Is "Simple Investing" a better choice for my Fidelity/NetBenefits 401k in my use case?

I have my paycheck set up in quicken to make contributions (my own, and my employer match) into an account in Quicken that represents my 401k at Fidelity. I do like seeing "Historic Performance" from time to time in Quicken, but over the past 9 years, enough kruft has crep in, downloads failed, and missing transactions have kind of messed it up. And with the recent Fidelity EWC+ issues, "Historic Performance" is currently not even useful. (Fidelity.com shows a +14% gain the past year, while Quicken shows -34% loss for the same period.) I periodically "Adjust Share Balances" when I visit Fidelity website for details.

Most of the time, when I enter my paycheck it updates cash, and then subsequent downloads convert those to purchases, and ReinvDivs get applied. So, I'm considering giving up and switching this account to "Simple Investing" to ease headaches, and because there's currently no real tax implication for periodic transfers between funds. But before I switch to "Simple Investing", I want to know:

Is switching to 'Simple Investing' going to create any issues as far as entering my paycheck is concerned?

If I decide to switch back, will it give accurate values for AvgRR 3-year and 5-year, or is going to 'Simple Investing' a one-way deal?

Best Answers

-

Is switching to 'Simple Investing' going to create any issues as far as entering my paycheck is concerned?

Simple Investing shouldn't create issues for entering paychecks, but prior to the EWC+ conversion, Fidelity NetBenefits 401(k) accounts in Simple mode were reporting twice the correct account balance. I have not seen any indication that that issue has been fixed.

If I decide to switch back, will it give accurate values for AvgRR 3-year and 5-year, or is going to 'Simple Investing' a one-way deal?

Because Simple mode does not download detailed transactions, Quicken is not able to compute the Average Rate of Return for periods that include the time the account was in Simple mode, even if you switch back to Complete mode. You would have to enter the missing transactions.

QWin Premier subscription0 -

I know I am somewhat late to dinner - on this question - but I do want to chime in on some thoughts.

You asked 2 questions. The first was "Is switching to 'Simple Investing' going to create any issues as far as entering my paycheck is concerned?"

The answer to that is - "Absolutely not", without question or pause.

And the answer to your second question - i.e. "If I decide to switch back, will it give accurate values for AvgRR 3-year and 5-year, or is going to 'Simple Investing' a one-way deal?

The answer to that is - "Yes - it is a one way deal, because that data will not be available in the future".

But, with the history you have provided to us, I highly doubt that the switch in the method will have any significant on your ability to evaluate the investments and their effectiveness.

Frankx

Quicken Home, Business & Rental Property - Windows 10-Home Version

- - - - Quicken User since 1984 - - -

- If you find this reply helpful, please click "Helpful" (below), so others will know! Thank you. -1

Answers

-

Is switching to 'Simple Investing' going to create any issues as far as entering my paycheck is concerned?

Simple Investing shouldn't create issues for entering paychecks, but prior to the EWC+ conversion, Fidelity NetBenefits 401(k) accounts in Simple mode were reporting twice the correct account balance. I have not seen any indication that that issue has been fixed.

If I decide to switch back, will it give accurate values for AvgRR 3-year and 5-year, or is going to 'Simple Investing' a one-way deal?

Because Simple mode does not download detailed transactions, Quicken is not able to compute the Average Rate of Return for periods that include the time the account was in Simple mode, even if you switch back to Complete mode. You would have to enter the missing transactions.

QWin Premier subscription0 -

I know I am somewhat late to dinner - on this question - but I do want to chime in on some thoughts.

You asked 2 questions. The first was "Is switching to 'Simple Investing' going to create any issues as far as entering my paycheck is concerned?"

The answer to that is - "Absolutely not", without question or pause.

And the answer to your second question - i.e. "If I decide to switch back, will it give accurate values for AvgRR 3-year and 5-year, or is going to 'Simple Investing' a one-way deal?

The answer to that is - "Yes - it is a one way deal, because that data will not be available in the future".

But, with the history you have provided to us, I highly doubt that the switch in the method will have any significant on your ability to evaluate the investments and their effectiveness.

Frankx

Quicken Home, Business & Rental Property - Windows 10-Home Version

- - - - Quicken User since 1984 - - -

- If you find this reply helpful, please click "Helpful" (below), so others will know! Thank you. -1 -

Thanks both of you. @Frankx , you pointed out:

But, with the history you have provided to us, I highly doubt that the switch in the method will have any significant on your ability to evaluate the investments and their effectiveness.

If I were to try to salvage at least a year of performance, preferably 5 years, do you think it it would be better to:

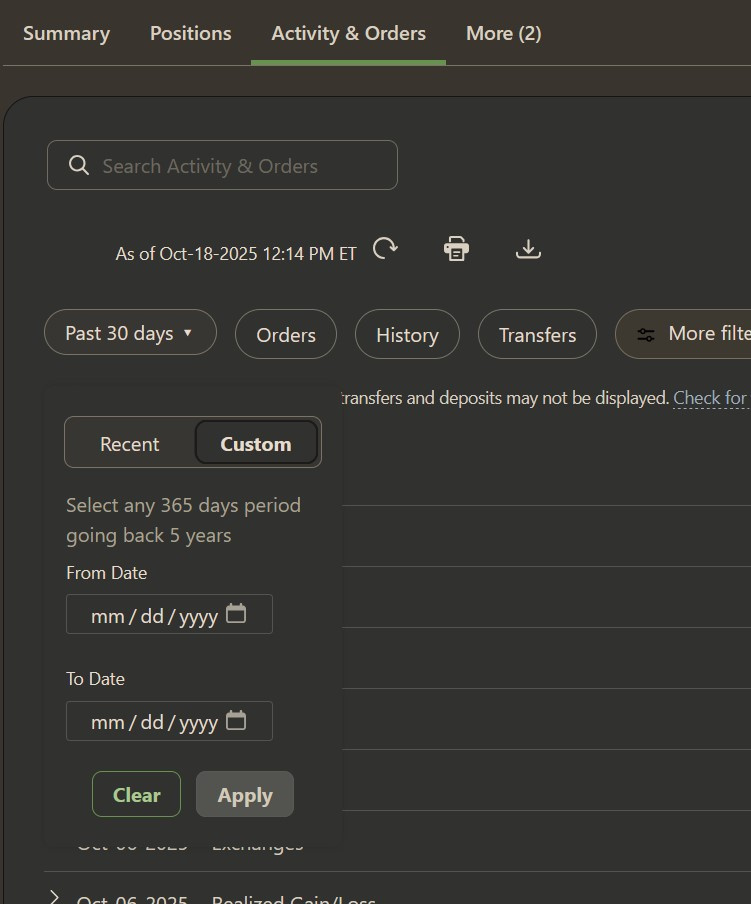

A) switch the account in Quicken to Simple, then back to complete, and download/import as much history as I can get in a QIF?

B) Create a new account in Quicken, download/import as much history as I can get in a QIF and adjust all my previous and future paycheck entries to reference the new file?

C) give up and just move on with Simple investing?

Fidelity offers the option to download 5 one-year blocks of history.

0

Categories

- All Categories

- 56 Product Ideas

- 34 Announcements

- 238 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.1K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub