Fidelity Cash Balance Issue even after converting to SPAXX

A few days ago, I was forced to go through the conversion from DC to EWC+. Some of my accounts did the cash conversion, and some did not. The accounts with SPAXX and FCASH worked fine, but those with FDRXX and FZFXX did not. Those accounts don't display either of the buttons for updating the cash holdings (clicking on the blue balance button in the account register or the button in the Online tab under the Account Details. So I went in and changed the accounts to all use SPAXX. Now have sell transactions for the old funds and buy transactions for SPAXX and negative cash balances (still w/o the ability to change the cash display). Talked to Quicken support, and they recommended Validate. Did nothing.

Even tried going through the Reauthorization process on an account with the new SPAXX, and no luck.

Has anyone been through this and come up with a way to force Quicken to associate SPAXX as the cash account? Thanks !!!

[Edited-Readability]

Comments

-

@TommyD3 I was able to convert my cash balance in three accounts from FDRXX to SPAXX. All of these accounts now work fine and I no longer receive any securities comparison mismatch errors. I also converted a fourth account from QPIAQ to SPAXX even though Quicken was handling the cash correctly. For the fourth account, the process was more automated. I received a few pop up screens, and everything is fine with the account.

Below are my notes and screenshots of what I saw. Perhaps you may see something here that might give you an idea. By the way I do not have the option "never interpret downloaded Money Market funds as cash" checked.

NOTES from my last download:

- Since the last update I asked Fidelity to change my core cash from FDRXX to SPAXX. So far three accounts have been changed and all are OK. The cash balances are fine and there are no more Securities Comparison Mismatch errors.

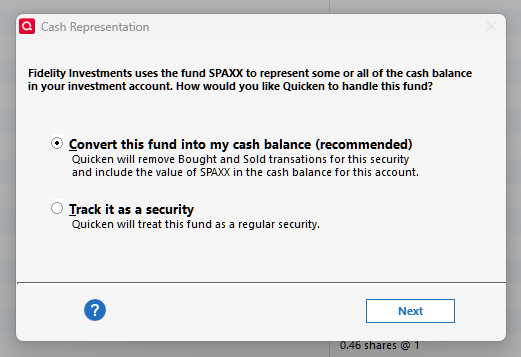

- Here is what happened for the three accounts. I was asked to convert SPAXX into my cash balance. This is correct, so I accepted

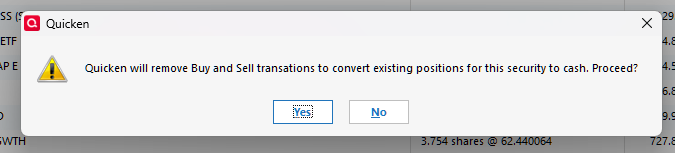

- Quicken then told me what it was going to do. I said YES.

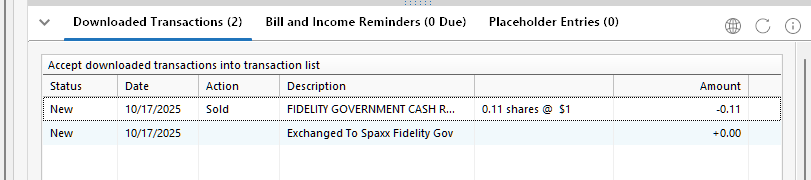

- Two transactions were downloaded for each of the accounts. I manually deleted the first (SOLD) transaction. I kept the second $0.00 transaction and added a memo to document the core position change.

- I also had Fidelity change my core position in a fourth account from QPIAQ to SPAXX even though Quicken was correctly handling the cash for this account. The end result was the same but the process was a little different. All is OK

- Quicken did not ask me to convert SPAXX into my cash balance. Instead, it told me it did it for me automatically.

- There was no SOLD transaction to delete.

- End result is OK,

0 -

I just did another update and I now have the ability to convert my SPAXX to cash !!!

This is after I had deleted the fund buy and sell transactions from the conversion.

Thanks !!!

1 -

Thank you both for sharing your experience and letting us know what worked for you, as this could be helpful for other users in the future.

If you need more help, don't hesitate to reach out.

Thanks again!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub