Fidelity monthly Interest Earned no longer assigned category after EWC+ upgrade

Fidelity reported Interest Earned in one account for the core MMF for the first time after the EWC+ upgrade. The interest was reported as a Deposit in Quicken but without any category assigned. Previously, for the DC connection, it was assigned monthly as a Deposit but with category _IntInc. How can I make Quicken assign the correct category to this transaction in the future?

Unlike in the DC connection which showed a payee as INTEREST EARNED, the payee shows as "INTEREST EARNED as of 2025-09-2" , so memorizing the payee would not help. I noticed there is already a memorized transaction for INTEREST EARNED with category _IntInc.

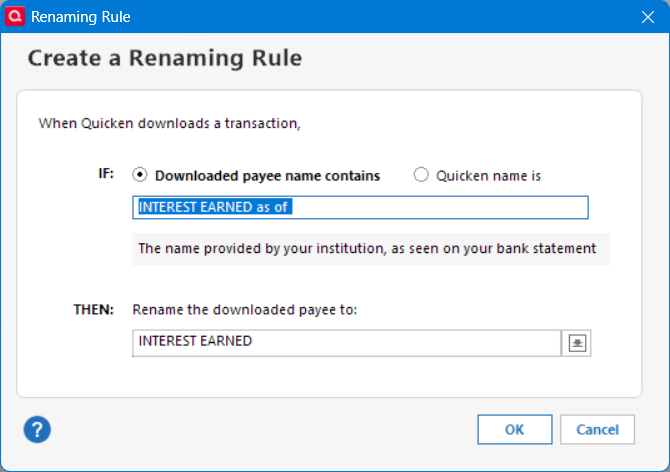

Should this renaming rule do the trick?

Deluxe R65.17, Windows 11 Pro

Answers

-

There is no "category" per se, on an investment transaction. The category is determined by the Investment ACTION … so a downloaded interest payment becomes _IntInc.

So, in your investment account, what's in the ACTION column for the transaction?

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP-1 -

The Action in Quicken was "Deposit". This has been the same action prior using the DC connection. I think I've figured it out. I had a memorized transaction for "INTEREST EARNED" which has the correct category of _IntInc assigned. Now EWC+ connection has a payee of "INTEREST EARNED as of 2025-0-22" which ignores the memorized transaction. That's why I created the renaming rule. I hope it works.

Deluxe R65.17, Windows 11 Pro

0 -

I'm not sure why it's coming in as Deposit instead of _IntInc. Perhaps was the interest actually earned in a different account and directed to this account?

This might have to do with Fidelity's DC to EWC cutover, so you might consider reporting it to Q Support.

But, in any event, I'd just change that Deposit to an _IntInc and be done with it.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

It worked that way even with the DC connection. The memorized transaction used to take care of categorizing correctly as _IntInc, but the Payee was always "INTEREST EARNED". With EWC+, the payee has changed to "INTEREST EARNED as of 2025-09-22" which means the payee will change every month. So I created a renaming rule as described above and hope that will make the transactions categorize properly.

Deluxe R65.17, Windows 11 Pro

0 -

What's the security that's involved in this? Because I have MMF and bond funds held at Fidelity, and they all come in as dividends, not interest.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

SPAXX is the core MMF. I just talked to Fidelity about the fact that I get INTEREST EARNED for an account that has a core MMF which reports monthly dividends which are transferred to another account automatically along with the Dividends from other securities in the account. They said that if the DIV for the core MMF is issued on a Friday, the funds are swept into an FDIC account that generates interest before the DIV amount is transferred the following week along with the DIV's from the other securities. The interest amounts are very small, less than $1 monthly, but it was strange to see.

Deluxe R65.17, Windows 11 Pro

0

Categories

- All Categories

- 61 Product Ideas

- 35 Announcements

- 223 Alerts, Online Banking & Known Product Issues

- 21 Product Alerts

- 704 Welcome to the Community!

- 672 Before you Buy

- 1.2K Product Ideas

- 54K Quicken Classic for Windows

- 16.4K Quicken Classic for Mac

- 1K Quicken Mobile

- 812 Quicken on the Web

- 115 Quicken LifeHub