Roth IRA rollover showing up in both accounts

Hi. I rolled my money from a traditional IRA to a Roth IRA a couple of months ago. In Quicken, I marked everything as sold in my traditional IRA and did a transfer to my Roth IRA. Everything looks right in my Quicken accounts, but in reports, the money is showing up in both accounts. Any idea what could be going on?

Answers

-

Which report are you looking at? What options did you select? Do you include all dates?

Quicken user since 1995, now using Premier Subscription on Win11 Pro.

0 -

I’m looking at a net worth report of all of my accounts over the past year. My net worth looks right on the left sidebar, but not in this report. I also see the problem if I subset to just my retirement accounts. The amounts also look right if I click on the “Investing” header in the sidebar and view my portfolio value.

0 -

My first thought is to zero in on your transfer transaction. In the traditional IRA account, did you create a Type=Payment/Deposit transaction with the Category field set to "Transfer:[name of Roth account]"? If you entered a category other than the linked transfer, that could could problems with reports. (Quicken Mac should not allow you to create a transfer transaction with a category, but it does, and that causes problems with some reports because reports can't show one transaction as both a category and a transfer.)

My guess is that you applied the category of "Personal Income:Taxable IRA Withdrawal" to the transfer because the Roth conversion is, indeed taxable income. So that would be logical and seemingly correct… but as I just mentioned, a categorized transfer creates problems in Quicken Mac.

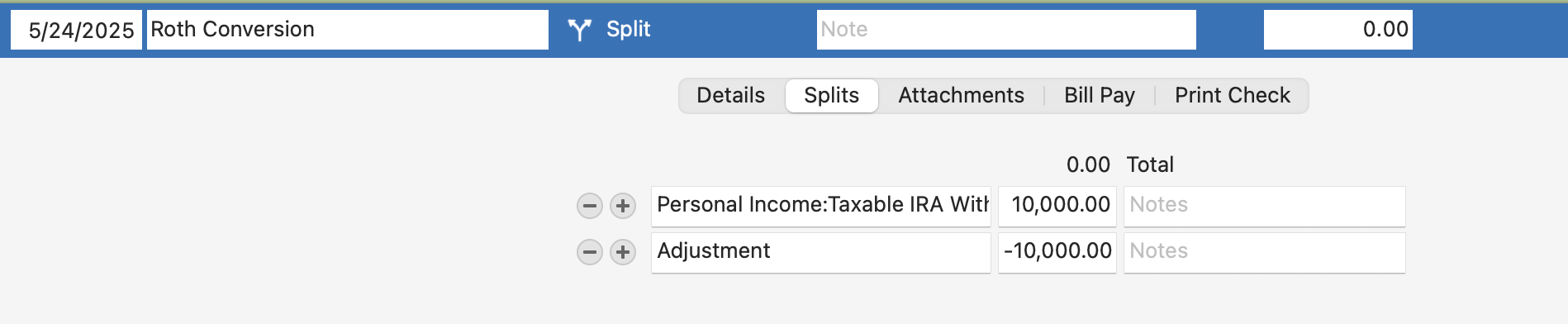

So how do you correctly record the transfer from the traditional IRA account to the Roth IRA account, and have Quicken count it as taxable income? Quicken Mac currently lacks a tool to do this, so you need to resort to a hack. In any non-retirement account — such as your checking account, or a non-retirement brokerage account; it doesn't matter what account you use — create a transaction with an amount of $0, and two split lines. The first split line should be the amount of the Roth conversion, with the Category="Personal Income:Taxable IRA Withdrawal". The second split line should be the negative of the amount, and use Category="Adjustment". Here's an example of a $10,000 Roth conversion:

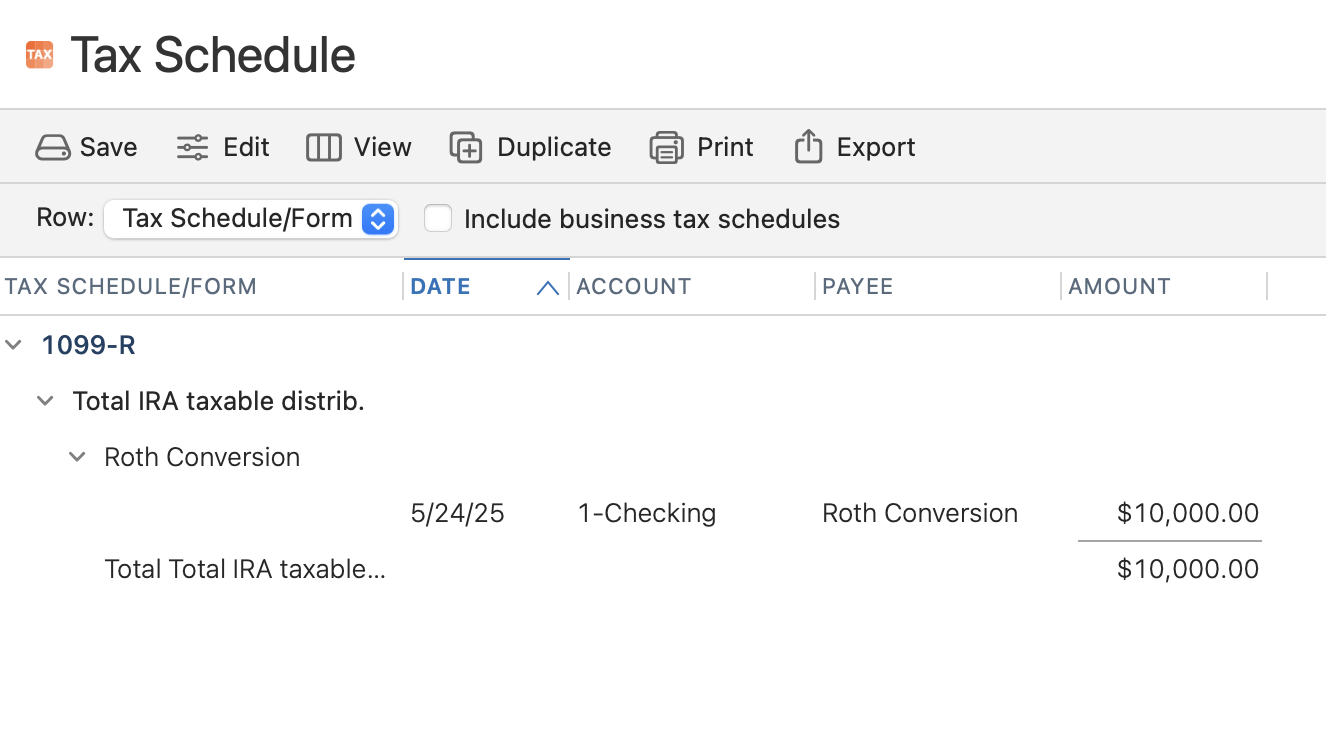

And here's how that shows up on the Tax Schedule report as 1099-R taxable retirement income:

Why does this work? The first split line creates the taxable IRA withdrawal income, so it's correctly reported on the tax report. But you don't actually have any income in this account, so the second split line makes the income "disappear", which is why the transaction itself is a zero dollar transaction which doesn't affect the balance of the account you put this transaction in. the category "Adjustment" is a special Quicken Mac category which doesn't show up as income or expense on any report. So it enables you to violate the rules of accounting by creating the taxable income out of thin air.

As I said, this is a hack to work around how Quicken Mac works. I hope you will take a moment to view this "Idea" thread calling for the developers to implement a way to process taxable IRA withdrawals like RMDs and Roth conversions and to add your vote and comment to the thread:

Quicken Mac Subscription • Quicken user since 19930 -

I did “Payment/Deposit” and “Transfer:[account name]”. I don’t track taxes in Quicken, so I don’t have to worry about that.

0 -

@Megan O'Byrne Let me see if I've got this straight…

- In the traditional IRA account, you sold the securities creating cash.

- Then you did a transfer to the Roth account. The transfer transaction has no category; it shows the transfer to the retirement account in the category field.

- The left sidebar correctly shows the reduced (or zero) value of the traditional IRA account and the increased value of the Roth IRA account.

- When you click Investing or Retirement in the left sidebar, and view Portfolio by Account, it shows the correct reduced amount for the traditional IRA account (or that account doesn't show, if its value is now zero), and the Roth account shows the correct value incorporating the converted amount transferred to it.

- But when you run a Net Worth report, the Roth account matches the amount in the sidebar AND the traditional IRA account is still showing the amount transferred to the Roth account?

Are you using the "Net Worth" report, or "Net Worth by Month"?

On the line for the traditional IRA account, which should be zero but isn't, what do you see if you click on the amount and it opens a Details drill-down report?

Quicken Mac Subscription • Quicken user since 19930 -

@jacobs yes, that is exactly what is happening. i am running a net worth over time by month and if i do a drill-down, i see the roth ira amount go up in march, but the traditional ira amount stays the same for march, april, and may. i also checked just the net worth report, and the same error is happening there. i think this is probably just a bug?

0 -

@Megan O'Byrne This is indeed puzzling! But I can't replicate it, and I haven't seen any other reports of this issue, so I'm still thinking it might be some issue with your transactions rather than a bug which should be more apparent. Let's continue digging, because I'm thinking we're going to figure out what's going on… 😀

Is it correct that your traditional IRA account now has a $0 value since you converted the funds to your Roth IRA account? When you look at the left sidebar, is the traditional IRA account present or absent? (The sidebar can be configured to show or omit accounts with $0 value.) If the traditional IRA present, it's showing $0?

And if you run a new worth report (just the one called "Net Worth"), it defaults to today's date, but here it shows the traditional IRA account with the amount that you previously transferred to the Roth account?

And if so, when you click on that amount and it opens a drill-down report which shows every transaction in the hirsute of the traditional IRA account. Scroll to the bottom of the report. Is the transaction which transferred funds to the Roth account present or missing? Is the "Ending Balance (5/28/25)" zero or the amount prior to the transfer?

Other questions (sorry, troubleshooting issues like these without being able to see someone's set-up requires lots of questions)…

- Both the traditional IRA and Roth IRA accounts are in US dollars?

- What was the date of the transfer transaction?

- Could you take a screenshot of the transfer transaction as it appears in the traditional IRA account and the Roth IRA account and post them; you can black out the amount if you want.

Quicken Mac Subscription • Quicken user since 19930 -

@jacobs after I posted my last reply, I tried deleting and recreating the transactions for selling and transferring the amount to my Roth IRA and it fixed the problem! I have no idea what was wrong with them before because they look the same now as before. They were downloaded, so maybe there was something hidden in there somewhere?

0 -

Well, I'm glad the problem is solved! And I guess we'll never know what was actually going on. Clearly something with those original downloaded transactions was causing the unexpected behavior, but there's nothing hidden from view in a transaction which would generate the results you observed. Oh well, the mystery remains but the problem is resolved. 😂

Quicken Mac Subscription • Quicken user since 19930

Categories

- All Categories

- 54 Product Ideas

- 34 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.1K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub