How to update my banks login username in Quicken Windows?

I have four Truist Bank accounts set up in Quicken Online Pay under a single login. My bank recently changed the username and password for that login.

While I can see where to update the password in Quicken, I don’t see an option to update the username. How can I do that?

Best Answers

-

If you have not already done so, I suggest that you enter and save the dollar amount of the Opening Balance transaction into the Memo field. Do this for each of the accounts. (This is not necessary to the process but it is a proactive troubleshooting step that is recommended. More on this later.)

Back up your data file before proceeding.

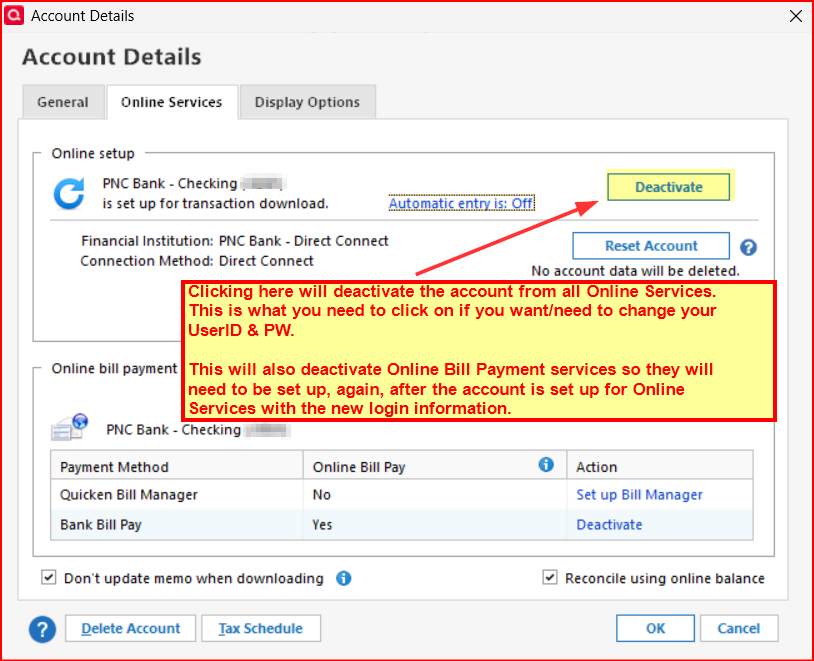

To change the username for an account you need to deactivate the account (Account Register > upper right Gear icon > Edit Account Details > Online Services tab > Deactivate).

Do this for each of the account.

Then go to Tools > Add Account and start the online setup process using your new login. When prompted, make sure Link the downloaded data to the appropriate accounts that are already in Quicken.

Once the process is completed, check the register balance for each account. If the balance is not correct go to the Opening Balance transaction. If the dollar amount of that transaction does not match what you previously entered into the Memo field, change it to match what is in the Memo field.

Did this answer your question?

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

These are 2 different things so yes it makes a difference. The Deactivate button toward the top of the Online Services tab is what you want to deactivate. This will also deactivate Bank Bill Pay and/or Quicken Bill Manager.

BTW, since it appears that you are using Bank Bill Pay you should note that deactivating the account will also disconnect the connection between Quicken and any/all non-posted bill payments that have been scheduled with the bank via Bank Bill Pay. This DOES NOT cancel the bill payments that have been scheduled….those payments will continue to be processed. It only stops Quicken from getting bill payment status updates from the bank and you will not be able to cancel such payments from within Quicken. When the payments have been posted by the bank they will be downloaded into Quicken and Quicken will match them to be bill pay transaction in Quicken….or you might need to manually match it to the bill pay transaction if the posting date is too different from the originally scheduled payment or delivery date.

After you get the account set up for downloading, again, you can reactivate Bank Bill Pay for new bill pay transactions.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1

Answers

-

If you have not already done so, I suggest that you enter and save the dollar amount of the Opening Balance transaction into the Memo field. Do this for each of the accounts. (This is not necessary to the process but it is a proactive troubleshooting step that is recommended. More on this later.)

Back up your data file before proceeding.

To change the username for an account you need to deactivate the account (Account Register > upper right Gear icon > Edit Account Details > Online Services tab > Deactivate).

Do this for each of the account.

Then go to Tools > Add Account and start the online setup process using your new login. When prompted, make sure Link the downloaded data to the appropriate accounts that are already in Quicken.

Once the process is completed, check the register balance for each account. If the balance is not correct go to the Opening Balance transaction. If the dollar amount of that transaction does not match what you previously entered into the Memo field, change it to match what is in the Memo field.

Did this answer your question?

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

Does it matter if I deactivate under online setup at the top or under bank bill pay at the bottom ?

0 -

These are 2 different things so yes it makes a difference. The Deactivate button toward the top of the Online Services tab is what you want to deactivate. This will also deactivate Bank Bill Pay and/or Quicken Bill Manager.

BTW, since it appears that you are using Bank Bill Pay you should note that deactivating the account will also disconnect the connection between Quicken and any/all non-posted bill payments that have been scheduled with the bank via Bank Bill Pay. This DOES NOT cancel the bill payments that have been scheduled….those payments will continue to be processed. It only stops Quicken from getting bill payment status updates from the bank and you will not be able to cancel such payments from within Quicken. When the payments have been posted by the bank they will be downloaded into Quicken and Quicken will match them to be bill pay transaction in Quicken….or you might need to manually match it to the bill pay transaction if the posting date is too different from the originally scheduled payment or delivery date.

After you get the account set up for downloading, again, you can reactivate Bank Bill Pay for new bill pay transactions.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

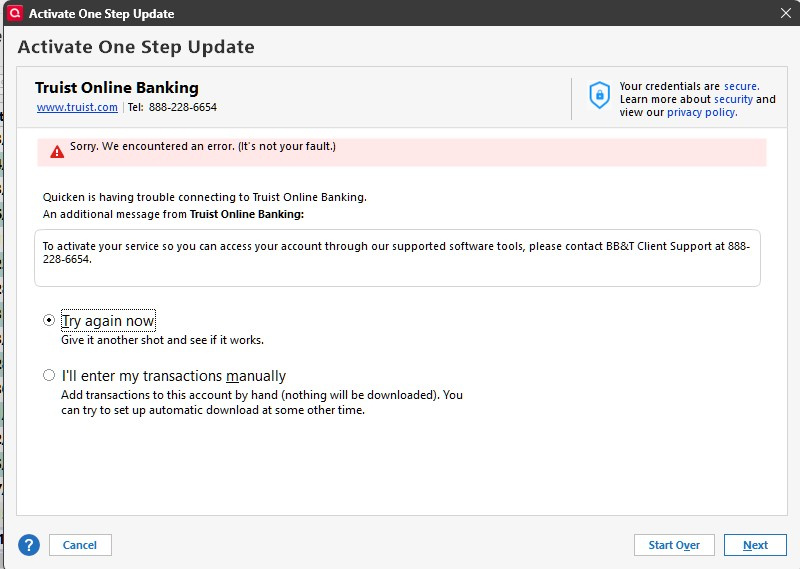

The system is not allowing me to re-enable the accounts its telling me I need to call my bank which is closed today

Do you know of any fix around this I can do on my own or do I need to wait to contact my bank tomorrow ?

0 -

All good I figured it out thanks for the help big time

0 -

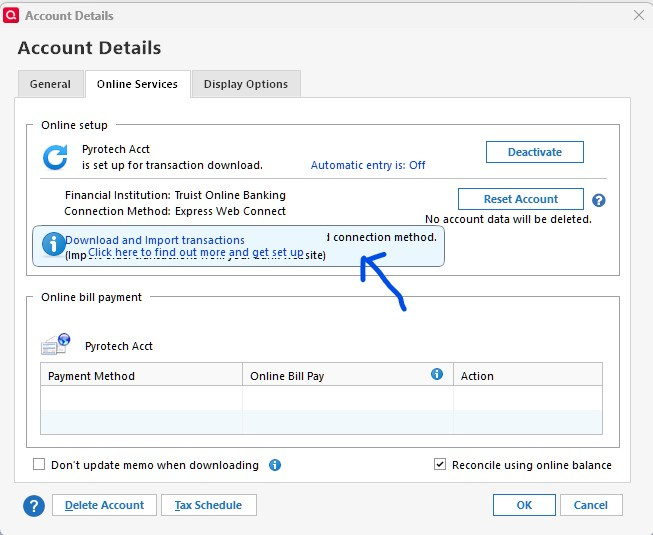

I just realized online pay is not enabled in Quicken how can I re-enable it ?

0 -

This Help article tells you how to do that: .

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

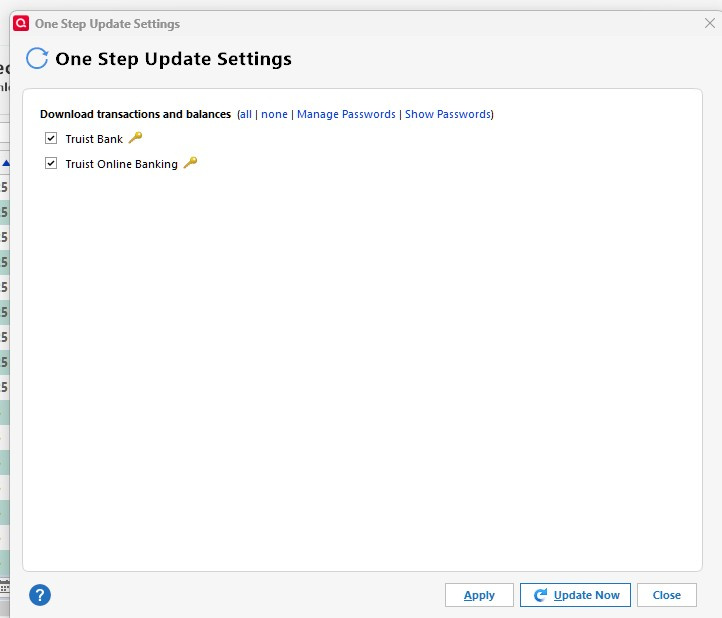

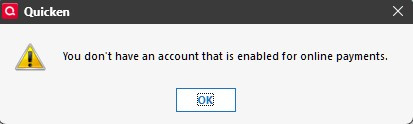

I'm able to download my bank transactions, but when I tried to make a new online payment, I got the following error:

"You don't have any account enabled for online payments." I tried enabling the only available option — "I Connect Method" — but that didn’t resolve the issue. Now, two bank accounts are showing up in One Step Update, which I didn't have before I'm still not able to make any online payments and it looks like I might even have some duplicate accounts listed under "Banking Accounts" on the left.0 -

You are connected to Truist with Express Web Connect+ which does not support Bank Bill Pay.

Per the Support Article that I referenced in my last post, only Direct Connect supports Bank Bill Pay. I am not very familiar with Truist connection options and how to set up Truist with DC but I seem to recall that they charge a monthly fee for the DC option. (Note: Quicken does not charge anything for DC nor for Bank Bill Pay. The DC fee is something that Truist charges, not Quicken.)

You can read up on Truist's requirements for setting up and using Direct Connect at .

If you have more questions about how to proceed with Truist you should perhaps be calling them to ask for assistance. Or, maybe another user who has DC and Bank Bill Pay with Truist will pipe in here and be able to provide some additional guidance/assistance.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

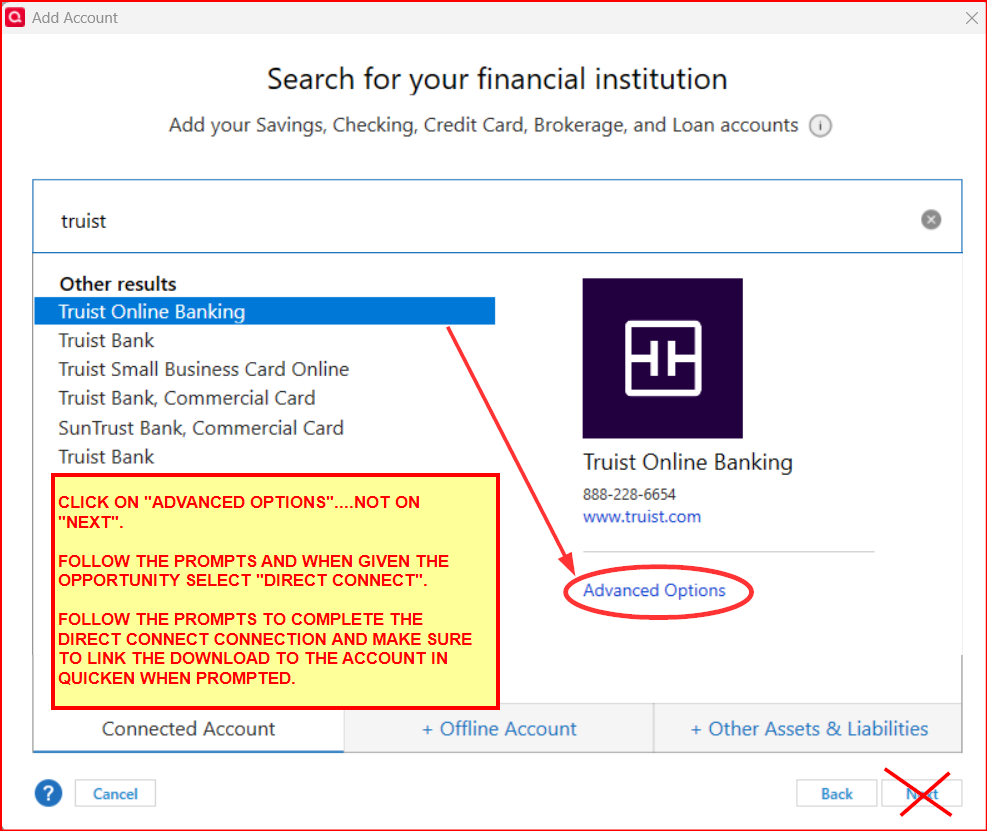

After you have followed Truist's instructions for enabling DC in their system, then you will need to set up DC in your Quicken data file. To do this you should Deactivate your EWC+ connection. Then go to Add Account and go to Advanced Options (not NEXT) to initiate the DC connection set up process as shown in the following picture:

Sorry, but this is about the extent of the assistance I can provide you on this. Best of wishes!

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

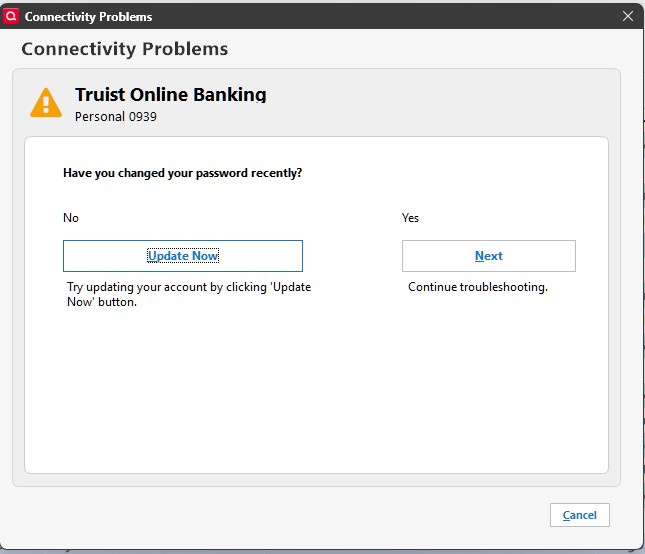

So tired of this mess. I’ve spent hours over the past three days going back and forth on the phone with Quicken Support and my bank. I finally got everything working perfectly while I was on the phone with support—only to run into the below issue as soon as I hung up.

Now, the system keeps asking for my login, but then refuses to accept it again.

Does Quicken still offer its own online bill pay service? If so, what do they charge for it, and does it include the annual Quicken Classic subscription upgrade?

0 -

Sorry to hear that you are having issues with getting the DC connection set up. Some financial institutions have special DC setup requirements (such as unique PW, online setup & authorization, specific Quicken financial institution, monthly fee, etc.) that are different from the EWC, EWC+ and online account logins. I had heard in the past that Truist is one such bank that has special requirements and that is why I'd provided that link to Truist's website so you could read through it to see what their DC setup requirements are.

Anyway, getting back to your question: Yes, Quicken does offer their Bill Manager program which provides Check Pay and Quick Pay features. I do not know much about it but perhaps you will find this Support Article helpful: .

Should you have more questions about how to subscribe to it and what is the best Quicken Classic subscription option for your needs, you should contact Quicken Support. They should be able to answer all of your questions and assist you with getting it setup in your Quicken.com account.

BTW, I am traveling for the next several weeks and my response times to inquiries you might have will be delayed. Don't think that I am avoiding you….I just won't have Internet access all that much.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 512 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub