How do I change an account from direct connect to express

I messed up and my accounts upgraded from express to direct connect.

How can I change them back to express without losing data

Thanks

Answers

-

Hi @Mike_L,

Can I ask why you want to "change them back"? Direct Connect is, in my opinion, a more reliable (and preferred by most folks) downloading method.

Frankx

Quicken Home, Business & Rental Property - Windows 10-Home Version

- - - - Quicken User since 1984 - - -

- If you find this reply helpful, please click "Helpful" (below), so others will know! Thank you. -1 -

I want to be sure that changes I make in quicken don't get sent to the bank.

The big issue is Transfers frequently come down messed up on the quicken side. Funds may be placed in multiple accounts or transferred from wrong accounts. I understand how the transfers are posted wrong and I can easily fix them. My problem is I may be deleting some of the incorrect data in quicken and am afraid these corrections may be posted at the bank in the wrong way. I really want the transaction data to be only download and NOT upload.

0 -

@Mike_L you don't say which financial institution your accounts are at, but usually you can just click on "Advanced Options" and change your connection method. But again, it depends on your financial institution.

I would first deactivate all your accounts with DC that you want to change to EWC. Go to the Online Services tab in Account Details and click on "Deactivate". Then go to the General tab and blank out the FI Name and Account Number.

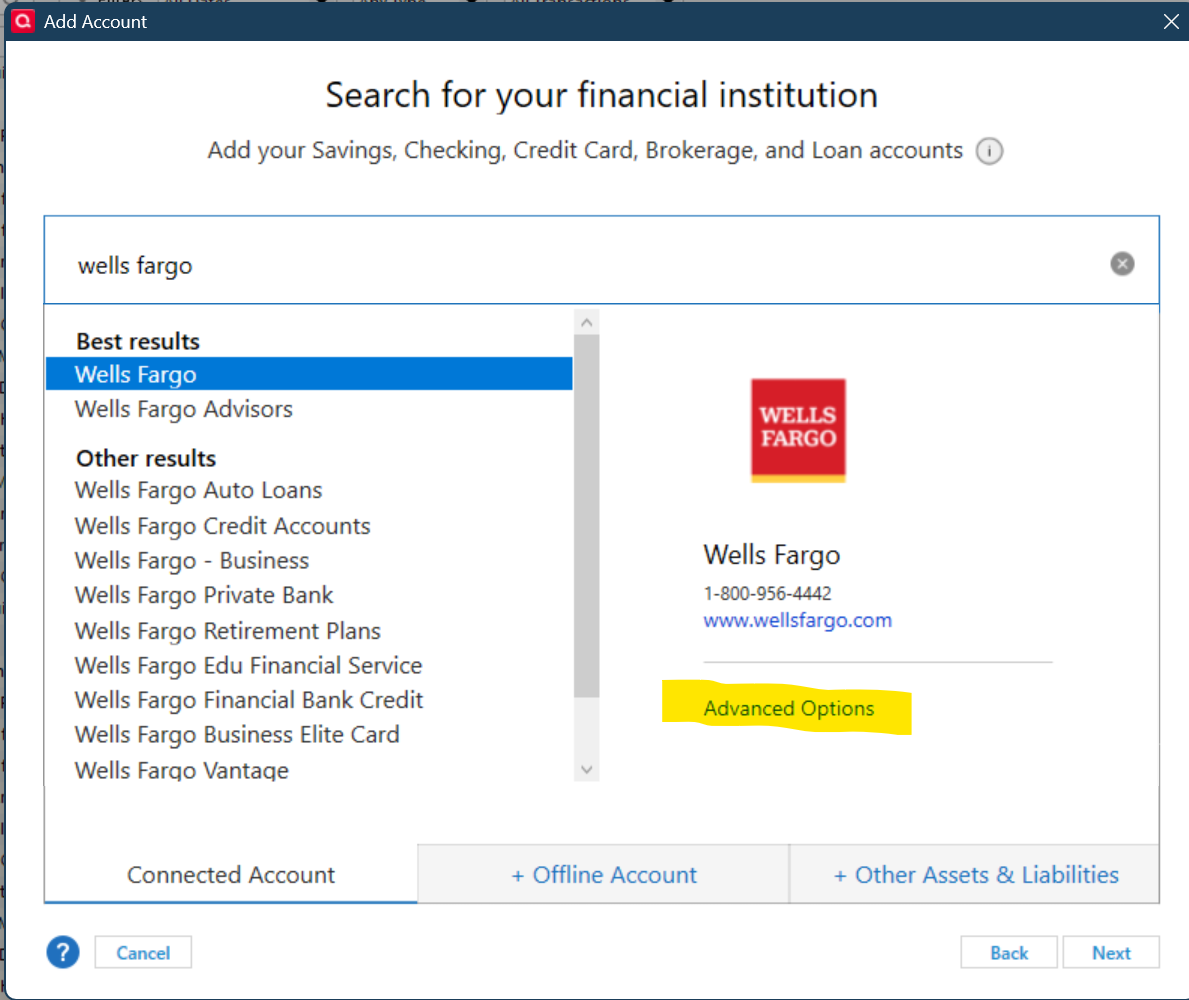

Then to reactivate, go to "Add Account" and choose your financial institution(s) by typing in their name. The initial screen should have an "Advanced Options" link. But that again depends on what financial institution. Here is an example -

When you click on "Advance Options" it should take you to a screen with connection method options. Choose "Express Web Connect" and then proceed with the rest of the set up. When you get to the screen that lists out your accounts at the financial institution, make sure to link the accounts to the existing accounts on Quicken.

1 -

I checked and they support both direct and express.

Appreciate the help. I tried the deactivate but did not delete the name and account # from the general screen. I did not have access to the advanced options. Perhaps after i blank out the fi & account number, I'll have success. I'll give that a shot in the morning.

I tried to restore a backup before the switch to direct occurred, however, the accounts would not update.

Really appreciate the help

0 -

Most banks with DC connections do not support DC Bank Bill Pay. DC Bank Bill Pay needs to be supported AND enabled in Quicken in order for any transactions made in Quicken to be communicated to the bank.

Even if your bank does support DC Bank Bill Pay it is very easy to make sure that the changes you make in your account in Quicken will never be communicated to the bank.

Just go to the Online Services tab of Account Details for the DC connected account and it is easy to see whether or not your bank supports DC Bank Bill Pay or what you need to do to enable or disable it. If DC Bank Bill Pay is not supported or it is not enabled here, then there is no way your actions in your DC-connected bank account in Quicken will ever be communicated to the bank.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

Advanced Options in Add Account is not available with every financial institution. It is only present when there are multiple connection methods available for that specific financial institution. It is also rather common for banks to have multiple financial institutions in Add Account…one for DC, one for EWC+, one for credit cards, one for loans, one for investments, etc.

If you would provide the name of your bank then perhaps we can confirm the specific Add Account financial institution that is to be used for EWC+.

But, still, I recommend you stay with DC if it is working for you and if your bank is not charging you a monthly fee for it. It is the superior connection method from a speed and reliability perspective. Also DC is more likely to provide current financial data rather than the data from last night that EWC+ usually provides.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

Hi again @Mike_L

Just to be clear - similar to Direct Connect - using Express Web Connect does not preclude a user from uploading transaction data that may affect the actual account. So, if that is your concern, that threat does not disappear just because you change the connection method.

Frankx

Quicken Home, Business & Rental Property - Windows 10-Home Version

- - - - Quicken User since 1984 - - -

- If you find this reply helpful, please click "Helpful" (below), so others will know! Thank you. -1 -

@Mike_L I wanted to tell you that some financial institutions, the "Advanced Options" are a different place, usually on the sign on screen. So be sure to check there also.

1 -

Thanks to all of you. All responses were very helpful and demonstrated great patience. I was able to restore all the accounts to receive transactions and not lose anything. All accounts are express, however, my credit card account has to be accessed manually - thats okay as it how I had to set it up when it started. I can export the credit cart transactions and import them into quicken in less than a minute and as I only need to do that once every few days, I'm happy as a bug in a rug.

Really appreciate your help

0

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 512 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub