2025 New Senior Tax Deduction

Lenn

Member ✭✭

For 2025 seniors will get an additional $6,000 per eligible individual ($12,000 for married couple) deduction over and above the standard deduction; however, Quicken has not factored this new provision into Tax Planner and there is no facility to make an adjustment for it in Tax Planner. Will they correct this feature soon?

0

Comments

-

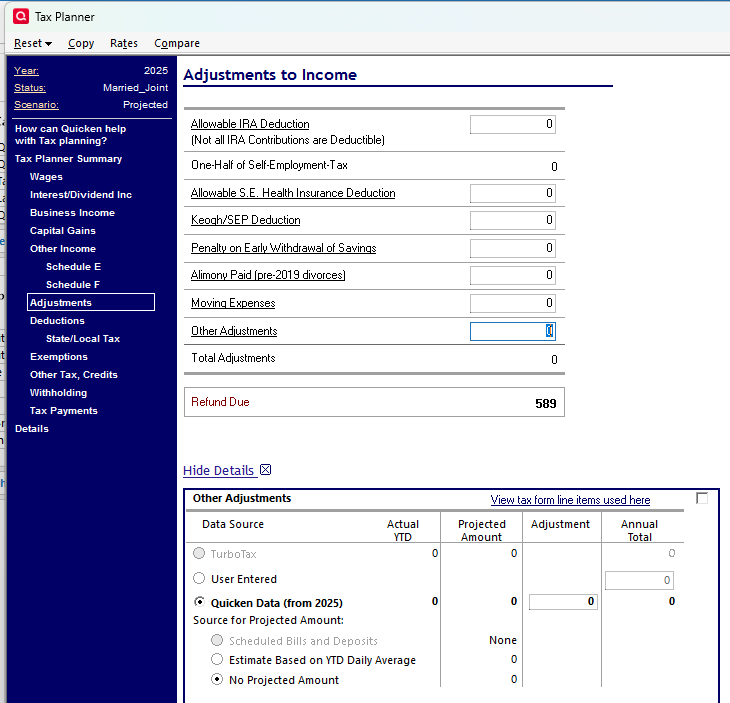

While you are waiting for Quicken to implement this, you should be able to enter the amount of the deduction you qualify for (there are income limits) on the Other Adjustments line in the Adjustments to Income section of the Tax Planner.

QWin Premier subscription1 -

Jim, that was helpful. I was not aware of those adjustments. THANKS!

0

This discussion has been closed.

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub