Large Expense Accounting Strategy Help Needed - Quicken 2013 [Edited]

I could use some advice on accounting/budgeting strategy; I’m using Quicken 2013 Deluxe.

I have had several recent costly projects – new car, new deck, new roof, new furnace, special trips, etc. – as I catch up on overdue big-ticket items. I want to account for these large expenses in my future planning and estimates, without skewing my yearly budget.

Here is the question: if I want to create and follow a fairly accurate budget, how do I account for such large unusual expenses? Budget for each as a separate entry, which would blow my yearly budget given I’m retired and have limited income, and these are for the most part special circumstances? Put them under “Special Expenses” in the Lifetime Planner? Consider them as assets (such as the car) or add the maintenance and upgrade costs to the value of the property asset?

I’d like to have a reasonably accurate yearly budget and one that reflects my actual “normal” income and expenses so that I can monitor my spending. Any suggestions?

Thanks.

Answers

-

Would anyone care to share with me why they did not wish to respond to this question?

Thanks, again.

-1 -

I use both LTP and budgets and am retired myself. This is how I think and approach things like you describe in your OP.

In terms of LTP, I use Special Expenses for the large one-off (or more) expenses such as roof, HVAC, deck et al, for future years. I slot these special expenses under the Home asset>Expenses tab. I name them in a similar way as I would name them in my budget, to avoid any confusion. I also indicate if they are an improvement item or maintenance item, since I have 2 category groups for discretionary and non discretionary spending.

As far as the car goes, it also goes into LTP as a Special Expense as well, ex: $35K every 6 years. I dont include any sort of expenses against the car asset, but simply budget for recurring car expenses (fuel, service et al) in my budget.

In terms of Budget, I will budget these big ticket items in the current year (if there are any in the current year, according to my LTP planning). I don't see including these expenses as blowing my budget, since they are indeed budgeted for (and easily seen as one-offs). I find it useful to include them in the budget for visibility. Tax planning also factors into this since I need to determine how the one-offs get funded and from which investment account(s).

In terms if income, I am not covered by a pension and too young for social security, so my income comes from investments. I do not budget for investment income since the income I need are the budgeted expenses themselves.

0 -

This isn’t chat and most of the questions are answered by other users not the moderators, so you just have to wait until someone comes along and thinks they can answer your question.

Signature:

This is my website (ImportQIF is free to use):1 -

For a very complex question, expecting an answer within 12 hours seems a bit premature. Patience.

I am not a lifetime planner user, so I can’t offer anything constructive, but your basic premise of

I want to account for these large expenses in my future planning and estimates, without skewing my yearly budget.

strokes me as an impossible task. Sort of like having your cake and eating it, too.

My non-professional opinion is that you need to either formulate a complete budget that would include set asides for major capital expenditures, or keep to your simpler annual budget knowing you have some sort of rainy day fund set aside.

0 -

@JCC555 , There are times that a question goes unanswered for weeks or if no one knows it or doesn't use certain features. This is a user community and people are busy with life. Just trying to set your expectations. Very glad to see that you received a few responses.

- Q Win Deluxe user since 2010, US Subscription

- I don't use Cloud Sync, Mobile & Web, Bill Pay0 -

I will add this though. Questions can get “lost” because if there are a lot of questions on any given day they be several pages back especially if the question is one that people can’t answer off the top of their head. So, it can be a good idea to post a comment like you did to get it back on the first page. I’m pretty sure this exactly what happened here, and in fact your second comment actually did get the question where people noticed it.

And I want to apologize for a mistake I made. I saw two times very close together and thought your comments were just a few minutes apart. I should have looked closer at the AM/PM.

Signature:

This is my website (ImportQIF is free to use):0 -

Thanks for the responses. I will look them over much more carefully later today.

The reason I asked the question is this: I'm not sure where the line should be drawn between questions regarding the proper use of the Quicken software per se, and questions which are more theoretical and straight up accounting questions which may not be the intent of this community page. I've asked a few questions in the past that were more software focused and received excellent answers fairly quickly (thank you again for those).

So, I did not intend any criticism. Just trying to understand and maintain the spirit of the endeavor and the good will of the participants.

BTW, I own a number of the Quicken guide books, and generally the authors do an excellent job of addressing the many features of the software. But often time the books address the "how to" much more than the "why do", or so it seems, and I try to figure things out myself for obvious reasons before I call upon the community.

Thanks again for your help, and your patience.

0 -

To answer your question both kinds of questions are welcome.

Different people on here have different use cases and expertise and as such a wide range of questions can be answered. But that is one of the reasons for some questions being answered "slower" because the right person might not have yet see your question, especially with time zone differences.

Signature:

This is my website (ImportQIF is free to use):0 -

Scooterlam: You state:

"In terms of Budget, I will budget these big ticket items in the current year (if there are any in the current year, according to my LTP planning)."

Question: if you have already added the "Special Expense" to the LTP, it has been included/factored into the ongoing plan calculation, has it not? If so, and you add it to the budget in the year it is due, haven't you in some way counted the expense twice, hence skewing your overall budget planning?

In addition, I kept a record of my new deck expenses, under the category of "House", subcategory "Deck". Now I think I wish to move that final amount, say $20,000, to the the "House" asset as an improvement item. I can't seem to figure out how to do that. Can I do so, and if so, how so? Or are the two actions ultimately separate? (As you can see, I'm likely lacking an aspect of fundamental accounting theory/strategy.)

Thanks, again, for any help you can render.

0 -

The LTP doesn't get any of its information from the budget. About the only way it would be counted twice is if in the Living expenses section, you use "Category Detail" and include that category, which you certainly wouldn't want to do because the LTP uses that amount for every year. Any one-time expenses shouldn't be included here.

In general, the budget is "this year", and LTP is "long term".

On the category question, this does sound like you are trying to "double count" some transactions. You can certainly change the transactions from House:Deck to just House, or even just remove the Deck category and have the transactions in it move to the House category, but you can't move the "final amount" to House without double counting it, once in House:Deck and in House.

Signature:

This is my website (ImportQIF is free to use):0 -

There is no double dipping by reporting the planned expense in both the budget (current year only) and long term planner (for current and future years). They are two different time perspectives of the same planned cost that happen to show up in the current year. They are used for entirely different forecasting periods (and purposes).

In your second question, do you wish to add that $20K to increase the value of the house asset or as a planned expense under the house asset, or both?

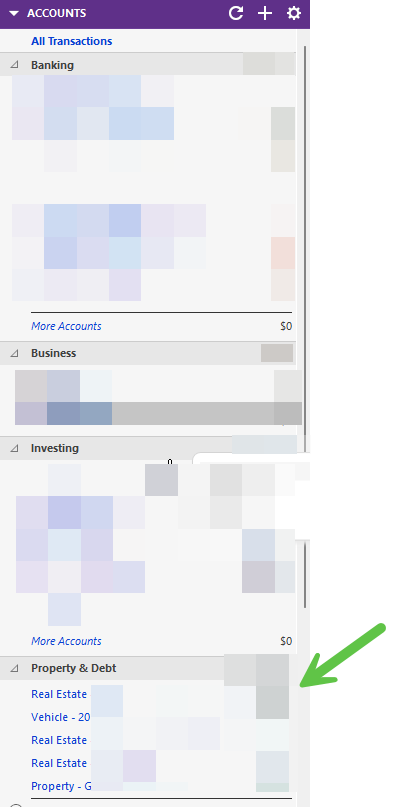

- If you feel the deck (or other improvement) adds to the current value of the house, then adjust the house value under the Property and Debt section of the side bar where you have entered the house asset account. See image 1. This new house value will reflect back into LTP.

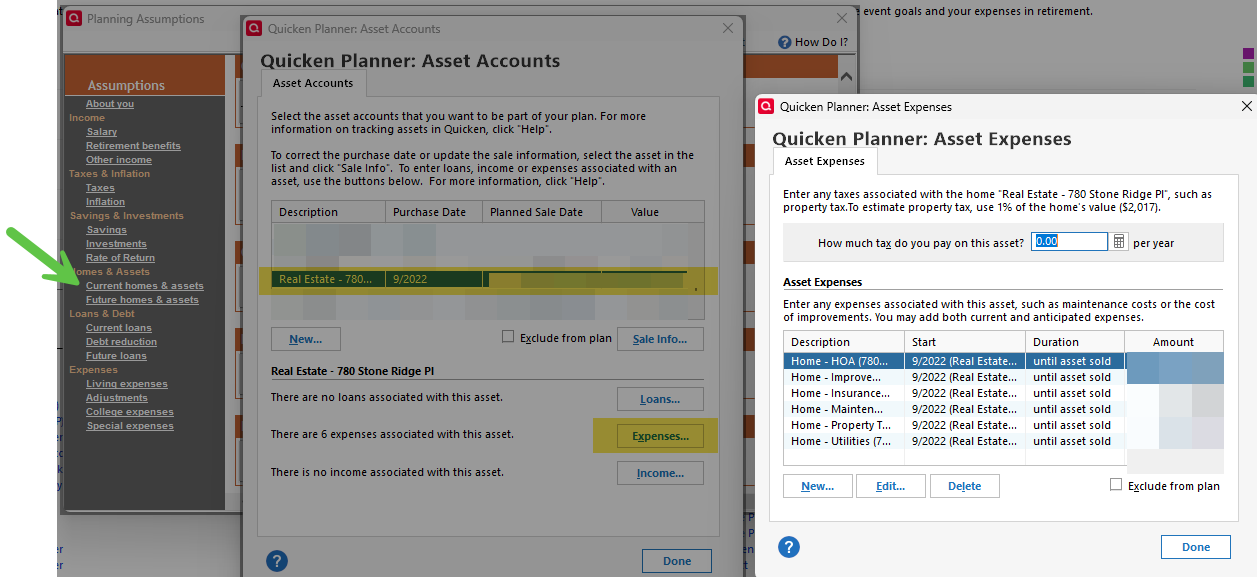

2. If you want to include the new deck budget expense under that house asset in LTP, then go to LTP's planning assumptions>current homes & assets, select your home in the table and click expenses and enter it there. See image 2.

3. 1 + 2 😊

You could do both 1 and 2 in LTP to see the impact on the final retirement plan balance based upon your rate of growth you set in the "sale info…" section of the asset. See image 2. Note that the home rate of growth will show up in your LTP plan graph in the year you sell the home (and you realize the proceeds from the asset)

0 -

Ok. Well done. I need to chew on these last two comments.

Thank you for your time and insights.

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub