this subject of reconciling accounts up for discussion here on the Quicken Community.

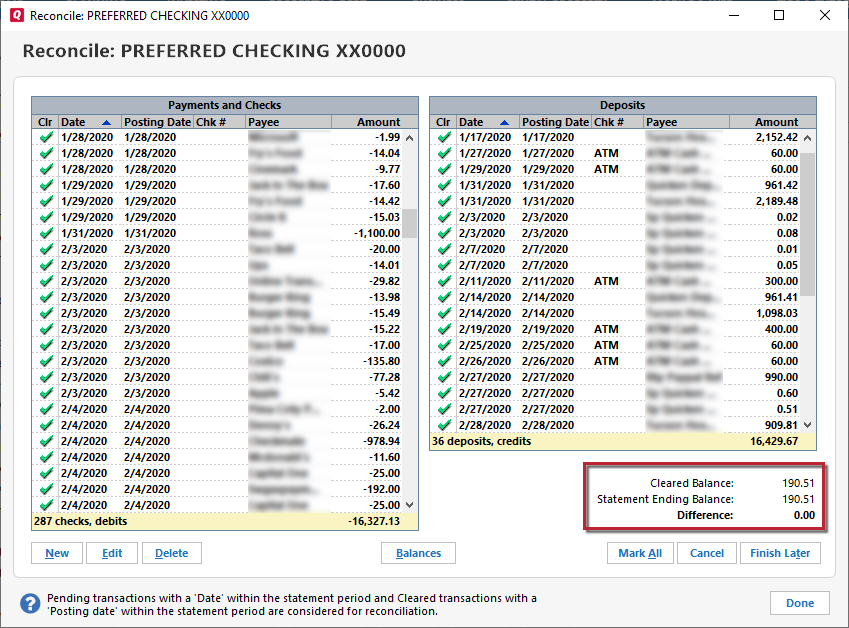

In order to return to the reconciliation screen, you can always go through the following steps when working with an online account:- Open the account you want to reconcile.

- Go to Tools > Reconcile an Account.

- In the Reconcile Online Account window, select Online Balance.

- Click OK.

- Click Done if the difference in the lower-right corner is zero.

If you're referencing a paper statement for reconciling accounts, then use these steps:- Open the account you want to reconcile.

- Go to Tools > Reconcile an Account.

- If you are presented a choice, select Paper Statement.

- Using your paper statement, verify the opening balance (your financial institution may call this the beginning or previous balance) and enter the ending balance. Note: The first time you reconcile an account, the opening balance is taken from the ending balance of your previous statement.

- Enter the amount, date, and category information, if there is a service charge or interest earned. (Optional)

- Click OK.

- Check off the transactions in the window that also appear on your statement. If necessary, you can click the column headings to sort the transactions.

- Click Done if the difference in the lower-right corner is zero.

I hope this is helpful, and I look forward to discussing this with you in greater detail, if necessary.

Thank you,

Quicken Jared.0 -

Jared, thank you for your assistance. When I go to the reconcile screen for the account that I need to correct, because I previously "cleared" the account but didn't hit the done button, the account now shows small c's.When I return to the reconcile screen, its beginning balance now shows the balance from the prior month that was supposed to have been reconciled. How can I complete the unreconciled account e.g. change the c's to capital R's and get the correct beginning balance for the current month? I have been reconciling for many years and have never had this occur. Thank you for your help.0

-

One way of fixing this is to go to the register and manually change all properly "cleared" transactions ("c") to "reconciled" ("R"), as appropriate. The Clr column entries are editable by you.Another way to fix this is to open the reconcile window, enter the appropriate date for the "prior month" statement along with the statement ending balance. If the "Difference" number shown on the screen is still $0, click on "Done." That should change all those prior month cs to Rs. Then do "this month's" reconcile.2

-

Tom, Thank you. I had come around to your second solution but was not clear as to what to enter for the date and whether I needed to also add the ending balance for that month and ?? the interest. I was afraid that if I did as you suggest without guidance, that it would really get messed up and more difficult to resolve. Is there a way to find the actual date that I reconciled in January...is the specific date important? and since the interest was already cleared, should I leave that off? Thanks, you have been very helpful...phil w.0

-

"Is there a way to find the actual date that I reconciled in January...is the specific date important? and since the interest was already cleared, should I leave that off? Thanks, you have been very helpful."I assumed, maybe incorrectly, that you reconciled to a statement. If that's the case then use that same statement amount and date.The "reconcile" date can be anything you want it to be, assuming you have a dollar amount to balance to for that date. So if your bank has a page at its site that gives you a running balance in the account after each transaction you can pick any date you want, that day's balance, and reconcile to that. In fact, you can use the "current month's" statement (assuming you have one) and reconcile the two months together if you want to.I'm not exactly sure about your interest issue. But if your bank is charging you interest or you're earning interest on your balance, make that entry in Quicken as of the date that it shows up on your statement, even if the statement is received a week or more after the statement closing date. The truth of the situation is that the interest was actually deducted or added to your account on that date and affect the balance of the account on that date and deserves to be entered "as of" that date even if you weren't aware of it at the time. Of course the interest will show up as cleared when you do your reconciliation and will receive an "R" just like all the other transactions that show up on the statement you're reconciling to.0

-

So very helpful. I'll get on it and see if I can get it corrected. Thank you so much for the information. There wasn't anywhere else that I could obtain it...phil w.0

-

It worked, Tom. As we discussed, I just utilized the beginning and ending balances from back in Dec. and didn't do anything with the date or the interest. It got me back to the reconciling page and all I really needed was to hit the done button. Then we were normally able to do January's reconciliation. Thank you very much for your help.0

This discussion has been closed.

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub