How can I add 401K employer match on my paycheck without increasing net pay?

mattfettman

Quicken Mac Subscription Member

Since Quicken for Mac does not have a paycheck wizard, I have set up my paycheck as a generic recurring split. I recently started a 401K and one category on my paycheck says "Other Items - Do not increase pay." I assume this is my employer's contribution.

I can't figure out how to enter this in the splits without increasing the pay.

I saw a hidden category "_401EmplyerContrib" but I am unsure how to get that to be a usable category. And if it can be a usable category, will this solve the problem.

Thank you in advance for any directions/suggestions/fixes.

I can't figure out how to enter this in the splits without increasing the pay.

I saw a hidden category "_401EmplyerContrib" but I am unsure how to get that to be a usable category. And if it can be a usable category, will this solve the problem.

Thank you in advance for any directions/suggestions/fixes.

0

Best Answer

-

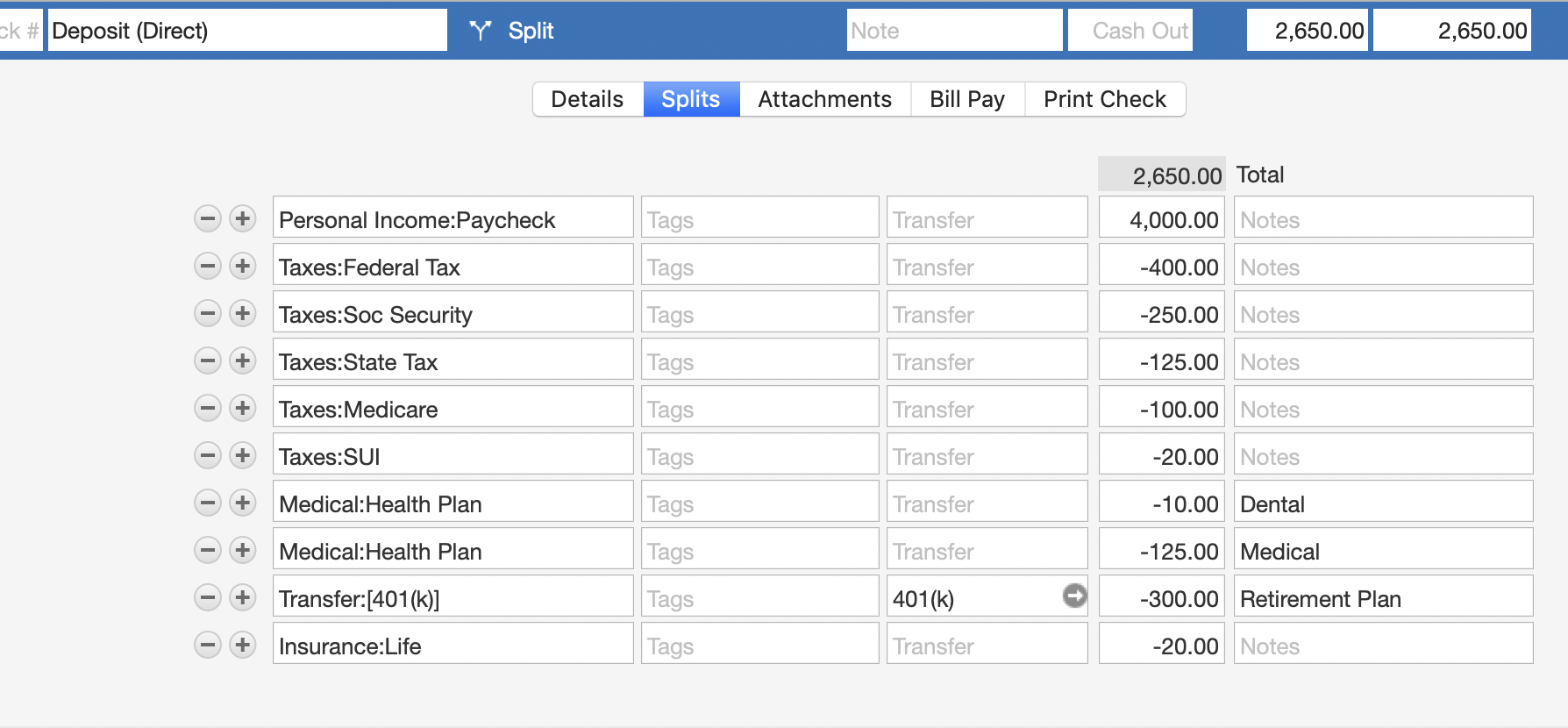

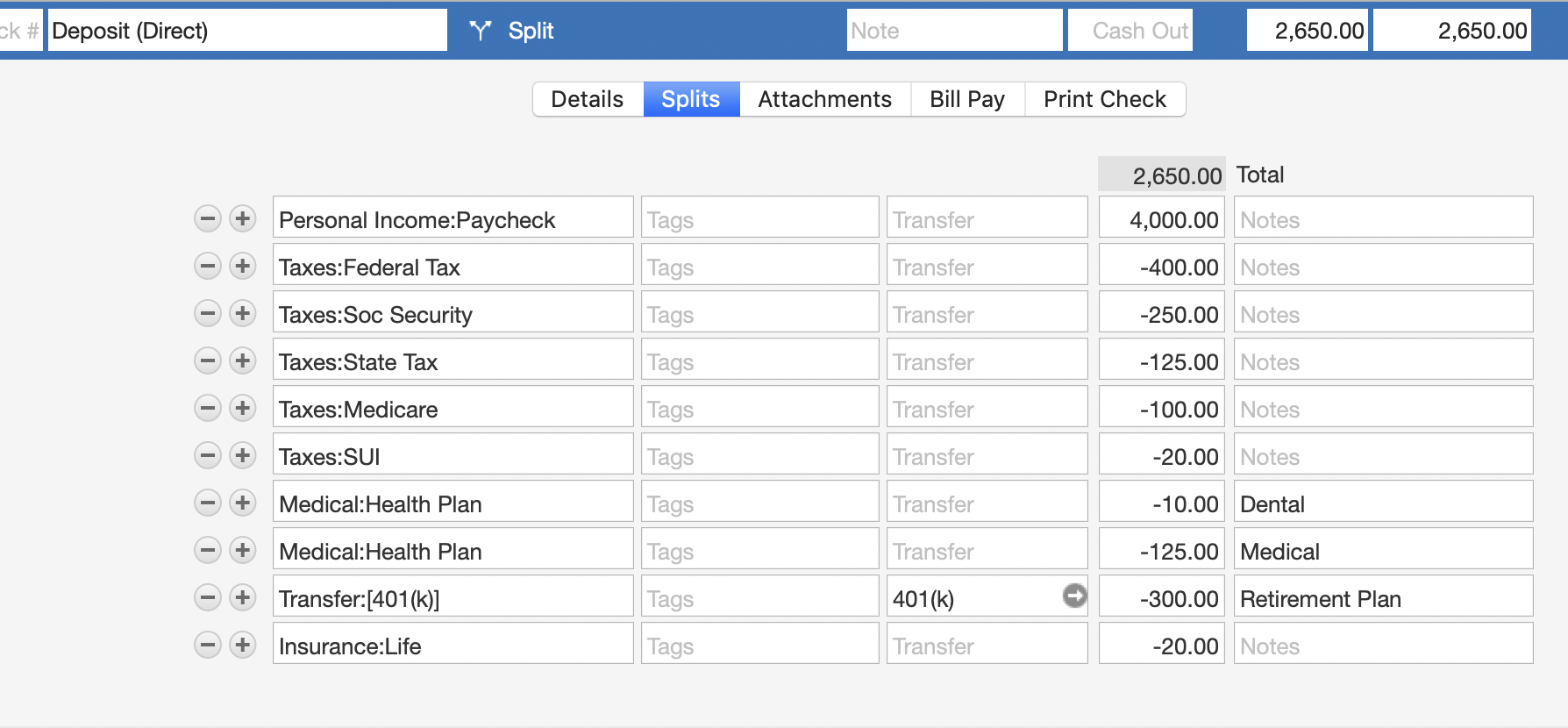

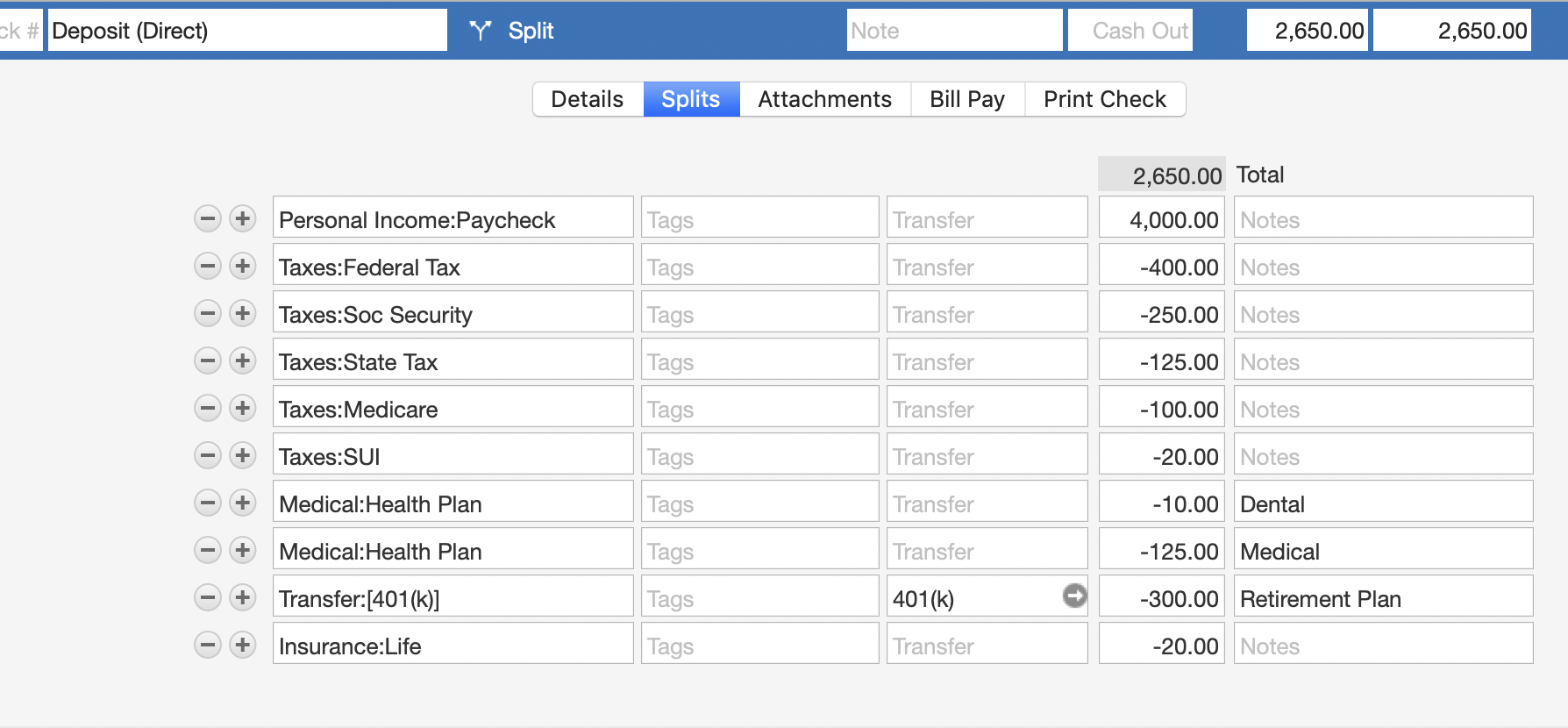

@mattfettman First, let's make sure we're on the same page about how you record your paycheck in Quicken. It sounds like you already have your paycheck set up in your checking account for the amount of your net pay, with split lines for your gross pay and all the deductions from it? For example, here's a dummy paycheck where the gross pay is $4,000 and net pay is $2,650:

This example shows an employee payroll deduction of $300 being transferred to a 401k account. Good so far? But now you need to create the employer matching contribution, which can be done a few different ways.

On way is to add two additional split lines in the paycheck transaction. The first is to create the employer match as a positive number; the second is to transfer that amount to the 401k account as a negative number. The transfer part is a new split line the same as the split line shown above, but how do you create the amount to be transferred?

If you want to see the employer match as income when you run your internal Quicken reports, then create a new sub-category under Personal Income like "Personal Income:Employer Match". Because this new sub-category is not marked as "tax related", it will not show up on the Tax Schedule report (because the employer contribution is not reported as income), but will show up on a Quicken report of your income.

If you do not want to see this as income on your Quicken reports at all, then use a special category called "Adjustment". Using Adjustment means the amount will not be seen as income or expense in reports; it's a way to create income or expense out of thin air.

You could, alternatively, leave the employer match out of the paycheck deposit and simply create a scheduled transaction for the deposits in your 401k account. You could use any income category for the employer match, because Quicken won't include income in a retirement account on the Tax Schedule report. If you want to make the match deposits invisible on all reports, then use the Adjustment category.

Make sense?

Quicken Mac Subscription • Quicken user since 19931

Answers

-

See this thread. It might just be for Windows but look at the last screenshot at the very bottom for how to enter the split.

I'm staying on Quicken 2013 Premier for Windows.

0 -

@mattfettman First, let's make sure we're on the same page about how you record your paycheck in Quicken. It sounds like you already have your paycheck set up in your checking account for the amount of your net pay, with split lines for your gross pay and all the deductions from it? For example, here's a dummy paycheck where the gross pay is $4,000 and net pay is $2,650:

This example shows an employee payroll deduction of $300 being transferred to a 401k account. Good so far? But now you need to create the employer matching contribution, which can be done a few different ways.

On way is to add two additional split lines in the paycheck transaction. The first is to create the employer match as a positive number; the second is to transfer that amount to the 401k account as a negative number. The transfer part is a new split line the same as the split line shown above, but how do you create the amount to be transferred?

If you want to see the employer match as income when you run your internal Quicken reports, then create a new sub-category under Personal Income like "Personal Income:Employer Match". Because this new sub-category is not marked as "tax related", it will not show up on the Tax Schedule report (because the employer contribution is not reported as income), but will show up on a Quicken report of your income.

If you do not want to see this as income on your Quicken reports at all, then use a special category called "Adjustment". Using Adjustment means the amount will not be seen as income or expense in reports; it's a way to create income or expense out of thin air.

You could, alternatively, leave the employer match out of the paycheck deposit and simply create a scheduled transaction for the deposits in your 401k account. You could use any income category for the employer match, because Quicken won't include income in a retirement account on the Tax Schedule report. If you want to make the match deposits invisible on all reports, then use the Adjustment category.

Make sense?

Quicken Mac Subscription • Quicken user since 19931

This discussion has been closed.

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub