How to Record Exchanging Warrants for Co. Stock

Hello, with OXY offering to discount the exercise price of their warrants (OXY/ws) to $21.30. How do you record it in Quicken when the warrants were given by the company back in August 2020 in lieu of dividends. My current brokerage firm is showing a cost basis of $4.95, but they were given at no cost to me.

My initial thought was to record the sale of the warrants at the same price as the cost basis, however, I do not think that is correct.

Any input would be appreciated,

Best Answer

Answers

-

It looks to me like Oxy paid $4.95 in dividends, but immediately used that to buy the warrants … so they do have a basis of $4.95.

Did you (if so, how) did you report this on your 2000 tax return?

So, yeah, I'd probably sell the warrants at cost and then buy the stock.

BUT, I should qualify all of this with I've personally never had such a transactions, so I'm kinda speculating here.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

I am in the same boat with 2 warrants that I ok'ed to excercise, just to get them off the books, and not sure how to handle. Quicken wants to treat it as a Short Sale cover but that does not seem right? See screenshot. Any suggestions are appreciated.

1 -

#q-luker your thoughts would be appreciated.

Regarding Ted's message above, I am running into the same issue. I don't know if this is a known issue with Quicken or something else.

My thoughts are to delete Schwab's downloaded activity and just enter the sale at the same average cost price. Then when the OXY shares are delivered show them with the purchase price of $21.30.

0 -

My thoughts -

a) I wasn't sure @Ted Gallagher was posting about the OXY warrants. Doesn't really matter.

b) If Quicken is wanting to treat (forcing?) a short sale, it must be that your file does not have the warrants as a security under that name. Not enough detail to comment further in that regard. Do you really have the warrants in the file as a security? From where is the short sale getting initiated: a download? Is the download using the same security information as is being used in the file? Can you enter the 'sale' of the warrants independent of some downloaded transaction?

c) I am not familiar enough with these types of transactions. It may well be that the regular OXY security should 'acquire' the warrants (Corporate Acquisition) rather than a Sell/Buy exchange. The Corporate Acquisition would generate Remove Shares (of the warrants) and Add Shares (of OXY) transferring the cost and acquisition dates of the warrants to new lots of OXY shares. Right? Wrong? I don't know.

1 -

@q_lurker, Thanks for your response. I did have the Warrants in my account since 8/3/2020 when they were issued. I originally listed it as a security and posted all of my warrants to my account. Aug. 10-12 are the downloads from Schwab into Quicken. As you can see on 3/12/25 they show the buying of shares on 3/12 as a Cover Short trade. Still scratching my head on this one. Hopefully this will give you more insight into posting and any ideas you might have. In the meantime, option "c" seems like it might be the best route to take.

0 -

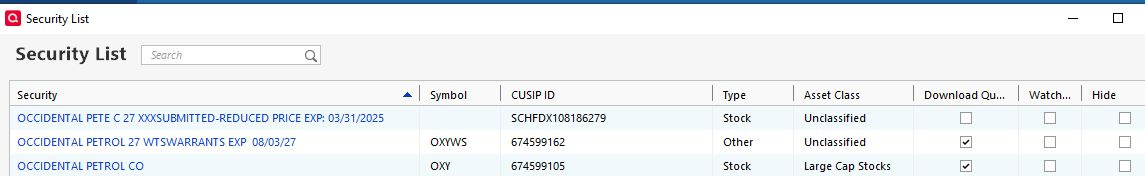

Yes, I am referring to OXY warrants. The warrants are being tracked in Quicken w/ symbol OXYWS. After accepting the offer Schwab dropped a name change — the one at the top of this list.

Let me know if more info is needed.

Thanks,

0 -

Oh and BTW the shares which I presume I should be receiving in exchange for the warrants have not yet landed in my account.

0 -

”dropped a name change” — Don’t know. Appears to have a new symbol as well. Does it have a different CUSIP as well?

From a quick look at a description of the special deal, it appears that by taking this deal now (by March 31) you get to buy OXY shares at $21.75/sh, a better price than the original warrants at $22/sh. Does that make them a new security?

It further appears that you will be buying the OXY shares at the end of the month. That is when Occidental delivers the OXY shares and you are required to pony up the cash and the warrants go away because you exercised them. Does that somehow create a short position? (Not that I see, but I am not knowledgeable.)

Seem to me you need to manually create Quicken transactions that make sense to you and are generally consistent with brokerage information. There are a variety of possibilities there. I’d be inclined to keep it as simple as possible, delete short sale stuff, maybe just end up with a remove shares (warrants) and buy shares (if applicable) at end of month.

0 -

First screenshot is from quicken with the entire new CUSIP number exposed. Second shot is the transactions from my Schwab account. It looks like they removed the 2 warrants from my holdings and $42.60 from my cash account. I don't see any mentions of any short positions.

0 -

Yep, they made adjustments to my account as well. I ended up entering the 3/12 exercised trades as follows:

The buy order shows Oxy as a "When Issued" since the shares will not be added until sometime in April. Once the shares are delivered, I'll just Remove the W/I shares and then add those shares to my Oxy holdings. After doing this, it shouldn't affect anything tax wise.

Earlier today I exercised some more shares, and this is how they reported those. Looks like Schwab finally got their act together. However, Quicken posted them as deposits. I guessing this was because they do not have a drop down for Exercising Warrants. See below:

Oh well, just another day in paradise.

0 -

Thanks, that is helpful. I did the same.

0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub