Writing checks from an investment account - no check number in register

Win 11 Home; Quicken R61.17

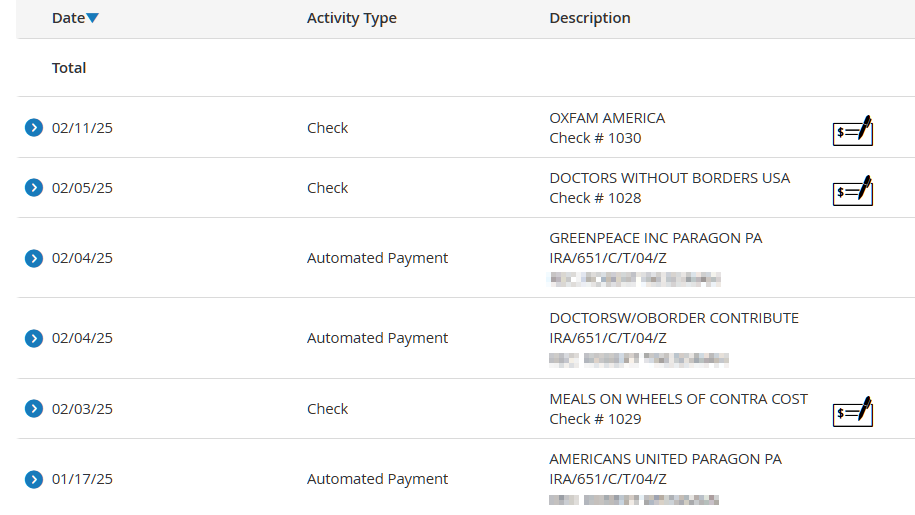

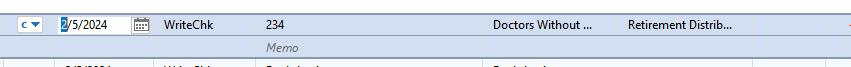

I make qualified deductible contributions by writing checks from my IRA account. I use the Write Check action to create the transactions. My problem is - neither the 1-line nor 2-line register display shows the check number! (You have to highlight or edit an individual transaction to see the check number) And when I get the transaction downloaded from my investment account, it only shows the Check Number and not the Payee! So reconciling is A REAL PAIN !

I have not set up a linked checking account because I was hoping to avoid yet another account to have to manage. AND because Quicken Windows Help explicitly says the following:

"The investment transaction list can accommodate and display both banking and investing transactions. As with investing transactions, you use specific dialogs to enter your data for common transactions such as writing a check, making a deposit, creating an online payment instruction, and withdrawing cash.

Bill and income reminders are the only banking feature not supported by the investment transaction list."

So am I missing something? Can something be done to have check number displayed? Or is my only recourse to set up a linked account? And if so, is it really straightforward, or are there any "gotchas" that I should be aware of?

Thanks!

-ceej

Best Answers

-

my question is why Quicken does not show the check number in the investment account transaction register!

"Why?" Nobody knows. It's a quirk of how investment registers were coded. It's always been like that. I agree it's annoying.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

0 -

I am beginning to think that when I do the Write Check entry, I will just put the check number into the 'memo' field and leave well enough alone!

I think that is a reasonable strategy. It is unfortunate that the check number field is not broadly visible. No difference in that regard between taxable and tax-deferred brokerage accounts.

I also have a couple of those old-time tax-deferred brokerage accounts dating back to the early 90s, just none still active. They do offer a "Convert" option. The Help information leads to this statement:

you can easily convert it to a Quicken 401(k) or IRA account. Doing so will more accurately identify the purpose of the account in Quicken, and assure that its tax-deferred status is represented correctly in Quicken reports and graphs.

I don't find that explanation of the benefit to be compelling. YMMV.

You definitively lose the ability to "Write Checks" by making the conversion, though you can still make 'Withdrawals" to the same effect.(Incorrect statement stricken.)0

Answers

-

Oh, and if I do need a linked checking account, how do I get the downloaded (check) transactions into the checking register? Do I have to first accept them into the investment register, then move them (how?) to the checking register?

0 -

Here's a Catch-22 for you:

Yes, you can write checks from an investment account defined as retirement (IRA, 401k, etc.), but

No, you cannot set up a linked checking account to be part of your retirement account register.

IMHO, the entire process of writing checks from an IRA account in Quicken seems to be buggy as h… and needs to be reviewed by the programmers.

And, a transaction downloaded from the bank does not, has never and will probably never contain the Payee Name which you wrote on the check. All you can ever get in a downloaded transaction is the check number. Hopefully the bank correctly places this check number into the Check# field and, optionally, in the Payee Name as "Check 1234".

IMHO, workaround: Transfer the money out of your IRA into a regular bank checking account, taking optional federal income tax withholdings into account. Write the check to draw from this bank checking account.

0 -

I make qualified deductible contributions by writing checks from my IRA account.

Do you really mean Qualified Charitable Distributions (QCDs)? If not, this scheme may not be as rewarding as you'd like because you'd still pay ordinary income tax on the distributions. If they're QCDs, the ordinary income tax is waived.

IMHO, workaround: Transfer the money out of your IRA into a regular bank checking account, taking optional federal income tax withholdings into account. Write the check to draw from this bank checking account.

If you are making QCDs, the checks must go directly to the charities. Writing them to yourself and then sending the dollars disqualifies the distribution as a QCD. Or you can have the charities pull the dollars directly from the IRA. Then there's no check number to worry about.

a transaction downloaded from the bank does not, has never and will probably never contain the Payee Name which you wrote on the check.

Morgan Stanley Wealth Management actually does this. They determine, record, and download payee names to Quicken. If I go to their site and ask for a list of checks & payments from my IRA, I see the payees. This is great if I need to show the IRS a report from Morgan Stanley. MS is the only brokerage I know that does this, and I marvel how they do it. I doubt that they have OCR that can read my terrible handwriting, so the payee must be coming to them electronically.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

0 -

Rocket: When I said "qualified deductible contributions" I meant (to infer) "Qualified Charitable Distributions (QCDs)". And you are indeed correct about the deductions - that is why I write the checks directly from my IRA. Charles Schwab does not seem to record the Payee on those IRA/QCD checks. The downloaded transaction just has something like "IRA Check #nnnn".

AS to the payee name. I'm guessing that when Doctors w/o Borders deposits your check, an ACH transaction is created from their bank to yours (Morgan Stanley) — the paper check is most certainly NOT sent! That ACH transaction likely has the payee name (inserted by the payee's bank from their account) as well as your routing number, account number, and the check number (from the MICR encoding on the check). And Morgan Stanley is nice enough to have written code to extract the payee name and associate it with the transaction against your account. Sweet!

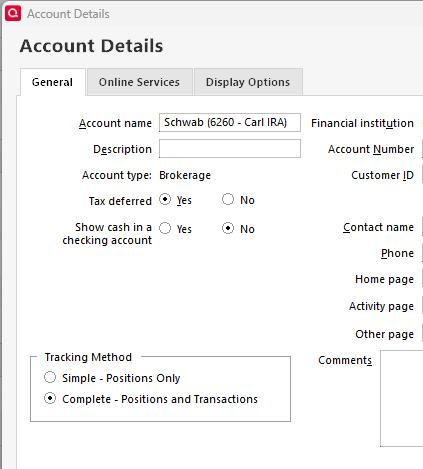

UKR: this link takes you to a quicken windows help page that describes how to "show cash in a checking account" =⇒

See also the attachment of what I see when following the initial steps. IF I decide to go this route, I will take real baby steps w/backup, since it says: "Quicken converts all transactions in the investment account to their transfer equivalents. For example, Buy transactions are converted to BuyX transactions, Sell transactions are converted to SellX transactions, and so on." I'll want to be sure that it does not mess things up!

??? Anyone out there done this? On an investment account that you've had "for some time" - or one that has a fair amount of transactions?

Thanks,

—ceej

0 -

I don't know if you can write the check yourself. Did you ask Charles Schwab how to make a QCD? I have Vanguard and fill out a form online and they send me a check made out to the Charity and I mail it to the Charity with the donation form from the charity. I don't download transactions so I enter a Sell in Quicken which puts cash in my IRA account. Then I enter a withdrawal to category Charity. And you have to be sure to get a confirmation letter from the Charity.

I'm staying on Quicken 2013 Premier for Windows.

0 -

I searched on Schwab

It says

A QCD must be directly transferred to a qualified charity. Investors should request that the IRA custodian send a check directly to the charity. I

I'm staying on Quicken 2013 Premier for Windows.

0 -

@-ceej You have your account set up as a tax deferred brokerage account. That setup allows you to make the checking account link.

Accounts set up as IRA or 401k / 403b accounts (different than brokerage accounts) do not have that link available.

I am not knowledgeable enough to elaborate on what 'features' you might be missing by having the account as a simpler tax-deferred brokerage account rather than an IRA type account.

0 -

Yes, yes, yes - my IRA is set up to be able to write checks. And I write them and mail them. And it satisfies the IRS - it is only necessary that the funds go directly from the account to the charitable organization. None of my question had anything to do with Schwab or my understanding of how QCD works!

What is/was my question is why Quicken does not show the check number in the investment account transaction register! When I manually enter the check information (Action == Write Check) quicken lets me enter the check number, and even keeps track of it so I can just leave the drop down on "Next Check Number". And if I highlight a Write Check transaction in the register, the check number shows. But only one Tx at a time, when I highlight it.

AT this point I am guessing that the display of the check number in a transaction register is not supported in an investment account. So, presumably, one must use a linked checking account, or do as I did last year, manually search for and clear each transaction after downloads.

q_lurker - My IRA account is, in fact, set up in Quicken as a Brokerage Account. It was set up that way "decades ago". I do not remember, but suspect it was because it was self-managed and/or an IRA account in Quicken at that time did not support all the (investment) functions that were permitted in an IRA. In any case, it is a Brokerage Account, and as I said above, it certainly appears that I can set up a cash account for it.

I am beginning to think that when I do the Write Check entry, I will just put the check number into the 'memo' field and leave well enough alone!

0 -

my question is why Quicken does not show the check number in the investment account transaction register!

"Why?" Nobody knows. It's a quirk of how investment registers were coded. It's always been like that. I agree it's annoying.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

0 -

I am beginning to think that when I do the Write Check entry, I will just put the check number into the 'memo' field and leave well enough alone!

I think that is a reasonable strategy. It is unfortunate that the check number field is not broadly visible. No difference in that regard between taxable and tax-deferred brokerage accounts.

I also have a couple of those old-time tax-deferred brokerage accounts dating back to the early 90s, just none still active. They do offer a "Convert" option. The Help information leads to this statement:

you can easily convert it to a Quicken 401(k) or IRA account. Doing so will more accurately identify the purpose of the account in Quicken, and assure that its tax-deferred status is represented correctly in Quicken reports and graphs.

I don't find that explanation of the benefit to be compelling. YMMV.

You definitively lose the ability to "Write Checks" by making the conversion, though you can still make 'Withdrawals" to the same effect.(Incorrect statement stricken.)0 -

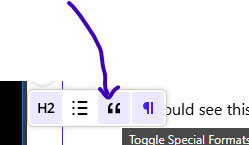

I can't see how you all make those neat quotes. When I click 'quote' I get the entire conversation w/o any way i can find to edit it.

so, ….

I don't find that explanation of the benefit to be compelling. YMMV. You definitively lose the ability to "Write Checks" by making the conversion, though you can still make 'Withdrawals" to the same effect.I agree.

0 -

What you do is copy and paste what you want into your comment and then select it.

Then you should see this:

As for the original question, I think it comes down to "history".

To this day you will see that Quicken Inc refers to these as "investment transaction lists", not a "register".

And that is exactly what it was when it was introduced decades ago, a list.

I have gotten features over time, but it has always been a completely different "animal" than the non-investing registers.

Internally (as looked at in a debugger) I can tell that it is built up completely differently. As such, it has its own "quirks", like focus problems and such.

And this is one of the reasons they created the "Linked checking account", because the realized that even though there was an "attempt" at some of the banking features they never were "complete". And that was just one of the workarounds. Just like recently to have features like "edit transactions" they popup a separate window because they can't do multiple select in the "investment transaction lists".

Contrast that to Quicken Mac which got a rewrite. Their register view is used for all accounts.

Signature:

This is my website (ImportQIF is free to use):0 -

You definitively lose the ability to "Write Checks" by making the conversion, though you can still make 'Withdrawals" to the same effect.I agree.

I routinely Write Checks in QWin from my Traditional IRA. It works fine.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

0 -

My apologies for not checking fully.

With an Account Type as Traditional IRA (and I presume all the other related variations), you cannot initiate a 'Write" check via an inline transaction list entry. You can do it using the Enter Transactions button. I swear we went through this a few months ago, but I forgot about there being two ways to make the entry. The tax-deferred brokerage setup and the 401k-type setup do allow such entries by either approach.

0 -

Chris_QPW:

What you do is copy and paste what you want into your comment and then select it.

Thanks for your tutorial - I appreciate it!

THANKS to EVERYONE for your help/suggestions ! I think I have a plan to soldier on that will solve my problem but is not onerous. And I am glad to have found a place that has responsive people with answers. I hope I can pay it forward, if not here then some where/how else.

-ceej

0 -

you cannot initiate a 'Write" check via an inline transaction list entry. You can do it using the Enter Transactions button.

A long time ago, I stopped trying to use the inline transaction entry. It's too limited and I can never remember what's there and what isn't. (And I think that list has changed over the years.) So I always use Enter Transactions so I don't have to think about it.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

0 -

I'm glad you mentioned this. To me this another one of those "quirks" of the "investment transactions list", trying to enter a transaction as if in a banking register, is an exercise in frustration!

I have always used the "Enter Transaction" button. Not only couldn't I remember what was available, I remember all kinds of "focus" problems.

Signature:

This is my website (ImportQIF is free to use):0 -

When I get my broker (ML) statement, it has the check # and payee under Cash/Other Transactions. My transactions downloaded in to the account with Quicken update show the transaction without check # or payee. I change the transaction type to Withdraw, edit the transaction, adding the Payee, Category (Charity), Memo (QCD), and Number (check #). I can get listing from Quicken Reports with payee, check #, and amount.

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub