Transferring Vanguard Individual Mutual Fund Accounts Into Single Brokerage Account

Hello,

This is a continutaion of a very helpful discussion linked below.

Although this seems like the correct approach, there are still some clean up questions. When executing the transfer, I used the actual date Vanguard consolidated the accounts (9/1/2023), but clicked on the button "transfer all securities". This presented the warning 'Recording a short sale" before proceeding. I now know why.

By using the date of the original transfer (18 months ago), while including all of the shares iin the account as of today's date, I orphaned all the reinvestment transactions which ocurred after that date and were included in the total of shares that were transferred. There transactions were left behind in the old mutual fund account (which Quiken interpreted as short transactions) in which the dividend reinvestments eventually made up the difference between the amount reported as transferred and the amount actually in the account on the date of transfer.

What is the best way to clean up the transactions that occurred after the transfer date?

- Should I use the "move transactions" option in the upper right hand gear in the old account and merge all of the remianing transactions with the brokerage account?

- Revise the original transfer to specify (on a FIFO basis) the true amount of shares that were transferred to the brokerage account on 9/1/2023? If so how should I transfer each of the share transactions (all dividend reinvestments) that occurred after that date.

Thank you all for your interest and help.

R.

Answers

-

I don't quite follow what you did, especially when you say you told Quicken to transfer the shares as of today's date rather than the date they were actually transferred.

Here is the process I would have used, largely because it mimics what happened in real life. This will enter one Removed transaction for each security held in the old account(s) on the transfer date and an Added transaction in the new account for each tax lot of each security. It preserves the cost basis and acquisition dates of the securities transferred. The pre-transfer cash and security transactions will remain in the old accounts.

- Make sure the holdings in your old account(s) prior to the transfer are up to date and accurate.

- Back up your data file in case something goes wrong.

- In the old account(s), click on the gear, pick Edit account details, and on the Online Services tab, click on Deactivate.

- If there are transactions in the old account(s) that remove the holdings for the transfer, delete them.

- Set up the new account in Quicken if you have not already. If there are already transactions that transfer the holdings into the account or transactions that duplicate ones that are already recorded in the old account, delete them.

- In the old account(s), click on Enter Transactions and pick Shares transferred between accounts. Set the date for the Shares Transferred to the actual date the securities were transferred.

- Select All securities and click on Enter/Done.

- If there is any cash in the old account(s), enter a Cash Transferred out of account to move it to the new account.

- If you are entering the transfer after the fact and there are transactions in the old account(s) after the actual transfer date for the securities that were moved, you should use the Move Transactions operation to move those transactions to the new account.

When reporting on performance over a period that includes the transfer, include both the old and new accounts in the analysis.

QWin Premier subscription1 -

@robert@ If I am following your steps so far,

- you had a Quicken account for the mutual funds that was up-to-date with transactions even though the real world account transitioned to a brokerage account in Sept 2023.

- you recently did a Shares Transferred dated 9/1/23 in Quicken to move the MF shares from the Quicken MF account to a new Quicken brokerage account.

- That action properly removed and added the shares held 9/1/23 from the old account to the new account.

- The same action did nothing to the shares acquired (mostly by reinvestment) after 9/1/23.

- Somehow in that process a later sale of shares became a Short Sale because the 9/1/23 holdings had been removed from that original account.

Yes, I believe you could MOVE the transactions from the original MF account to the new brokerage account. Backup first. Be careful in specifying which transactions are being moved (all transaction after 9/1/23 to my understanding). Those would include reinvestments and any other buys, sells, contributions, etc. Essentially, the old account would end as of 9/1/23 with no holdings and no later transactions.

I don't know what your status is with Vanguard about downloading transactions, but you may still be able to download the transactions from Vanguard to the new account in which case you would then delete those transactions from the old account achieving the same 9/1/23 cutoff date.

Regarding your question about specifying the shares removed, the Remove Shares generated by the Shares Transferred would default to a FIFO basis, so I don't understand what any additional specification by you would accomplish.

Please clarify if I have misinterpreted anything.

1 -

J. Harmon, Lurker:

Many thanks for your interest in my question.

First, to eliminate one variable, I do not use online, auto download from Vanguard. Al transactions are entered manually, and then reconciled against monthly statements.

JH: the issue in your solution is point #7. When I click on "all securities" it scoops up all the additional securities in the old mutual fund account accumulated due to reinvestment of dividends after the 9/1/23 transfer date by Vanguard. Quicken then tries to account for the post transfer transactions in the old MF account as short sales (not sure why).

As another approach, I limited the "shares transferred between accounts" to the actual number of shares in the mutual fund account as of the 9/1/23 transfer date (on a FIFO basis), and then followed your point #9 (echoed by Lurker) by executing a "Move Transaction" for all of the remaining transactions in the MF to the Brokerage. This "almost" works as the share totals and current value come out correctly, but the cost basis has changed slightly. I would like to fix this so everything is exactly as it was before transferring between accounts.

Any suggestions on how I troublehsoot this? Specifically, how can I compare cost basis for each lot, both before and after the transfer, to see what has changed?Again, many thanks for your interest and suggestions.

R.

0 -

When you entered the Shares Transferrred, what date did you use at the top left of the entry dialog? If you used 9/1/23, it should have transferred your holdings as of that date. For each security, you should see a Removed transaction for that date in the old account and multiple Added transactions for the same date in the new account. Do you see something different?

Make sure the share prices are accurate for that date.

QWin Premier subscription1 -

JH:

Negative. On the right hand side it asks whether to transfer "all securities" or a specific number. As described in my post, I've tried it both ways (i) selecting "all securities" (which then transfers all of them including shares accumulated by reinvestment after 9/1/23), or (ii) specifying only the number of shares in the account as of 9/1/2023.

My take away is the date of transfer does not control the amount of shares transferred, only the date you want to record for the transaction. The number of shares transferred is controlled by the "Transfer" dialog.Both approaches introduce different issues, as I've described.

I will try a few different approaches and report back.

Thanks for the quick response.

R.

0 -

Oh wait! I tried this and if you go to Shares Transferred between Accounts and select All Securities, it transfers everything in the account as of today, not as of the transaction date you set. That is a bug I think.

I guess this does not usually come up because usually when all shares are transferred to another account, there are not any transactions for those shares already recorded in the old account after the transfer date.

As a workaround, I guess as you have found, you must set the transaction date, select the security, and specify the number of shares you held and the lots as of that date.

QWin Premier subscription1 -

JH,

I should add that clearing the post 9/1/23 transactions from the MF by using the "move transactions" option is also puzzling. The selection of transactions eligible for moving includes those covering the shares previously transferred under the "transfer shares" tool (i.e. the pre 9/1/23 shares). Logically, I should be transferring only those transactions which occurred after 9/1/23.

However, when I deselect "select all transactions for the same security as a group" I am met with a warning that this may affect the cost basis. This may be the source of the corruption to the cost basis.I will keep experimenting.

Again, thanks for your interest,

R

0 -

If you are entering all of your transactions offline and you have already entered all of the reinvestments in the old accounts, I think you could simply pretend that the transfers occurred today and enter the Shares Transferred between Accounts with transaction dates of today. That will move all of your current holdings, including the tax lots, from the old accounts to the new one. If the cost basis was correct in the old accounts, it will also be correct in the new account.

QWin Premier subscription1 -

@robert@ is that 9/1/23 date truly relevant? I could understand maintaining the 9/1/23 date if there was a legal reason to do so, such as an inheritance where DOD determines the cost basis for the heirs. But, it seems like this consolidation is merely for administrative reasons. Why not just move all transaction history for each fund to a consolidated account on Quicken regardless of date and just note the 9/1/23 date in a memo transaction?

1 -

I agree with @Jim_Harman that the situation you are seeing with the All Securities selection is a bug.

I will also point out that once the Remove Shares and Add Shares transactions are generated they are independent of each other. Thus you can edit the Remove Shares to limit the shares to those held at that time (9/1/23) and in the receiving account delete the erroneously added shares acquired post 9/1/23. That might me easier than recreating everything.

@robert@ you are right about the Move Transactions selection. You need to unselect the 'grouping' checkbox. The message is that the process may change "gains and losses". While such messages can sometimes be imprecisely worded and that message does imply cost basis, when I executed the move in my test file, the basis of the lots transferred correctly. Admittedly, mine was a simple test.

As far as seeing the basis of the individual lots, I suggest a portfolio view grouped by account. Clicking the '+' next to the security name will expand the listing to include the lot specific data. You can get a view like shown below. Again because the Add Shares in the receiving account are now independent, you can edit each such Add Shares to change the cost basis of that lot. (You could also change the number of shares per lot or acquisition date if you chose to.) I would only do such editing if I was confident of the values I was revising.

Hope this helps

2 -

To work around the bug with transferring all securities defaulting to today’s date, you could temporarily set your computer date to 9/1/2023, do the transfer all securities, then set the computer date back to the current date.

Quicken user since Q1999. Currently using QW2017.

Questions? Check out the Quicken Windows FAQ list0 -

@mshiggins The issue is not the date so much. It is that when "All Securities" is the selection, it is treated as all securities in the account without regard to date.

My test for this was to not reset the date but rather to enter a future dated transaction. Then enter a Shares Transferred dated 8/1/23 for All Shares to be transferred. All the shares got added to the transfer account - the shares acquired before 8/1/23, the shares acquired between 8/1/23 and today, and the shares acquired in the future (relative to today's computer date). All those shares were added to the transfer account as Shares Added effective 8/1/23 with their correct basis and with their correct acquisition date, even the acquisition dated in the future. A Short Sell was entered in the originating account rather than a Remove Shares as the OP initially reported.

I will add here that if the user specifies the security to be transferred (rather than using all securities), the program behaves correctly. Even if one picks 'All' for the shares of that one security to be transferred, only the shares held as of the date of the transferred are included in the transfer.

1 -

What I have personally experienced is if you need to transfer securities based on a specific date in quicken, you need to do it on that actual date or near after it. If you try to backdate the transfer date to 9/1/23, it won't work because there are security transactions posted after that date. If keeping the transactions prior to 9/1/23 in separate account is important, then the only way to do it is to delete all transactions after 9/1/23 from the individual accounts, then do the security and cash transfers, and then reinput the transactions after 9/1/23 in the consolidated account.

1 -

Sorry for the delay in responding to all the excellent feedback, but I have been experimenting with different approaches. I will try Lurker's approach to see if I can isolate the gremlins.

Thanks and regards,

R

0 -

[Deleted]

0 -

Hello,

I found the source of the error. The individual mutual funds had been set to "average cost basis". By unchecking this box, the transfers into the brokerage account yielded the same cost basis as the individual mutual fund accounts before the transfer. Hat tip to Lurker who pointed out this feature in another thread.

The result is that my Quicken accounts are now fully aligned with my Vanguard accounts. The only downside I have been able to identify is that the transfer completely destroyed all of my historical performance tracking in the portfolio view. Apparently, the brokerage accounts do not pull in the data (average returns, ROIs, etc.) for any of the periods prior to the transfer. Yes, you can go back to the now empty mutual fund accounts, reset the date to predate the transfer date, but this info is getting pretty stale.

I may open a thread on how to extract the most meaningful performance data, with or without transfers into an account. In the meantime, many thanks to all,

R

0 -

@robert@ you might be able to get historical performance by selecting "Show closed lots" by clicking on the "gear" icon in the upper right. You would also need include the old investment accounts in the portfolio view.

1 -

To get the overall performance when shares are transferred between accounts, you must include both the old and new accounts. This should produce the correct overall Average Annual Return (IRR) but ROI may be lost.

QWin Premier subscription1 -

CaliQkn:

Thanks for the tip. I'm getting more data, but not sure how to interpret it. The same fund is showing different values (e.g. avg annual return 3 and 5 years) for the stand alone mutual fund accounts compared to the brokerage accounts. Given that the funds resided in different accounts over these time spans I need to understand how Quicken calculates the overlapping periods. The transfer took place in Sept 2023. In calcualting 3 and 5 year avg returns, how does Quicken account for the stub years (i.e. when the fund moved accounts during those periods)?

More to discover.

R.

0 -

I suggest you set up a Portfolio view that includes just the old and new IRA accounts and includes the Avg Annual Return 3 and 5 year columns.

The number in the Totals line at the bottom of the view should show the overall performance of all the accounts.

QWin Premier subscription0 -

@robert@ I wouldn't think that there would be any overlapping periods. I am a little confused by that comment. The securities cannot be in two accounts at once. For fund returns, I wouldn't think it would make any difference which account the security was held in. I was under the impression that the securities were held in individual accounts until 9/3/23 and then transferred to a single brokerage account.

Maybe @Jim_Harman can give some better insight on how this all works. I don't want to muddy the waters here.

1 -

CaliQkn:

By overlapping I meant the funds were transferred within the 3 year and 5 year periods offered by Portfolio View for average annual return and average annual return. Thus, the performance results (%) are now split between the old single individual mutual fund accounts and the consolidated brokerage accounts. The question is whether these partial results in the old and new accounts add up to the correct total.

I will experiment with Jim's suggestion by creating a subset View that includes only the transitioned accounts and see if that makes sense. The acid test will be comparing the results to a prior backup file before the accounts were consolidated.

Testing continues …

Thank you both for your continued interest.

R.

0 -

IMO, the best way to test and understand the Average Annual Return values in a portfolio view is to recreate the calculation in an Investment Performance report. The report can be customized to the same time frame, accounts, and securities.

By showing cash flow detail, you will see the detailed transaction that flow into the calculation. If not subtotaled, you should see the same values removed from old account and added to the new account on the same date. Those then cancel each other out leaving no effect on the overall AAR percentage determined.

Transactions included will be noticeably impacted by selecting to include or exclude the “No security (includes cash)” option.

I would expect in your situation variously subtotaling by security or by account would be illuminating.

2 -

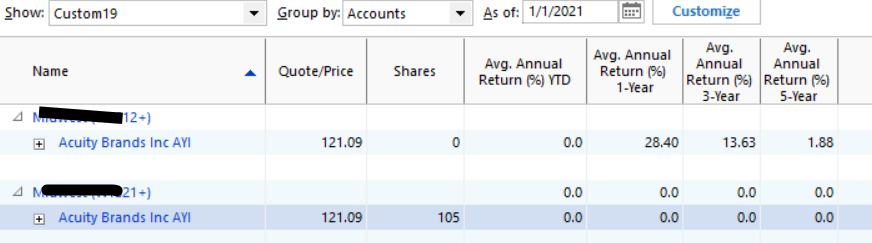

It appears that transferring shares from the single fund mutual accounts to a brokerage account materially affected the performance reports in portfolio view.

The first image is from my last backup on June 2 before the shares were transferred out of the single mutual funds.

The next image is the same funds when using the portfolio security view after they have all been nested inside a single brokerage account.

Attcahed is a comparison of average annual returns (AAR) before the transfer and after.

The cost basis is still the same, and all the transactions are intact. The time difference is only 10 days, and during that interval there have been no tranactions or updated pricing. So what explains the difference?

I will explore Lurker's recommendation regarding running reports, but my goal is to continue using Quicken Portfolio for ease of comparison across all investments.

Thank you for your interest,

R

0 -

The individual account returns will be different after consolidating because the accounts have different holdings.

If you make a Portfolio view that has just the affected accounts and look at the combined returns at the bottom. they should be the same.

QWin Premier subscription0 -

I tried running a performance report that mimics Portfolio view, but it includes in "Returns" the value of the shares removed from the original single fund mutual fund account as well as the ending market value as of today's date in the brokerage account, which grossly inflates the total return by essentially double counting the same shares.

Is there a better approach in analyzing performance when shares have been transferred between accounts?

R

0 -

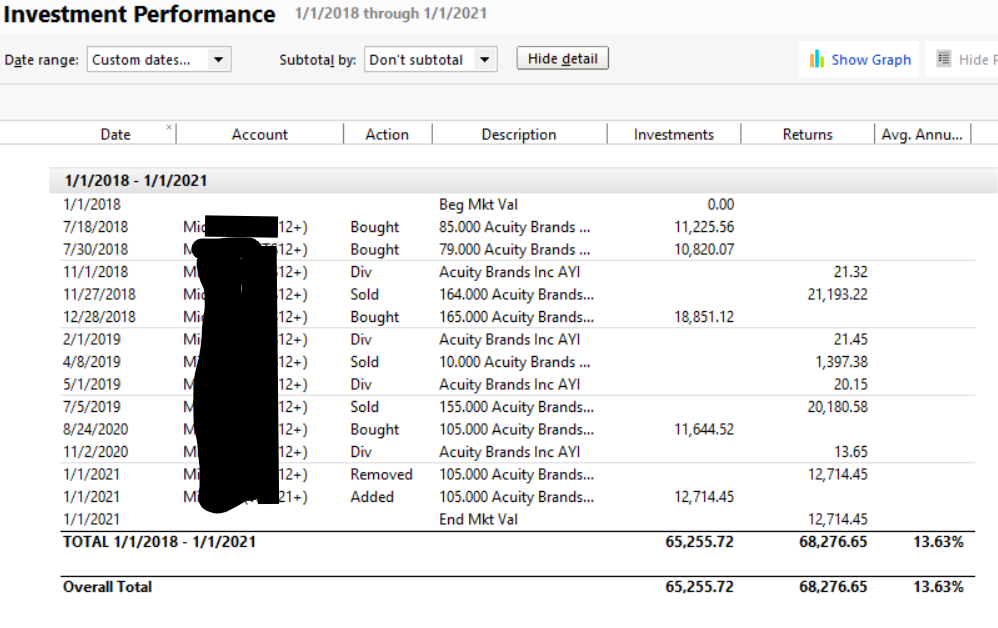

On 1/1/21, I transferred a lot of holdings from one account to another. Below I show just one of those securities where one lot of 105 shares was transferred. On that date, it was one Removed shares in the older account and one Add Shares in the new account.

I am snipping a portfolio view for the date 1/1/21 (date of transfer). For that view, I needed to set the Options to show closed lots. Without that setting, the …12+ account with no security held on 1/1/21 would show nothing.

The summation at the bottom of the portfolio view reflects those AAR values - 0, 28.4, 13.63, and 1.88.

When I customize an Investment Performance Report properly, I get what is shown below for the prior 3-year period, 1/1/18 - 1/1/21.

Keys to note: This IPR is showing the details (the applicable transaction in the three year period, all in the 12+ account). That can help in the understanding of the calculation. The 13.63% matches the 3-Year AAR for the portfolio view, as I have dated the report for a three year period. In the report, you can see the 1/1/21 transactions removing 12,714.45 from the 12+ account and adding that same amount in the 21+ account. Those two counter-balance each other in the calculation such that the remove and the add have no net effect. If I subtotal by account, the 12+ account shows the 13.63 and the 21+ account shows 0% — as expected since the 21+ account has no other transactions and no price changes. If by some chance your Removed and Added values do not counter one another, the numbers would come out differently.

In my experience, the numbers in the portfolio view match what a comparably setup Investment Performance Report calculates and the comparable transaction date entered into Excel with its XIRR() calculation results in the same percentage.

Hope this helps

1 -

J Harmon:

Actually that is what I did (limited portfolio to just the affected accounts - old and new). There are no other funds in the new brokerage account, so the only transactions are for the transferred funds. The only difference is I used "group by securities" in portfolio view so I could analyze each fund seperately. If I switch back to "group by account" it merges all of the fund results.

Thanks for your interest,

R

0 -

q. lurker,

I take your point that that the investment report average annual return ties to the portfolio view screen. What baffles me is how the report can double count the $12,714 investment return by counting it twice, first in shares removed and again with ending market value.

My situation may be unique because of the lag between dates of the actual transfer and when I finally caught up with accounting for the transfer in Quicken. This gives me the ability to screen and report investment returns for the same period (3 year and 5 years) from both the perspective of stand alone mutual funds and when combining results with both the single mutual funds (for the pre-transfer period) and the consolidated brokerage account (for the post transfer period). I agree with J. Harmon that the results should be the same, but as demonstrated in my jpegs, they are not.

Just to be clear, the effective date of the transfer was 9/1/2023. So a three and five year performance calculation must include both the individual fund accounts and the post transfer brokerage account.

R.

0 -

Lurker:

To simplify the troubleshooting, I narrowed my reports to just one fund that was transferred and tried to match the portfolio view results to an investment report.

Attached is Portfolio View (note it includes both the old fund account and the new brokerage account). The AAR for three years, after adding the results in both accounts, is 5.94%

Then I ran an Investment Performance Report for the same three years and got a result of 4.63%

They don't match. (I deliberately left out the detail because of the report's length, but it dutifully included all the "Add" and "remove" shares between the two accounts).

Suggestions for troubleshooting?

R

0

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 512 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub