Securities Mismatch on UBS Cash Balance Account

This issue is for Quicken for Windows 11 R63.21.

This problem has been ongoing for awhile and I noticed some conversations about it a few months ago. I thought it might resolve itself in time but it hasn't, so I'm pursuing a solution anew. This is occurring in all my UBS accounts; it didn't previously happen.

The UBS Bank UBS Deposit Account is a cash balance account.

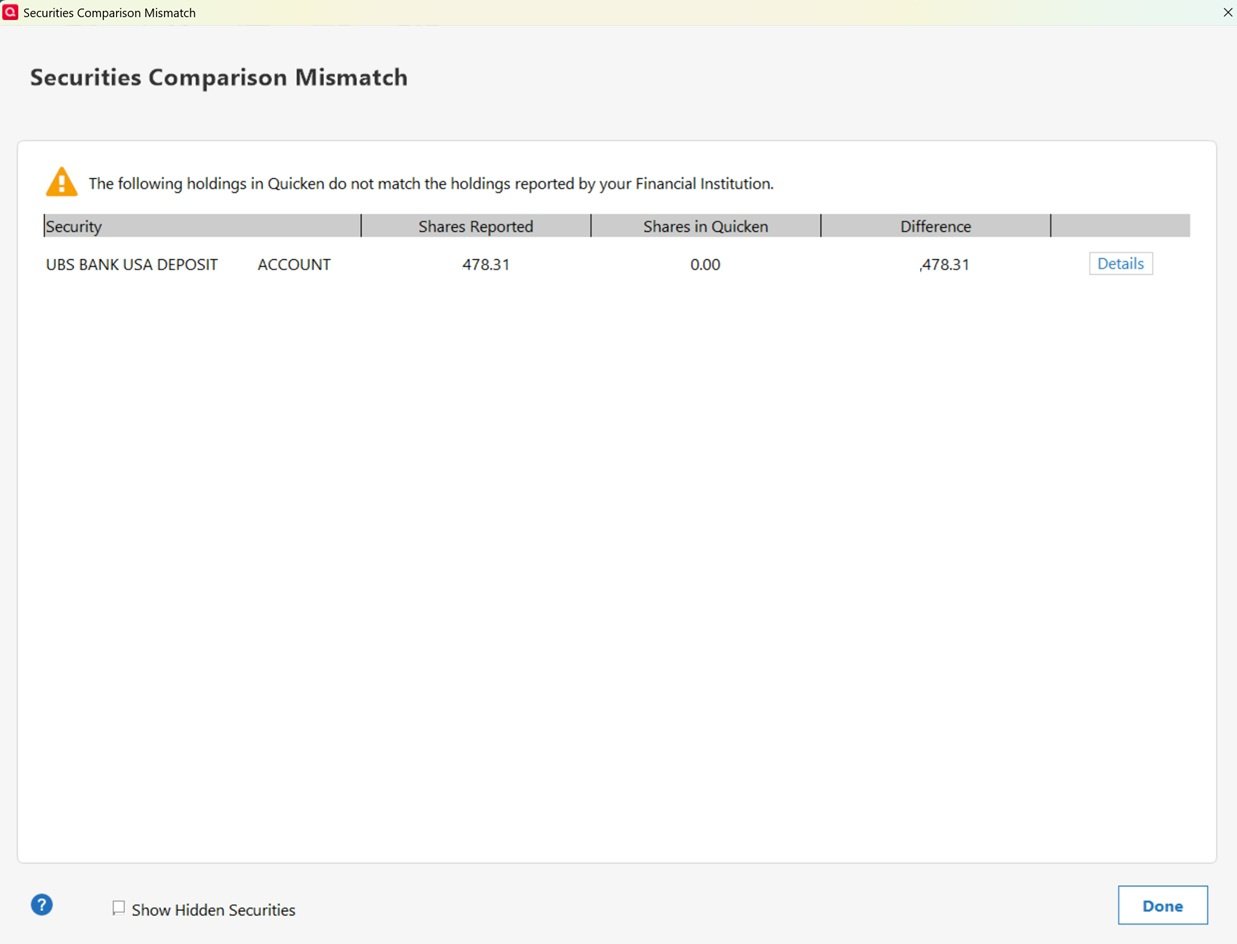

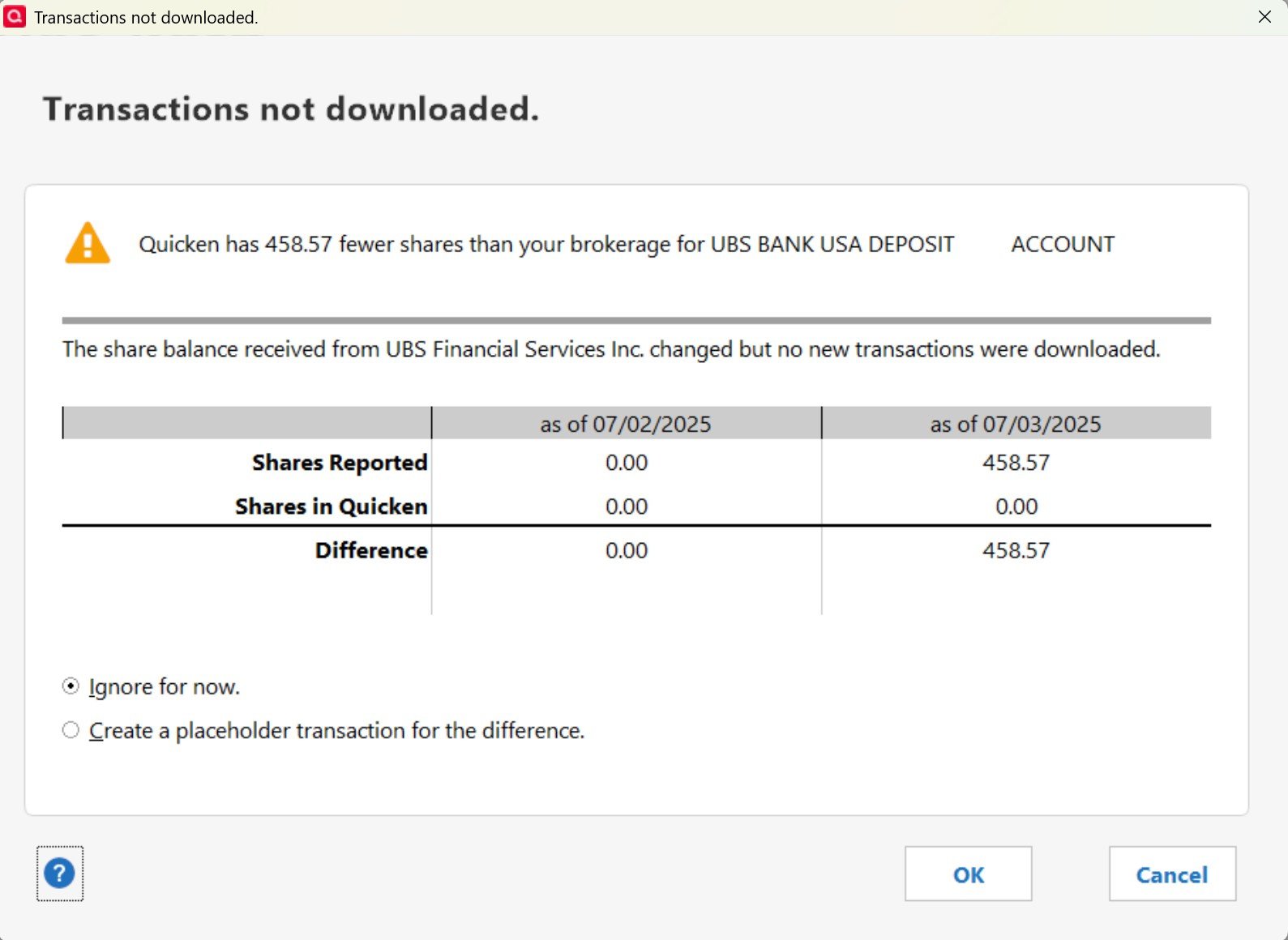

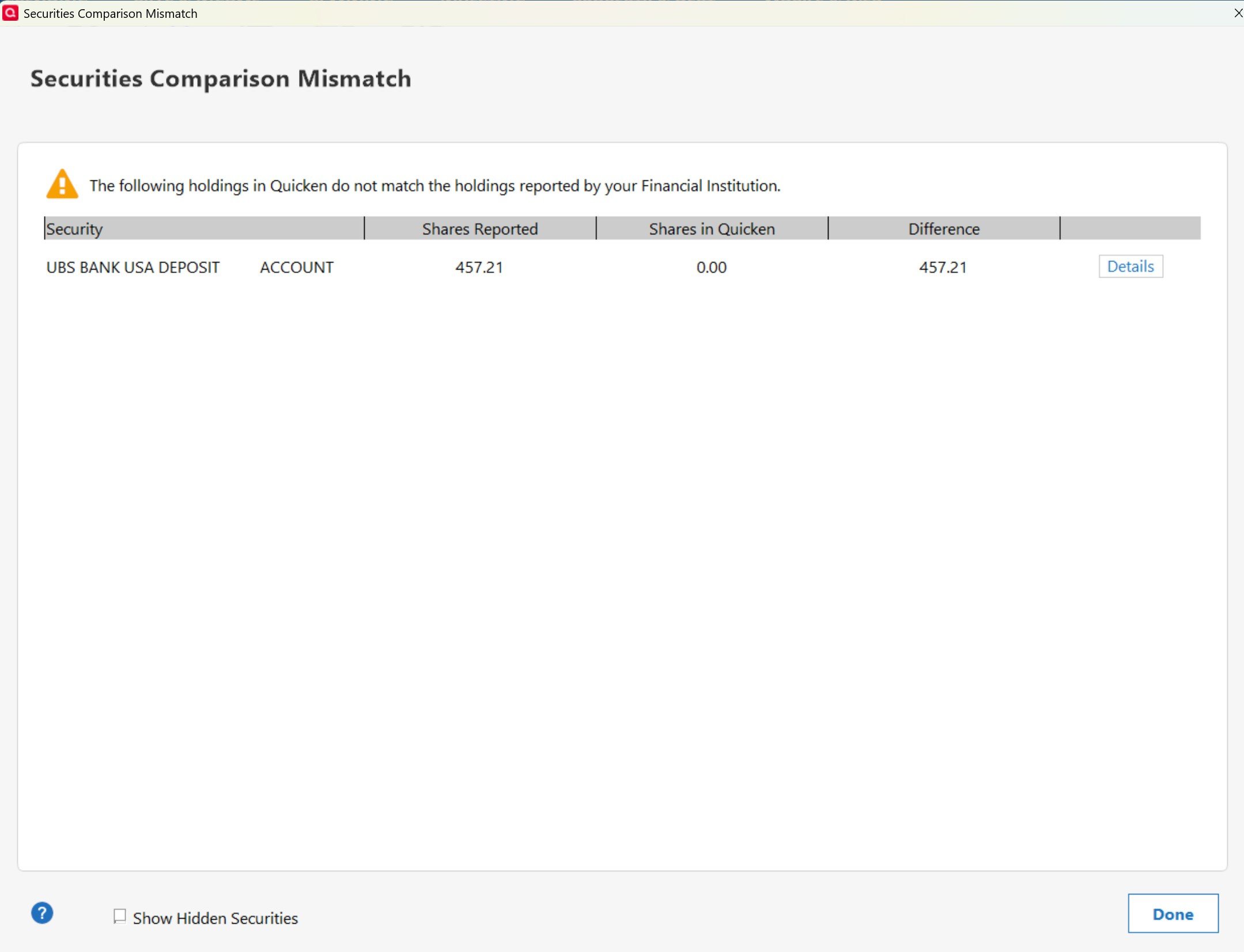

After download, I see the first screen. If I click Details, I see the second screen.

There is already a Cash balance in the account, so if I create a placeholder, I'm going to show both the UBS Deposit Account and the cash, effectively double counting and throwing off my net worth calculations.

Any thoughts on how to make this pop-up stop appearing?

Answers

-

I wasn't sure what a "UBS Bank UBS Deposit Account" really was - a true "Account" or a "Security" - so I Googled this and got: "UBS Bank USA offers FDIC-insured deposit accounts to its clients."

This tells me that the actual account at UBS Bank is a bank account, and a bank account only has "dollars" in it, it doesn't have "shares" in it. So it seems that the Quicken Account is an Investment Account and you have the "UBS Bank UBS Deposit Account" in the Investment Account as a "Security?"

0 -

Tom, that is correct. It is a UBS investment account. I have seven such UBS investment accounts. Each of the seven accounts has this issue.

Each has a cash balance that I reconcile each month. The UBS Deposit Account is a security in the account. I didn't add the UBS Deposit Account as a security, it's downloaded as such.

The UBS Deposit Account and the cash balance always match. I don't know why both are there. It would be great if they were tied together accurately somehow to avoid double counting.0 -

@jerrylcanterbury click on Edit → Preferences → Downloaded transactions, and see if "Never interpret money market funds as cash" is checked. If so, uncheck it and see if it makes a difference.

1 -

The other thing to check is if UBS offers different options for showing money market funds.

Click on the Online Services tab in Account Details. Is there an button in the bottom right - "Reset Money Market securities/cash options"?

Some financial institutions offer this option, but most do not. If it is available, follow the prompts to set the options for the money market fund to be treated as cash.

1 -

Thank you @CaliQkn I will try each of these in turn and let you know. Will take a few days/downloads to see, especially with the holiday weekend.

0 -

It was unchecked so I checked it. The problem is still occurring.

I also looked for the "Reset Money Market securities/cash options" button. It does not appear for my UBS accounts.

0 -

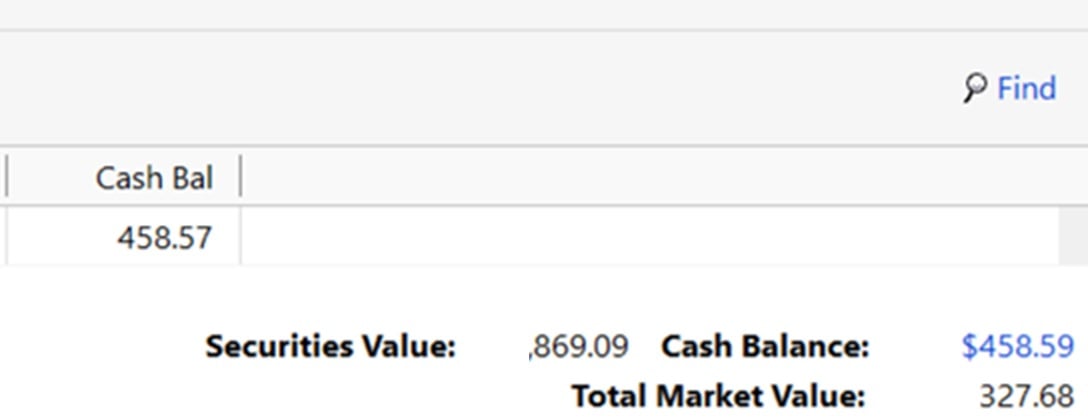

@jerrylcanterbury if you click on "Cash Balance" in the lower right of the account register, does the screen show that the cash is in balance?

0 -

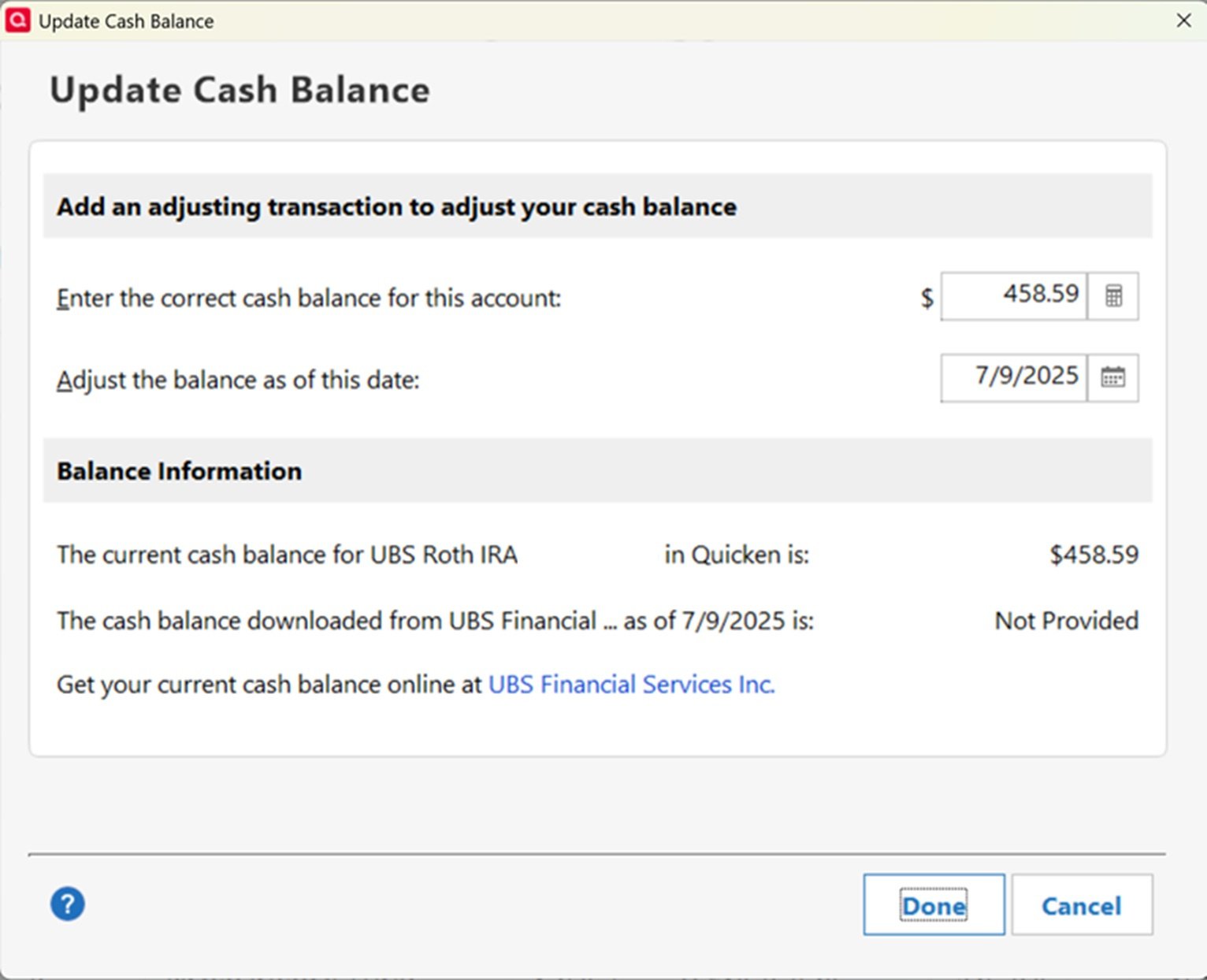

By happenstance, I was reconciling my June month-end statements for these accounts today. They are showing out of balance now.

A very good example is one of the IRA accounts, which always has a zero balance (any dividends are immediately reinvested). It now shows a cash balance of $458.59.0 -

@jerrylcanterbury on that cash screen, do the current cash balance and downloaded cash balance both indicate $458.59?

0 -

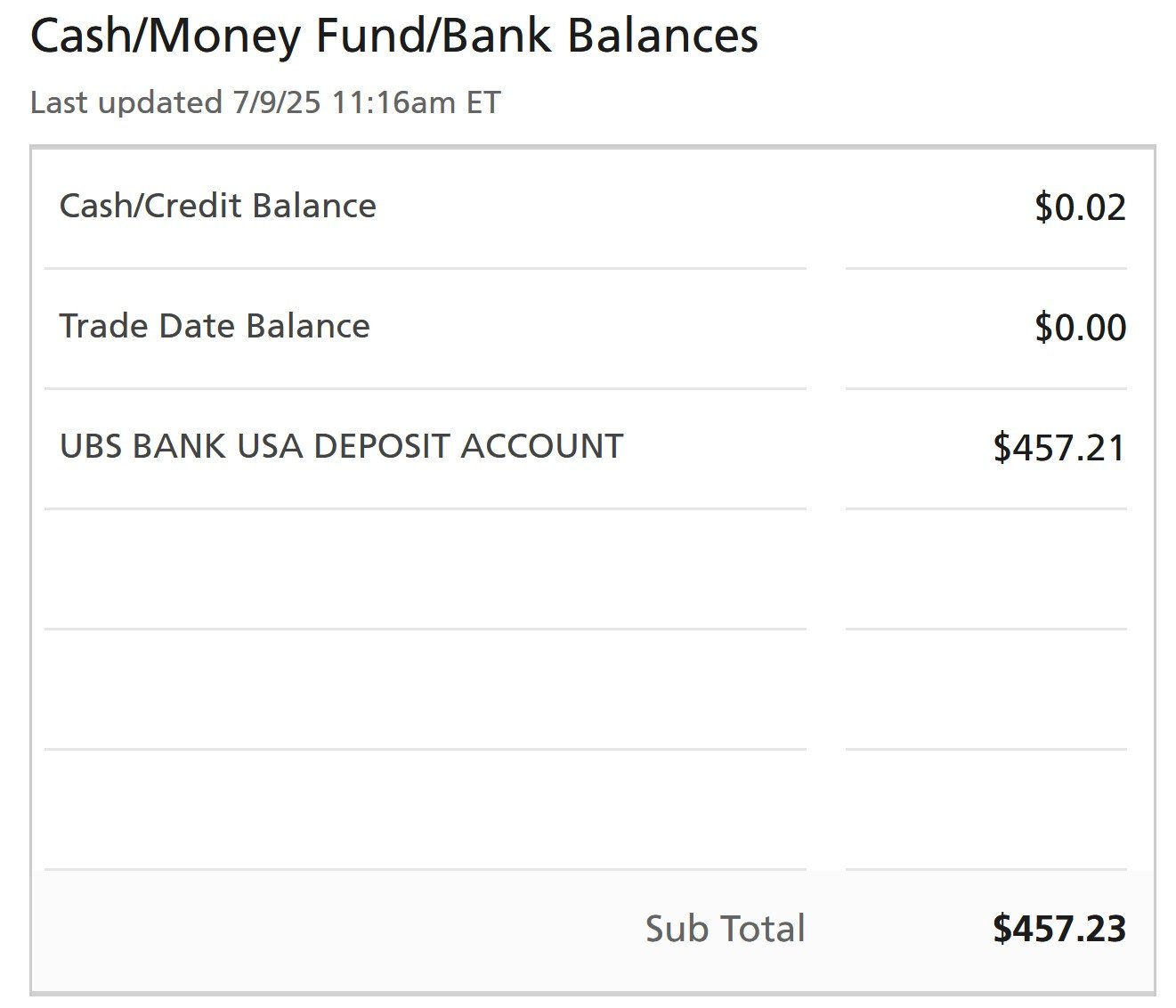

I don't understand your question exactly, but here are three screenshots showing what I'm seeing. The first is from the account's website, the next is the from the account register, the last is the mismatch error message.

0 -

@jerrylcanterbury if you click on the blue "458.59" at the bottom right of the account register, you will get a cash reconciliation screen that shows various cash balances. What does it show for each of these cash balances?

0 -

Here is a screenshot.

0 -

@jerrylcanterbury part of the issue is UBS is not reporting a true cash balance for the account.

It looks like the UBS Bank USA Deposit Account is being used as a "pseudo" security and the cash deposits are being either purchased or reinvesting into this security.

I would create a dollar par (price=1.00) security on Quicken called "UBS Bank USA Deposit Account" and buy up the cash to equal "457.21". Then, each time a deposit is made to this fund, you would either do a buy or reinvest transaction, depending on if cash is actually deposited to the investment account.

0 -

OK, but that's extra steps.

I'm looking to avoid extra steps. Just clicking OK on the Mismatch error message each time is also an extra step, but it's a simple one that doesn't require me to create new securities and so forth.0 -

@jerrylcanterbury it is extra steps, but I cannot see any other way to get your accounts to reconcile and remain reconciled. It's hard to tell which side the issue is - Quicken or UBS. But since UBS is not sending a cash balance in their update file, that could be a contributing factor.

My only other suggestion is to contact Quicken Support. They can review logs and do a remote session with you to troubleshoot the issue.

0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 247 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 830 Quicken on the Web

- 123 Quicken LifeHub