How to show loan payments as category expenses

If you get a loan for a home improvement like HVAC, the loan is an account and the payments from checking go against the loan. But there is nothing to show this as an expense category for something like "home repair". Is there a way to show the loan payments as an expense for a category?

Answers

-

You've got the accounting confused. The original transaction, that created the loan is the "home repair" … NOT the loan payments.

If the loan payments were expenses, you'd be double counting them.

What you need to look at is a "Cash Flow" report, not Income/Expense

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

When you setup the original loan, the full loan should have gone to the expense category. Then each payment you enter from the checking account is split to interest and to the Loan account. Only the interest is the expense to interest exp. The principal part of the loan payment is not an expense because you already entered the whole amount as the expense when you took out the loan.

I'm staying on Quicken 2013 Premier for Windows.

0 -

Rephrasing the sequence @volvogirl offered, I would see it as:

- First transaction in loan account is a transfer of cash to the checking account = debt created in loan account and asset increase in checking account. (Net worth not changed; Liability taken on and cash increased equally.)

- Same time or soon thereafter, either:

- cash goes out of checking account as expense for HVAC work (Net worth dropped by value of HVAC expense) OR

- cash goes out of checking account to Home Asset account; value transferred from one asset to another. (Net worth not changed; one asset decreased and one asset increased)

- Over time, payments go out from checking account with principal portion transferring to HVAC loan (Net worth not changed; cash reduced and liability reduced) and interest portion of payment against whatever Interest expense category you are using (Net worth reduced).

So is (or do you want) the value of your home increased by the value of the HVAC improvements or do you want a one-time hit on the home repair category? Either way, the expense is not related to the loan payments, as I see it.

0 -

When you set up the loan, it doesn't have an expense category, it is just an account. That account (HVAC Loan Company XYZ) can appear in spending reports, but because it has no related category, it will show up as it's own category like "HVAC Loan Company XYZ". It makes more sense to me to include this under an existing expense category like "Home Repair" or "Home Improvement" but it seems like that cannot be done.

0 -

My problem is the original transaction, which is creating the loan, has no link to "home repair". Unless I'm really braindead I don't see a way to create the loan account and link that to a "home repair" category. Instead what I see in my expense report are the loan payments going out under the category/account name of "HVAC Loan Company XYZ", while my "home repair" expense category remains empty.

Maybe I'm missing something basic but if the purchase was done in cash it would trivial to assign this to the "home repair" expense category as my money would flow directly to the seller. I was hoping to do the same with a loan account in Quicken and track the flow of payments to the loan company while also showing the monthly expenses under the correct expense category. It sounds like that is not possible using the loan feature in Quicken.

0 -

You have two choices. Either you record the full expense at the time you set up the loan OR you put the amount to an asset account. At this point you could "amortize" it monthly using a reminder. This would then show the expense monthly for a period of time which you could make the same as the loan term if you want.

This is simply an accounting issue and per accounting rules loan payments are not expenses. However you can show the expense monthly by doing the amortization if the asset.

Quicken Windows user since 1993.

0 -

@matt56, It's really quite simple, but you're trying to combine 2 transactions into 1.

First, create the loan account. Don't input a transaction for the opening balance.

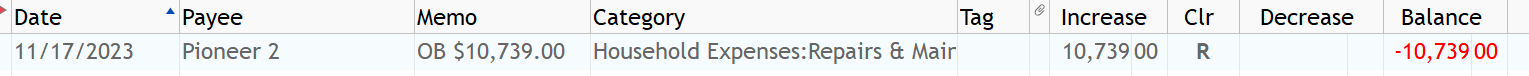

Second, create a transaction, using your "Home Repair" category. Here's an example:That memo field shows the Opening Balance in case that transaction somehow gets screwed up. And, because it's a loan account, the "Increase" is an increase in the amount owed, which is why the Balance is negative.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Hmm, that might work. The expense will be a lump sum but it will at least be in correct category. And the loan payments should still be tracked with Quicken. Let me give it a try.

0 -

The interest that you pay on the loan will be an expense … but the initial amount might not be.

A new HVAC also might add to the Cost Basis of you home, rather than being an expense. BUT not giving tax advice.

A Cash Flow report would show the monies coming in and going out if you choose to record this as a Cost Basis item.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0

Categories

- All Categories

- 49 Product Ideas

- 35 Announcements

- 225 Alerts, Online Banking & Known Product Issues

- 18 Product Alerts

- 505 Welcome to the Community!

- 673 Before you Buy

- 1.4K Product Ideas

- 54.9K Quicken Classic for Windows

- 16.6K Quicken Classic for Mac

- 1K Quicken Mobile

- 824 Quicken on the Web

- 120 Quicken LifeHub