Updating MiscExp in Brokerage Removes the Security from the Transaction

Hello. I am a new Quicken Windows user, Version R49.29, Build 27.1.49.29 on Windows 11 Enterprise. I have created a brokerage account and added some securities, but I am having trouble with a MiscExp attached to a securities.

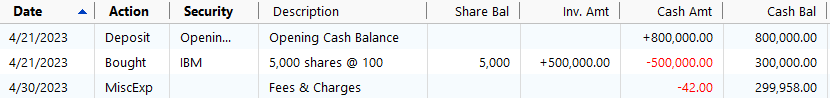

The expense gets entered fine, and might look like this in the brokerage register:

But now I want to change something, such as the date. So I click on the date in the register and change it to 4/30/2023, like this:

Notice that the Security field has changed to the word Num; I don't know why, but I continue to change the date to 4/30/2023:

Now I press Enter and the new date shows up, but the Security name has disappeared in the MiscExp:

Indeed, if I open the expense for editing, there is no Secruity listed:

The problem occurs for me only when editing a MiscExp or MiscInc from the register directly (without opening up the separate Edit window). I know that I can avoid the problem by always editing these things in an Edit window. And after the error occurs I can open the Edit window and re-add the security. But those solutions are inconvenient and (in my opinion) also a bug, So, I would love to know why the bug occurs in the first place, and if there is any way for me to edit these transactions from the register window.

All of this first occurred multiple times in my working file, but to show it to you here, I opened a clean Quicken file and added only this example with no other entires. And it happens whether the name is simply IBM or the full name that Quicken looks up for the stock.

Many thanks for your help.

Best Answers

-

I can reproduce this. Changing the transaction date does remove the security from a MiscExp.

That seems like a bug. But Quicken doesn't do anything with the optional security in a MiscExp transaction anyway. You might guess that Quicken would add to the security's cost basis if you had a security specified in the transaction. That's what I guessed and I was wrong.

If you need to include an expense which actually contributes to cost basis, you must enter that expense as Commission in the Bought transaction.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

1 -

of course a security can be associated with a misc transaction. Been possible like forever.

I’ve used that feature for years to associate foreign taxes withheld to the applicable security, as part of amortization of bond premiums, for ADR fees paid, etc.

Yes, it is more record keeping than bookkeeping. There is no adjustment to the security’s value or basis. It is nevertheless a valid use of a long-standing Quicken feature.

I too have noticed the lost security info such that I use the pop up form routinely for entry and edits.

3 -

Thank you all for your comments.

I see what you mean, NotACPA. Frequently, a MiscExp has no associated security. An example would be a fee that applies to an entire brokerage account.

But even Quicken itself will sometimes associate a security with a miscellaneous expense. One situation where that occurs is a purchase of a bond on the secondary market. In the Bond Buy transaction, you enter the amount of accrued interest expense paid to the seller; Quicken automatically turns that amount into a separate MiscExp that's associated with the bond security. (As I have read elsewhere in this forum, Quicken can put the tax consequences of the accrued interest expense into the wrong year, but I see that that's a different, previously discussed issue.)

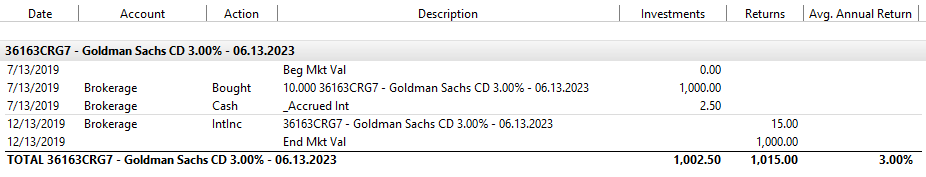

Ah, Rocket J Squirrel (nice name!), it's good to know that the error exists everywhere and not just for me. And I see that the cost basis of the associated security does not change via a MiscExp (which is a good thing). However, in some limited experimenting, it seems that Quicken does use the associate security in at least one report: an Investment Performance report with subtotals by security. For example, here is a CD purchase that has a $2.50 MiscExp for accrued interest paid to the seller:

And here is the investment performance report, showing a return of 3.00% for that period:

However, if I break the association between the MIscExp and the CD, then the return changes to 3.62% (because the expense was not subracted from the CD's income):

This might not be an important example, but it shows the principle that if you break the connection between a MiscExp (or MIscInc) and its associated security, then some reports will be wrong. For this reason, I believe it's important that Quicken should not break that connection unless it's explicitly broken by the user.

Thanks also to q_lurker for noting that others, too, want to associate MiscExp and MiscInc with specific securities. For the time being, I'll just try to be careful with my entries and also examine all MiscExp and MIscInc for inadvertant errors at the end of each year.

1

Answers

-

P.S. I should have mentioned that I am using Quicken Home, Business & Rental Property, Version R49.29, Build 27.1.49.29 on Windows 11 Enterprise. I have Validated and Super Validated the data file with no errors found. Thankis.

0 -

There's not supposed to be a security associated with MiscExp … it comes out of your Cash amount.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP1 -

I can reproduce this. Changing the transaction date does remove the security from a MiscExp.

That seems like a bug. But Quicken doesn't do anything with the optional security in a MiscExp transaction anyway. You might guess that Quicken would add to the security's cost basis if you had a security specified in the transaction. That's what I guessed and I was wrong.

If you need to include an expense which actually contributes to cost basis, you must enter that expense as Commission in the Bought transaction.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

1 -

of course a security can be associated with a misc transaction. Been possible like forever.

I’ve used that feature for years to associate foreign taxes withheld to the applicable security, as part of amortization of bond premiums, for ADR fees paid, etc.

Yes, it is more record keeping than bookkeeping. There is no adjustment to the security’s value or basis. It is nevertheless a valid use of a long-standing Quicken feature.

I too have noticed the lost security info such that I use the pop up form routinely for entry and edits.

3 -

Thank you all for your comments.

I see what you mean, NotACPA. Frequently, a MiscExp has no associated security. An example would be a fee that applies to an entire brokerage account.

But even Quicken itself will sometimes associate a security with a miscellaneous expense. One situation where that occurs is a purchase of a bond on the secondary market. In the Bond Buy transaction, you enter the amount of accrued interest expense paid to the seller; Quicken automatically turns that amount into a separate MiscExp that's associated with the bond security. (As I have read elsewhere in this forum, Quicken can put the tax consequences of the accrued interest expense into the wrong year, but I see that that's a different, previously discussed issue.)

Ah, Rocket J Squirrel (nice name!), it's good to know that the error exists everywhere and not just for me. And I see that the cost basis of the associated security does not change via a MiscExp (which is a good thing). However, in some limited experimenting, it seems that Quicken does use the associate security in at least one report: an Investment Performance report with subtotals by security. For example, here is a CD purchase that has a $2.50 MiscExp for accrued interest paid to the seller:

And here is the investment performance report, showing a return of 3.00% for that period:

However, if I break the association between the MIscExp and the CD, then the return changes to 3.62% (because the expense was not subracted from the CD's income):

This might not be an important example, but it shows the principle that if you break the connection between a MiscExp (or MIscInc) and its associated security, then some reports will be wrong. For this reason, I believe it's important that Quicken should not break that connection unless it's explicitly broken by the user.

Thanks also to q_lurker for noting that others, too, want to associate MiscExp and MiscInc with specific securities. For the time being, I'll just try to be careful with my entries and also examine all MiscExp and MIscInc for inadvertant errors at the end of each year.

1

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 238 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub