2024 Tax Planner Incorrect Standard Deduction

UPDATED: The standard deduction is correct for 2024. My tax planner was on tax year 2025.

2024 Tax Planner for Quicken Classic Deluxe has the incorrect standard deduction for married filing jointly and one over 65. It is calculating the standard deduction as $31,600. According to the IRS, it should be $30,750 ($29,200 + $1,550).

Best Answers

-

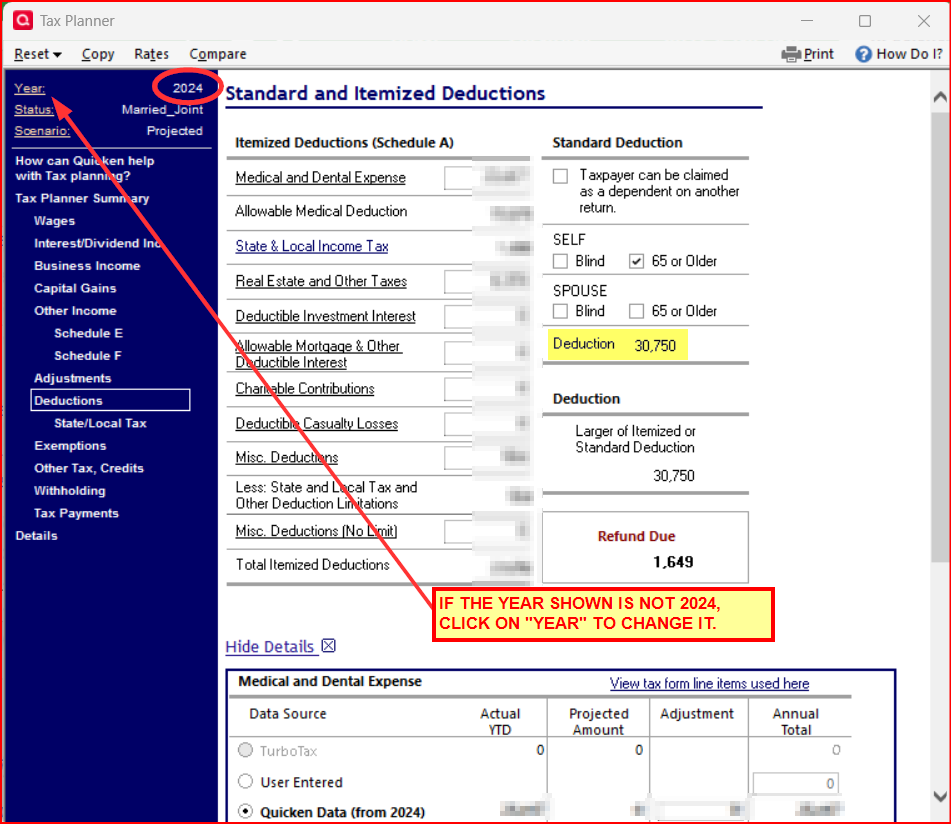

Are you sure you have the 2024 Tax Planner pulled up? Since it is now 2025, each time you open Quicken Tax Planner defaults to 2025, not 2024. If you want to see 2024 you need to change the year from 2025 to 2024.

For me and my wife, where I am 65+ but my wife is not, I am seeing $30,750 for 2024 and $31,600 for 2025….both as they should be.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

@Lenn - The 2025 std deduction for married filing jointly where both spouses are <65 yrs old is $30,000.

The higher deduction amounts are if one or both of you are 65+ yrs old which provides you an additional deduction amount. If you and/or your spouse are 65+ then you need to check the box(es) for that as shown in this picture.:

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0

Answers

-

Are you sure you have the 2024 Tax Planner pulled up? Since it is now 2025, each time you open Quicken Tax Planner defaults to 2025, not 2024. If you want to see 2024 you need to change the year from 2025 to 2024.

For me and my wife, where I am 65+ but my wife is not, I am seeing $30,750 for 2024 and $31,600 for 2025….both as they should be.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

Boatnmaniac you are correct. My tax planner was on tax year 2025 ☹️.

1 -

I also am see incorrect amounts for the standard deduction. The year selected in 2025 and we file jointly. The standard deduction that is populated is only $30,000. Why the difference? What am I doing wrong?

0 -

@Lenn - The 2025 std deduction for married filing jointly where both spouses are <65 yrs old is $30,000.

The higher deduction amounts are if one or both of you are 65+ yrs old which provides you an additional deduction amount. If you and/or your spouse are 65+ then you need to check the box(es) for that as shown in this picture.:

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub